The U.S. Treasury Department had no concerns about liquidity whatsoever when Treasury Secretary Steven Mnuchin called the heads of the six largest U.S. banks on Sunday, a senior Treasury official told CNBC's Sara Eisen on Monday.

The calls were intended to be a check-in with the executives on Federal Reserve Chairman Jerome Powell, the government shutdown, trade and the markets, the official said.

There is no reason to believe that the call was about anything relating to lending and liquidity, the official said. The message really should have been about the economy, which the bank CEOs said is looking quite strong, the senior official told CNBC.

Mnuchin spoke with J.P. Morgan Chase's Jamie Dimon, Bank of America's Brian Moynihan, Goldman Sachs' David Solomon, Morgan Stanley's James Gorman, Tim Sloan of Wells Fargo and Michael Corbat of Citigroup.

"We continue to see strong economic growth in the U.S. economy with robust activity from consumers and business," said Mnuchin in a statement after the calls.

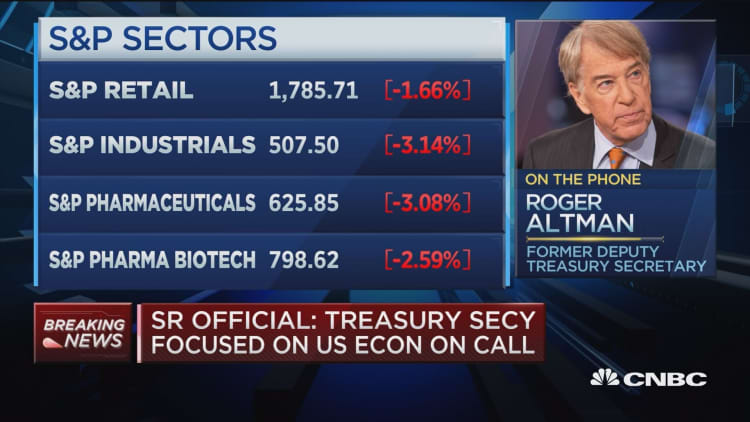

The calls came after last week's steep sell-off in the stock market that pushed the Dow Jones Industrial Average to its worst one-week drop in 10 years, on track for its worst December performance since the Great Depression in 1931.

The official also said the Treasury Department sees disconnect between market moves and the economy.

Mnuchin is dealing with the heated conflict between President Donald Trump and the Fed. The president has also reportedly discussed firing Powell because of his frustration with Fed rate hikes and stock market losses in recent months. In a tweet on Saturday, however, Mnuchin quoted Trump as saying "I never suggested firing Chairman Jay Powell, nor do I believe I have the right to do so."

— CNBC's Sara Eisen contributed to this report.