This is not how October was supposed to play out for the oil market.

After starting the month at nearly four-year highs, bolstered by looming U.S. sanctions on Iran's crude exports, oil prices posted their the biggest monthly drop in more than two years.

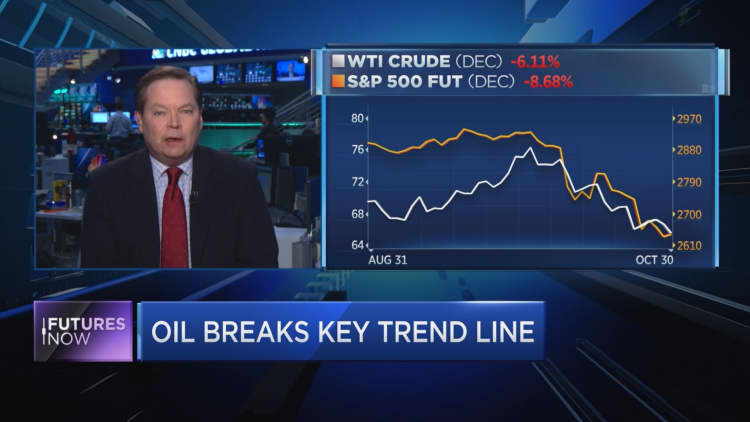

U.S. West Texas Intermediate crude dropped 10.8 percent in October, its steepest decline since July 2016. WTI is now more than $11 below its Oct. 3 high of $76.90.

The picture is nearly as ugly for Brent crude, the international benchmark for oil prices. It has also tumbled more than $11 from its Oct. 3 high at $86.74, falling nearly 9 percent this month. That's also the worst drop since July 2016.

For a sense of perspective, July 2016 was two months before a meeting that paved the way for an historic deal between OPEC, Russia and other producers to cut output. At that point, the market remained deeply skeptical that OPEC would reach a deal to tackle oversupply. Saudi Arabia was pumping at then-record levels, and U.S. drillers were adding rigs to American oil fields.

There's at least one similarity between 2016 and 2018: The oil market experienced strong gains in the first six months of the year before hitting a volatile patch in the second half.

There's little doubt that much of the oil market's problems this month are tied to the broader sell-off in equities, which has seen investors shed risk assets like crude futures. Both stock markets and crude futures jumped in early October before selling off sharply.

"The correlation has been about 80 percent over the course of the month" between equities and crude, said John Kilduff, founding partner at energy hedge fund Again Capital. "This is the highest correlation I've seen in quite some time."

Both the equity and crude markets are bedeviled by a slowdown in global economic growth, rising U.S. interest rates and worries about a prolonged trade dispute between the United States and China. A stronger U.S. dollar is also buffeting oil, Kilduff said.

Oil is sold in dollars, so a strong greenback increases the cost of crude for emerging markets and threatens to derail demand for the commodity.

But there's another similarity between July 2016 and October 2018. Then as now, traders were trying to determine OPEC and Russia's ability to steer the oil market through a challenging period.

Oil prices rallied in September as traders braced for the return of U.S. sanctions on Iran, OPEC's third biggest oil producer. President Donald Trump's threat to sanction foreign firms that buy Iranian barrels beyond his Nov. 4 deadline has wiped roughly a third of Iran's oil exports off the market.

But in the last month, forecasters have warned that oil demand will grow more slowly than anticipated in the coming months. Meanwhile, output from top producers Saudi Arabia, Russia and the United States — as well as from OPEC as a whole — has continued to rise.

Investors now appear less concerned U.S. sanctions on Iran will leave the world short of oil, though the full impact of the penalties is yet to be seen.

"It's a very confusing time for the oil market, which is grappling with a very fundamental question about whether we have a supply problem or not and the answer has been unclear," said Tamar Essner, director of energy and utilities at Nasdaq Corporate Solutions.

"The bulls got ahead of themselves, but not for a bad reason — spare capacity is indeed very low relative to demand growth at a time when we have big suppliers that are necessarily going to be exporting less for the foreseeable future," Essner said, referring to Iran and Venezuela.

Essner said the bull case for oil would have been sound, but the threat of a full-blown trade war and rising borrowing costs are now poised to curtail demand. An increase in U.S. crude stockpiles and a jump in American drilling is providing additional incentive for traders to sell oil after "hefty" gains this year, she added.

U.S. crude was up 26 percent this year through the high on Oct. 3. Brent was up 29 percent over the same period.

Last week, hedge funds and money managers cut their bets that oil prices would keep rising to the lowest level in more than a year, according to Reuters market analyst John Kemp.

U.S. WTI crude futures could post further losses if they break through support levels between $64.50 and $64.40 a barrel, Anthony Grisanti, founder and president of GRZ ENERGY, told CNBC's "Futures Now" on Tuesday. Grisanti is watching for WTI to break above its 200-day moving average at $67.47 for a rebound.

The market could get some clarity next week, when sanctions on Iran's energy industry go back into full force.

The recent drop in oil prices could embolden the Trump administration to implement the sanctions more forcefully, Vandana Hari, founder and CEO of Vanda Insights, told CNBC on Monday.

"I think there might be another spike left in crude still. It's not all downhill from here," she said.