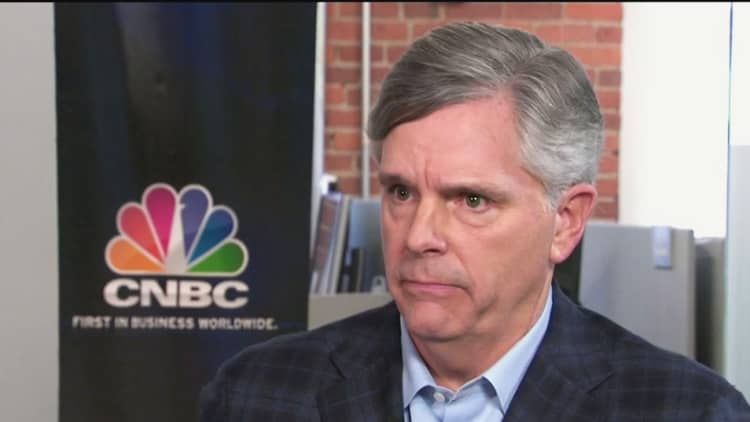

General Electric's Chairman and CEO Larry Culp said Monday he feels the "urgency" to reduce the company's leverage and will do so through asset sales.

"We have no higher priority right now than bringing those leverage levels down," Culp said in an interview on "Squawk on the Street" with CNBC's David Faber.

"The stock has been under pressure" during the last two weeks, Culp said, "no doubt about that."

GE shares closed down 6.9 percent in Monday trading, slipping below $8 a share for the first time since March 2009. The stock fell as low as $7.72.

"We need to bring the leverage down," Culp added, and that GE has "got plenty of opportunities through assets sales to do that."

Culp emphasized he will not rush the process of deleveraging even as he feels the pressure to move quickly and decisively. He gave three examples of how GE is freeing up cash: A possible IPO for GE's "tremendous" health-care business, the sale of its transportation business, and the coming exit of the Baker Hughes oil field services business.

"Aviation is our crown jewel," Culp said. While GE believes there are "various options" for how to make use of the strong business, Culp said selling part or all of the business is "not high on" GE's list of options for aviation.

Culp said the decision to remove the company's full-year profit forecast from its most recent earnings report was "another unpopular decision but one that was straightforward."

"We did not have the conviction that we would want, particularly around our power business, as we looked toward the end of the year," Culp said.

GE management is "working hard with the power team" to turn the struggling business around, Culp said. He did not have conviction "to offer up numbers" for how power will end the year but Culp said GE "will in time."

Questions about GE's liquidity are understandable, Culp said, given the company's position. But Culp said GE "put that to rest given that fact the we got $20 billion of cash" on hand from asset sales. Culp also said GE has used only $2 billion of "$40 billion of bank lines."

"That gives us a foundation to really talk to the leverage," Culp said.

As the company has noted previously, Culp said GE "has no plans for an equity raise."

Culp was appointed chairman and CEO on Oct. 1, a month before GE reported third-quarter profits that were sharply below forecasts. Additionally, GE slashed its quarterly dividend to a penny a share in a dramatic first move for Culp. While the cut will free up cash for GE, the overall results gave some on Wall Street conviction that GE shares will continue to fall.

GE shares have fallen more than 50 percent this year.

WATCH: CNBC's full interview with General Electric's Larry Culp