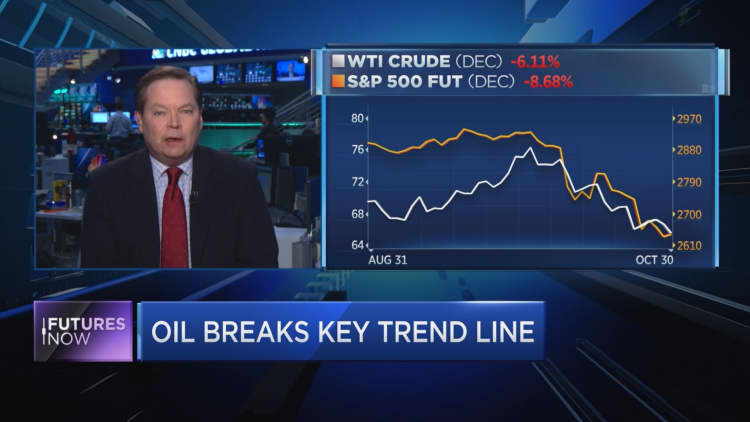

Oil prices fell in volatile trade on Wednesday, posting their worst monthly performance since July 2016.

Strong U.S. demand for fuel helped offset a sixth straight weekly jump in American crude stockpiles and evidence of rising global supply, but oil prices fell late in the trading session.

U.S. light crude ended Wednesday's session down 86 cents, or 1.3 percent, at $65.31. The contract plunged 10.8 percent in October.

Benchmark Brent crude oil fell 44 cents at $75.47 a barrel, ending October down nearly 9 percent.

Both benchmarks were about $11 a barrel below four-year highs reached on Oct. 3 and saw their worst monthly performance since July 2016.

Oil has been caught in the global financial market slump this month, raising concerns about global oil demand. Equities have been under pressure from the trade war between the world's two largest economies, the United States and China.

The United States has already imposed tariffs on $250 billion worth of Chinese goods and China has responded with retaliatory duties on $110 billion worth of U.S. goods.

Oil market sentiment received some support on Wednesday from equity markets, which bounced from 20-month lows after pledges by China to support its markets.

Oil prices briefly gained after the U.S. Energy Information Administration said crude inventories rose 3.2 million barrels last week, less than expected. Gasoline and distillate stockpiles fell as total product demand over the past four weeks rose 5.4 percent from a year ago.

"In spite of the increase of crude oil inventories, crude futures prices are being supported by the inventory decline in refined products," said Andrew Lipow, president of Lipow Oil Associates in Houston.

New U.S. sanctions on Iran begin on Nov. 4 and Washington has made it clear to Tehran's customers that it expects them to stop buying any Iranian crude oil from that date.

Imports of Iranian crude by major buyers in Asia hit a 32-month low in September, as China, South Korea and Japan sharply cut their purchases ahead of the sanctions, government and ship-tracking data showed.

"The bullish argument for crude still centres on Iran sanctions which are due to begin in November, and continued output declines from Venezuela," said William O'Loughlin, investment analyst at Rivkin Securities.

But oil supply from other countries is rising. The top three producers - Russia, Saudi Arabia and the United States - pumped 33 million barrels per day (bpd) in September, Refinitiv data showed, an increase of 10 million bpd since the start of the decade.

Russian oil output has reached 11.41 million bpd, a level unseen since the collapse of the Soviet Union in 1991, an industry source told Reuters.

— CNBC's Tom DiChristopher contributed to this report.