The ongoing trade war with China could cost the average American family hundreds of dollars.

It all depends on how extreme the White House gets with protectionist policies. But Oxford Economics laid out various scenarios that, at the high end, could cost U.S. households as much as $800.

On the lower end, if the 25% tariffs that went into effect Friday are permanent and China retaliates, the U.S. economy could lose $62 billion in economic output by next year, according to Oxford Economics. That total translates to an equivalent loss of $490 per American household.

In a more extreme example, the firm considered the administration imposing 25% tariffs on all imports from China — not just the current $200 billion. Should China retaliate, Oxford Economics estimates that the U.S. economy would be about $100 billion smaller by 2020. That would translate to an $800 cost per household.

"While negotiations are ongoing, and the possibility of a deal remains significant, a further escalation of trade tensions would have dire consequences for both protagonists and the rest of the world," Gregory Daco, Oxford Economics chief U.S. economist, said in a note to clients Friday.

Stocks extended a week-long sell-off Friday after President Donald Trump said there's "absolutely no need to rush" on a trade agreement. He also said tariffs will make the United States "much stronger." Major averages fell near their lows of the day after Chinese Vice Premier Liu He left the Office of the U.S. Trade Representative. Treasury Secretary Steve Mnuchin said China trade talks are done for week but were "constructive."

The job market could also take a hit thanks to trade turmoil. The current tariff rise could result in 200,000 fewer jobs, with growth falling below 2% in early 2020, according to Oxford Economics. The more extreme scenario with tariffs on all imports, and Chinese retaliation, would lead to 360,000 fewer jobs being created.

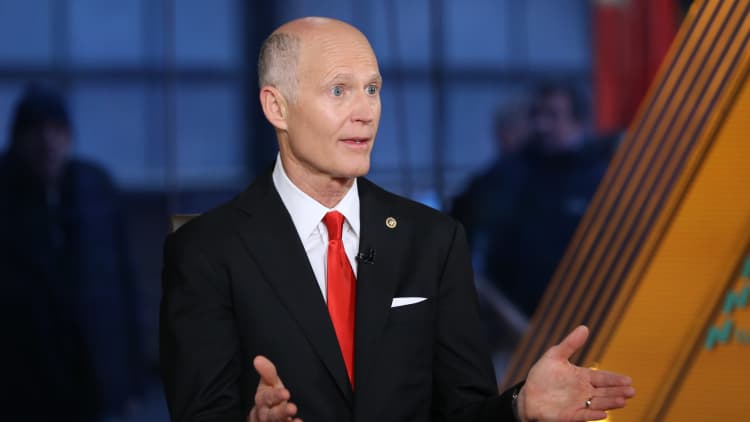

In a CNBC interview Friday morning, Sen. Rick Scott, R-Fla., said while the average American might not care about the Dow's triple-digit losses, they do pay attention to the job market.

"They're not thinking about the stock market every day," Scott told CNBC's "Squawk Box" on Friday. "Look at this job market — that's what people are thinking about."

Low unemployment and a strong economy have been a strong point for the Trump administration heading into a 2020 election. In April, the unemployment rate hit its lowest level in 50 years. In the first quarter, gross domestic product increased 3.2%, far exceeding analysts' expectations. Productivity during the quarter saw its biggest gain in five years.

"The average person says: Do I have a job, and are my wages going up? That's what they care about," Scott said. "We'd all like the stock market to go up every day, but reality is, for the typical American, they want a good job."

— CNBC's Yun Li contributed reporting.