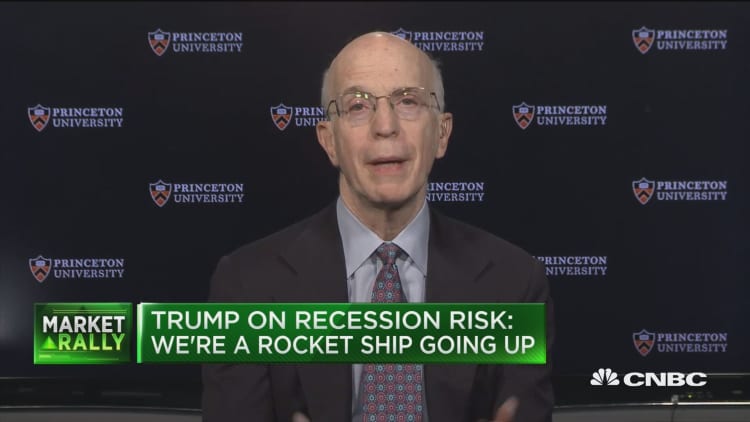

Alan Blinder, who served as Federal Reserve vice chairman during the Clinton administration, on Wednesday criticized President Donald Trump's latest prodding of the central bank not to increase interest rates anymore.

Trump told Reuters on Tuesday that it would be "foolish" for the Fed to hike rates next week.

Asked Wednesday if the president is right, Blinder said on CNBC, "No. Of course he's wrong as he's wrong about most things."

"What is forgotten in a statement like that is the Fed is [still] on the monetary accelerator," Blinder explained. "The process we've been witnessing since the end of 2015 is gradually taking your foot off the accelerator and into neutral. Then there's a question about whether you touch the brakes. But we're not up to that question yet."

In his Reuters interview, Trump also described the economy as "a rocket ship going up."

That's certainly an exaggeration, Blinder said on "Squawk on the Street." "But the economy is very strong. We don't need the monetary accelerator depressed now."

The White House did not immediately respond to CNBC's request for comment.

Blinder, an economics professor at Princeton University, believes the Fed will go against the president's wishes and raise rates at its final monetary policy meeting of 2018 next week.

"We're getting pretty close" to the target of just-below-neutral that Fed Chairman Jerome Powell laid out two weeks ago, in his walk back of his early October remarks that neutral was a "long way" off, said Blinder, who was No. 2 to longtime Fed Chairman Alan Greenspan, whose five terms spanned Democratic and Republican presidents.

After its latest hike in September, the Fed had forecast three moves in 2019. But with signs of pockets of weakness in the economy and recent turmoil on Wall Street, the market puts low odds on any hikes next year.

"If you're looking for shreds of pessimism in the current economy, you can find them here and there," especially in housing, Blinder said. But he added, "Markets always exaggerate what they see," pointing to the strong labor market as a reason not get too worried about growth yet.

On CNBC Tuesday, Richard Fisher, former Dallas Fed president, said: "If we don't get enough nuts in the tree — that is interest rate increases — you get a downturn [in the economy] what do you have to turn to? That's going to be the real issue. That's what I worry about in the long run."

Blinder broadly supports that notion, but predicts a neutral rate of more like 3 percent rather than a historical norm of about 5 percent. The Fed's current target range for its benchmark fed funds rate, what banks charge each other for overnight loans, stands at 2 percent to 2.25 percent.