Stocks are near all-time highs but investor Ron Baron thinks there is plenty of room to run.

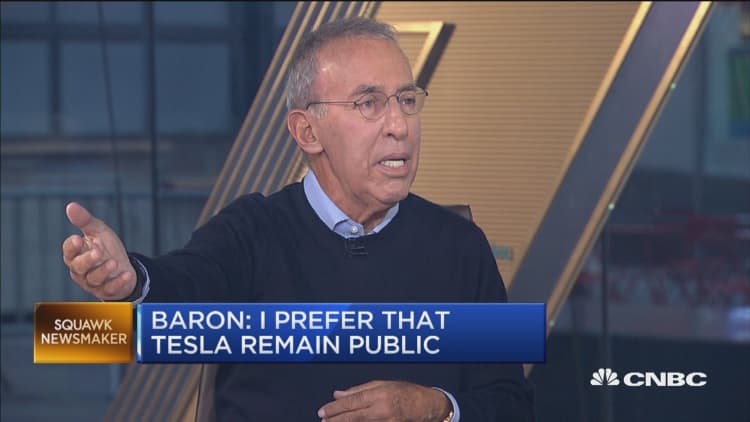

"I think the market is not at high levels," the billionaire founder of Baron Capital said on CNBC's "Squawk Box" on Tuesday. "Growth is accelerating."

The Dow Jones Industrial Average and hit record highs on Sept. 21.

Baron's firm had $100 million under management in 1992 but now manages $29.58 billion.

He said its premise "is that the stock market is tied very closely to the economy."

"The economy doubles roughly every 10 or 12 years and so the stock market should double every 10 or 12 years, over the long-term," Baron said. "I can't see any reason why that's going to change."

Baron explained the historical backing to his premise, pointing out that the Dow Jones index was at 600 in 1960.

"It's now 26,000," Baron said. "GDP of the country was $520 billion, it's now $21 trillion."

Baron thinks stocks are going to continue to rise, even after climbing 10 years from the last financial crisis.

"Stocks are the best play [as they return] 8 percent a year compounded," Baron said.

Over the last quarter century, Baron said, his firm has made "clients $27.3 billion in realized and unrealized gains."