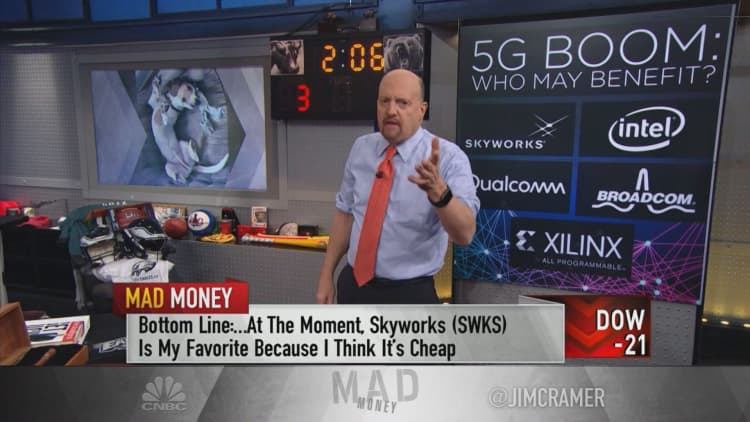

Five semiconductor companies are in a prime position to benefit from the rollout of 5G, the fifth generation of wireless communication that telecom companies are racing to implement, CNBC's Jim Cramer said Wednesday.

"If you're a semiconductor company with 5G exposure, this is your moment," he said after Skyworks Solutions, an Apple supplier that fits that description, surged over 12 percent intraday after delivering its quarterly earnings results.

Skyworks' surge was so strong that it lifted shares of other chipmakers involved in 5G, including Intel, Qualcomm, Broadcom, and Xilinx, all of which stand to benefit from the rise of 5G, Cramer said on "Mad Money."

And while he preferred the stock of Skyworks to its peers because of its low price tag and the company's focus on 5G, he said investors "can make the case for all five."

Still, Cramer began with his case for Skyworks. While he didn't find its earnings results very impressive, he liked that the company finally managed to change the narrative around its 5G prospects. The CEO repeatedly cited "the shift to 5G" as a "tremendous catalyst" thanks to all the new connected devices that will need Skyworks' chips.

"No wonder Goldman Sachs upgraded the stock today, predicting that the business will bottom in the first quarter and arguing that the risk-reward here is too attractive to ignore. That's a gutsy call. Makes sense to me," the "Mad Money" host said. "Even after today's run, get this: Skyworks sells for less than 12 times next year's earnings [estimates], and I think there could be a long runway here."

People might think of Intel as a personal computer business, but the company's multi-year diversification efforts have made it a player in areas like autonomous driving, the internet of things and communications, Cramer said, citing his recent interview with now-permanent CEO Bob Swan in which he spoke about Intel's 5G opportunity.

"Now, Intel's had some real execution issues of late — their latest results and guidance were unambiguously bad, although the stock has now rebounded back to where it was trading before the quarter because investors figured the industry is about to bottom," Cramer explained. "With its 2.5 percent yield [and a] new CEO who is very energized, I think you could do a lot worse than Intel as a slow-and-steady way to play the 5G buildout."

Third up is communications technology giant Qualcomm, whose president believes that "virtually all 5G mobile devices launched in 2019" will be embedded with Qualcomm's 5G tech.

"If Qualcomm's 5G business was an independent company, it would be the obvious winner here," Cramer said, acknowledging that Qualcomm's stock has been under pressure of late because of the company's ongoing intellectual property dispute with Apple, its largest customer.

"I'm optimistic about Qualcomm's long-term prospects when it comes to 5G, but if you want to buy it, I recommend building a position gradually over time because you might get more weakness," the longtime stock-picker said.

Broadcom is another way investors can play the 5G buildout, though Cramer admitted that the sprawling chipmaker was "far from a pure play" on the next-gen network.

"My only hesitation here is that Broadcom has run so much," he said. "That said, the darned thing still, even after that rally, sells for just 10 times next year's earnings estimates, Hock Tan is a fabulous CEO and he's been buying back stock hand over fist. My view? Broadcom's terrific, but if you don't already own it, you might want to wait for a pullback to pull the trigger."

Last but not least is Xilinx, a programmable logic device maker that recently reported what Cramer saw as "one of the biggest blowouts" of this earnings season. He attributed the strength, in large part, to its 5G rollout efforts.

The "Mad Money" host's only qualm was Xilinx's overseas business lines. While they're still strong, Xilinx's China business — which accounts for roughly 25 percent of its total sales — poses a risk while the trade war continues, he said.

"I like the stock of Xilinx so much, ... I re-named my new rescue mutt Xilinx," Cramer said. "But if you're going to buy the stock at these levels, you need to understand that this is the high-risk, high-reward way to play 5G."

So investors have options if they want to try and profit from the rise of 5G. And even though telecommunications stocks might seem to be the best bets, stock-pickers shouldn't ignore the chipmakers that actually build the tech, Cramer argued.

"The 5G buildout has arrived and there are a host of semiconductor companies that are poised to benefit," he said. "At the moment, Skyworks is my favorite because it's so darned cheap and [CEO] Liam [Griffin] is such a good manager [that] they've finally got investors focused on the 5G future, but you can make the case for all five."

WATCH: Cramer flags five 5G winners

Disclosure: Cramer's charitable trust owns shares of Apple.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com