One of the chief goals may be to curb inflation in the U.S. economy, but when it comes to wage inflation, the central bank should be careful how it proceeds, CNBC's warned on Wednesday.

"In short, the Fed should be careful what it wishes for" as it decides how many to put through as the economy heats up, the "Mad Money" host said. "Why not let this economy run? Would it really be so terrible if we went over their precious ?"

If Friday's nonfarm payroll report from the U.S. Labor Department reveals higher-than-expected job creation, it could spur the Fed to act quickly to stop inflation and stifle wage growth in the process, Cramer said.

"That brings me to the real issue here: there's been almost no wage inflation in this country for decades. Income inequality is a serious problem, and it's a problem that the Fed has absolutely had a hand in creating," he said. "How the heck are working people supposed to catch up if our central bank slams on the brakes every time wages start going higher?" he continued.

The "Mad Money" host pointed out the various downward pressures on wage growth, including the rise of cloud-based technology and automation and the growth of price-slashing giants like .

"When I look at Amazon, I'm seeing a company that's working to control wage inflation by embracing automation at its warehouses and and stock grants," Cramer said. "Even with , Amazon is one of the most powerful deflationary forces on earth. I defy you to think of a company that's done more to lower prices."

For more of Cramer's analysis, click here.

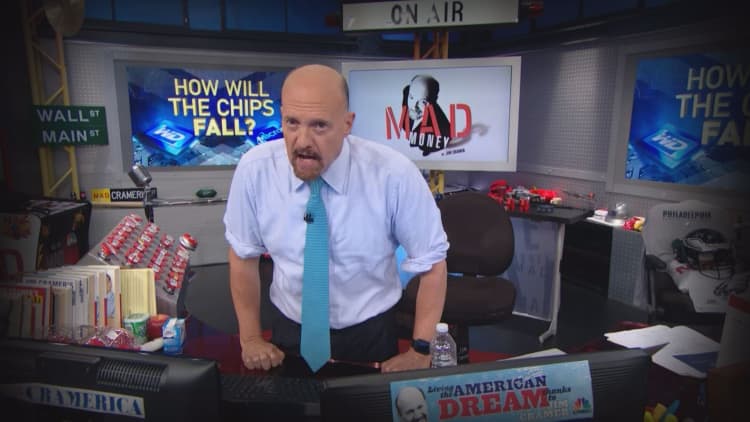

Chip stock battle: Western Digital vs. Micron

The stocks of and have been dragging on the semiconductor space, logging double-digit declines since their early 2018 highs, so Cramer felt he needed to investigate the weakness.

"The semiconductor space is important," he said on Wednesday. "Chips are in nearly everything these days and they need to be ordered early in the production process, so a downturn in the semis is often a leading indicator for the broader economy."

Western Digital, formerly a pure play on hard drives, got into the semiconductor industry after its 2016 . It specializes in NAND chips, a type of flash semiconductor used for data storage.

Micron deals in two types of chips, flash and dynamic random-access memory, or DRAM, chips, which end up in various electronic devices including computers.

But Cramer argued that there is "a fundamental difference" between Western Digital and Micron. Western Digital's business is largely driven by flash memory chip sales, whereas the majority of Micron's business comes from dynamic random-access memory chips, an entirely different market.

That difference was enough for Cramer to recommend one stock over the other. Click here to find out why.

'Beware the bears'

Market pessimists love to rally around overseas market drops and squawk about how they'll take down U.S. stocks, but often times, the other side of the trade ends up winning out, Cramer said Wednesday.

"Whenever you see these contagion stories, unless there's some direct connection to the U.S. banks — and there rarely is — you need to treat these pullbacks as buying opportunities," he told investors.

Cramer began by reevaluating the recent turmoil in Turkey, during which the independent nature of Turkey's central bank as it tried to .

The lira's initial decline was caused in part by U.S. President escalating , which, combined with the central bank's action, set the bears into a frenzy centered on how the currency crisis could affect U.S. securities.

But "the thing about Turkey is that it's kind of been a slow motion train-wreck for ages," Cramer said.

Still, the bears had their way. Click here for Cramer's take on how you could've profited from the panic.

CyrusOne CEO on why his data center REIT is going global

With CyrusOne fresh off its best quarter in history, some investors are wondering why the data-center-focused real estate investment trust decided to expand internationally. But President and CEO Gary Wojtaszek said his reasoning was simple.

"Data is global," Wojtaszek told Cramer in a Wednesday interview. "If your kids play Fortnite, they're playing against kids all around the world, so data is flying around the world. Our customers, which are predominantly Fortune 1000 customers, are deployed everywhere globally. So if you really want to be helpful to the customers' needs, you have to have a global platform, and if you don't, you're really in an inferior position."

Beyond that, the data center business is "accelerating" as major tech companies spend more on expanding data storage capacity for their growing businesses, which fuels CyrusOne's core business, Wojtaszek said.

"If you talk to any of the FANG companies or even the broader group — there's about a dozen companies that are really kind of driving this industry — everyone's capital expenditures are up dramatically," the CEO said, referencing Cramer's well-known acronym for Facebook, Amazon, Netflix and Google, now Alphabet.

"We look at all the success that we've had in the States over the last decade and we feel really comfortable that we'll be able to export that same success internationally, because all the growth internationally is coming from all the customers that we serve here," Wojtaszek continued.

Click here to watch his full interview.

Carvana nirvana?

The auto industry is seeing a shift in consumer purchases, with more and more people opting to buy used cars rather than pay up for new ones. Naturally, Cramer wanted to steer investors in the right direction.

"If you want to see the biggest winner here, look no further than Carvana, the online used car dealership," the "Mad Money" host said. "This stock has pulled back pretty dramatically from its recent highs, but get this: it's still up more than 500 percent from where it bottomed a few days after its IPO roughly 18 months ago, and it's given you a terrific 185 percent gain just for 2018."

Carvana's premise is simple. Rather than asking customers to physically go to car dealerships and spend their time fielding salesmen and filling out paperwork, the company puts all the relevant information on its website, letting people do research, secure financing or buy a car online. Once they buy, they can pick up the car from a Carvana "vending machine," an automated garage that simplifies the pickup process.

The stock, however, has run a lot, and even though it's not yet expensive, investors shouldn't put their hard-earned bucks towards investing in the stock if they don't have some money to lose, Cramer said.

"I would only buy Carvana for speculation as the stock's a real wild trader," he said. "You need to be prepared to be building your position gradually on the way down if it keeps falling."

"Even after its near[ly] 25 percent decline from its recent highs, the stock remains hot, hot, hot. So, yes, you have my blessing to buy it here, just don't be too aggressive and don't buy it all at one level," he added.

Lightning round: Please do stop the music

In Cramer's lightning round, he zoomed through his take on some callers' favorite stocks:

: "I have been behind this stock, literally, for $3 and a half and now I am starting to cool. I did not like the Pandora acquisition. You've got , you've got and now you have XM. No. It's too competitive for me. I'm now saying don't buy – that's a major change for me."

: "This stock's ridiculous. It's come down. Remember, it's up 54 percent for the year, but it has come down mightily, and I've got to tell you, I'm getting real interested in [CEO] Lew Cirne's company. I think the stock in the $80s is a buy."

Disclosure: Cramer's charitable trust own shares of Amazon, Facebook and Alphabet.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com