The semi surge may end up being short-lived.

As the group took off Monday after President Donald Trump came to a tariff truce with Chinese President Xi Jinping, not everyone taking part in the bullish boost.

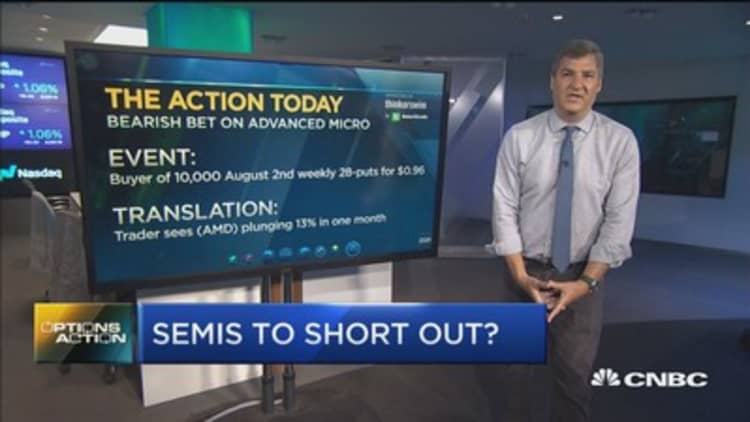

One trader, in fact, placed a bearish bet on one of the sector's top-performing names: Advanced Micro Devices, which is up nearly 70% year to date.

"Put volume was 1½ times that of calls" in AMD, Dan Nathan, co-founder and editor of RiskReversal.com, said Monday on CNBC's "Options Action."

The bet that caught his eye was a purchase of 10,000 of the $28-strike puts expiring Aug. 2, shortly after AMD's upcoming earnings report in the last week of July. The trade was executed when shares were trading around the $31.30 level on Monday.

For Nathan, this appeared to be a bet on AMD's practically unobstructed rally coming to an end.

"Here's a stock that's massively outperformed the whole space. It's up 70% on the year. It's ... up 100% from its 52-week lows," he said. "While a lot of names that we know and we talk about quite frequently have underperformed the broad market, AMD has massively outperformed. ... Sentiment's been very positive."

Even now, AMD's stock looks like it's ready to take off "despite a trader buying those puts," Nathan said, pointing to the chipmaker's one-year chart.

Stacked against the recent moves in the VanEck Vectors Semiconductor ETF, which tracks the semiconductor sector, AMD's run has been notably positive, especially considering some of the recently reported results from the space, Nathan said.

"Don't forget: just a few weeks ago we had this really disappointing earnings report and guidance from Broadcom. Last week, Micron had decent results, basically calling, possibly, a bottom in the second half of the year," he said.

As such, "this is going to continue to be a battleground group until we have some definitive color on trade with China and, obviously, global growth," Nathan said.

Mark Tepper, president and CEO of Strategic Wealth Partners, preferred a different chipmaker that he saw as "best of breed," he said in the same "Options Action" segment.

"My favorite pick here is Nvidia," he said. "With Nvidia, you really get good, best-of-breed exposure to all the highest-growth end markets we want to be a part of, from autonomous vehicles to AI, data center, gaming. They had some problems, they had some issues with regards to crypto exposure that they've kind of cleaned out, so I think, at this point right now, the risk-reward profile looks very good with Nvidia."

The VanEck Vectors Semiconductor ETF was almost 1% lower in early Tuesday trading. AMD shares also fell less than 1%. Nvidia's stock was down more than 1%.