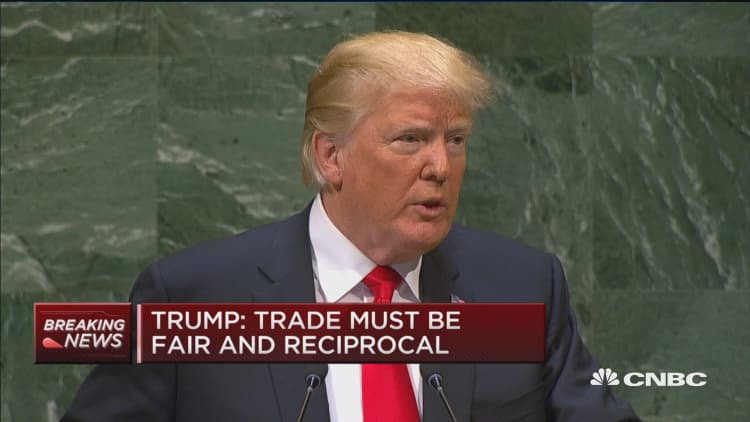

President Donald Trump on Tuesday told a gathering of world leaders that OPEC is cheating them, bringing a grievance he has voiced throughout the year on Twitter to the halls of the United Nations headquarters.

"OPEC and OPEC nations are as usual ripping off the rest of the world, and I don't like it. Nobody should like it," he said before the U.N. General Assembly in New York City.

"We defend many of these nations for nothing, and then they take advantage of us by giving us high oil prices. Not good."

Trump's remarks came just days after OPEC, Russia and several other oil producers rebuffed his latest call to tamp down crude prices by boosting output.

The coalition of roughly two dozen exporters has been limiting its output since January 2017 in order to end a punishing oil price downturn that bankrupted hundreds of American oil companies and heaped financial pressure on crude-producing nations.

Trump blames that policy for pushing oil futures into a range between about $70 and $80 per barrel and keeping the national average gasoline price anchored near $3 a gallon.

To be sure, the alliance cut output more than anticipated due to production problems in countries like Venezuela and Libya. In June, the group agreed to restore some of that output and return to its goal of keeping 1.8 million barrels a day off the market.

However, Trump's decision in May to pull out of the 2015 Iran nuclear deal and restore sanctions on that country, OPEC's third-biggest producer, is also a major factor behind this year's rally.

The Trump administration has pushed prices higher this summer by telling oil buyers they must cut their purchases of Iranian crude to zero by Nov. 4 or else face U.S. sanctions. The aggressive deadline has left the market to wonder whether top exporter Saudi Arabia and other producers can fill the gap left by the anticipated loss of about 1 million barrels a day in the coming months.

"OPEC has actually been a pretty good first responder. They have put a significant number of barrels on the market since President Trump started tweeting and since the June meeting," said Helima Croft, global head of commodity strategy at RBC Capital Markets.

"The real challenge though for OPEC going forward and for President Trump is there's not a lot of gas in the tank," she told CNBC's "Power Lunch" on Tuesday. "Saudi Arabia is about 320,000 barrels away from their 2016 pre-cut high, and there's a question mark about how much more they can really do beyond that in the near term."

Brent crude prices rose to a nearly four-year high above above $82 a barrel on Tuesday after OPEC and its allies said they would stick to the plan they agreed to in June.

"We want them to stop raising prices," Trump said Tuesday. "We want them to start lowering prices."

"We are not going to put up with it, these horrible prices, much longer."

Saudi Energy Minister Khalid al-Falih told CNBC on Sunday that Trump's claim on Twitter last week that OPEC is pushing oil prices higher and higher is "not true." He said the cartel is focused on "more important" aspects of the oil market, like assuring the world is adequately supplied with crude.

Falih said he is concerned about the global economy due to the Trump administration's trade disputes with several countries and currency pressures in emerging markets. Those factors could dampen demand for oil, making it perilous to increase supply.

"It's no longer about supply only. I think demand is emerging as a concern as we look at 2019," he said.

Royal Dutch Shell CEO Ben van Beurden told CNBC this week that $80 oil is not "unreasonable" and may be necessary to fuel spending on oil and gas infrastructure after a period of underinvestment.