Alphabet is about to report earnings after the bell.

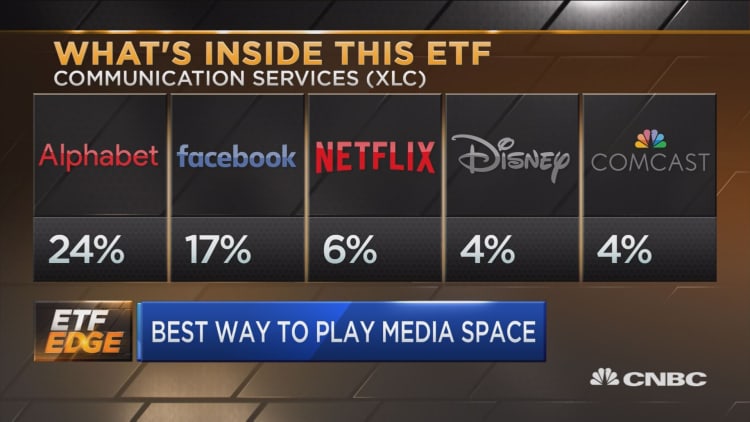

And given it's in a whopping 184 ETFs, including the largest holding in the communications sector ETF (XLC) with a 24 percent weighting, whichever way it moves will have a major impact on the market.

However, despite clawing back from December lows, the Google parent has underperformed the rest of the high-growth FANG names. Its nearly 9 percent advance in the year to date is equal to Amazon's gain and well below Facebook and Netflix's move of more than 28 percent.

For the investor looking for high-momentum exposure without any downside risk from Alphabet, John Davi, chief investment officer at Astoria Portfolio Advisors, said one ETF fits the bill.

"If you're trying to capture the risk characteristics of FANG stocks which are momentum-driven stocks, in my opinion, I would probably use something a little bit more diverse like MTUM, which is the momentum ETF," Davi said Monday on CNBC's "ETF Edge." "Basically 46 percent of the MTUM is from the XLC ETF so it's another way to get exposure to that theme and you have a lot more diversification benefits."

Amazon makes up the largest weighting at more than 5 percent, followed by Microsoft and Apple. The MTUM ETF also mixes in high-momentum players in other sectors, including health care's Pfizer and financial's Visa. Alphabet has not been a part of the ETF since April 2017.

That level of diversification shielded the MTUM ETF from the worst of the sell-offs in the back half of last year, Davi said.

"Since XLC has been around since July, it's down 10 percent. The MTUM is only down 3 percent so it's a way to kind of get a little bit more diversification and protect the downside," he explained.

The MTUM has not outpaced the XLC ETF so far this year as Facebook and Netflix rallies gave rise to big gains for the communications sector. The XLC is up 12 percent in 2019 compared with a 6 percent increase for the MTUM.

However, its dynamic holdings could turn MTUM's fortunes once again.

"MTUM also rebalances every six months so instead of always having Alphabet and Facebook and Netflix, it rotated and added some health-care exposure later on in the year, became a little bit more defensive," said Todd Rosenbluth, director of ETF and mutual fund research at CFRA, Monday on "ETF Edge." "You really need to look inside the portfolio on an ongoing basis, not just assume you know what's inside."