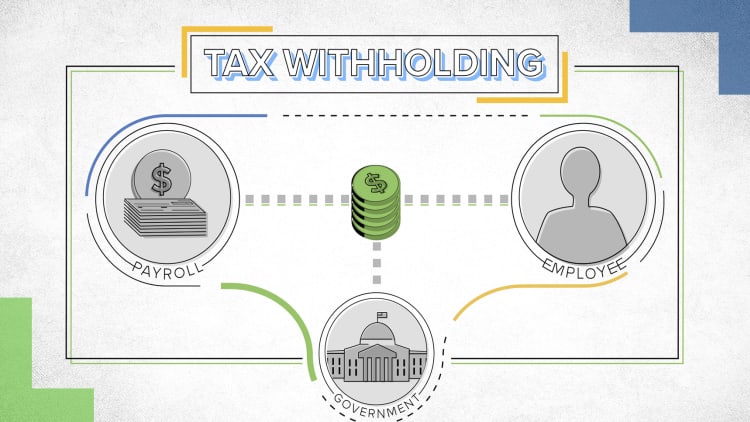

Tax withholding.

What is it and why does it matter?

If you're an employee of a company that gets paid through a payroll service, your employer likely withholds some of your income every paycheck, and sends the money to the government for you.

When you start working at a new company, you should fill out a W-4 form for your employer.

The IRS has a withholding calculator on its website. Check it out to get a personalized estimate of your taxes.

But if you work for yourself, nobody will withhold for you. So make sure you're putting some money aside to pay that tax bill each quarter.

Watch the video above to learn more about tax withholding and your W-4 form.

More from Invest In You

How to file a tax deadline extension

Here's what you need to know when you're new to filing a tax return

Prevent tax return anxiety by following these steps

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.