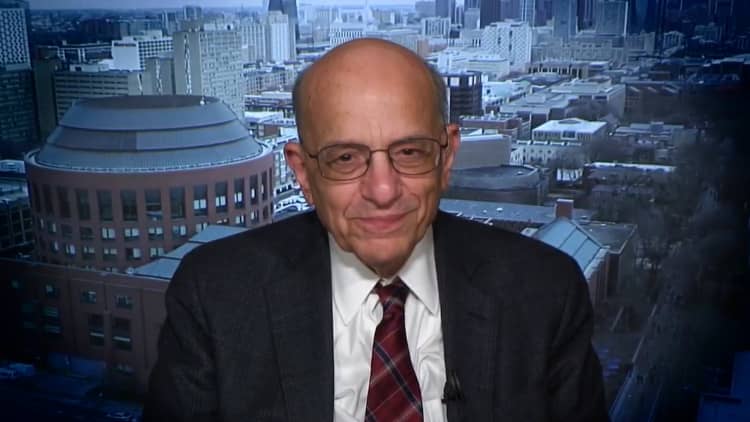

Wharton professor of finance Jeremy Siegel says U.S. markets expect a favorable outcome to U.S.-China trade talks, so a failure to reach a deal could be a big negative for the stock market.

He also cites tariffs and cutting back on needed immigration for the tech industry as a drag on the economy.

But overall, he believes President Donald Trump's pro-business policies, like corporate tax cuts and deregulation, have been good for the stock market and the broader economy.

He says that because of Republicans influence on the markets, the loss of the presidency and the Senate could mean bad news for stocks, but that's not a likely outcome.

If the Federal Reserve keeps interest rates too high, that could also prompt a recession, he says.

Watch the video above to hear more from Jeremy Siegel on Trump, China and the risk of recession.

See also: