The Federal Reserve's ultra-low interest rates during Barack Obama's presidency widened the wealth gap and fostered anger among working Americans, Republican Sen. Pat Toomey told CNBC on Wednesday.

That anger is emerging as a hot-button issue in the 2020 presidential race as the many Democratic candidates looking to prevent President Donald Trump from winning a second term call for the rich to pay more in taxes.

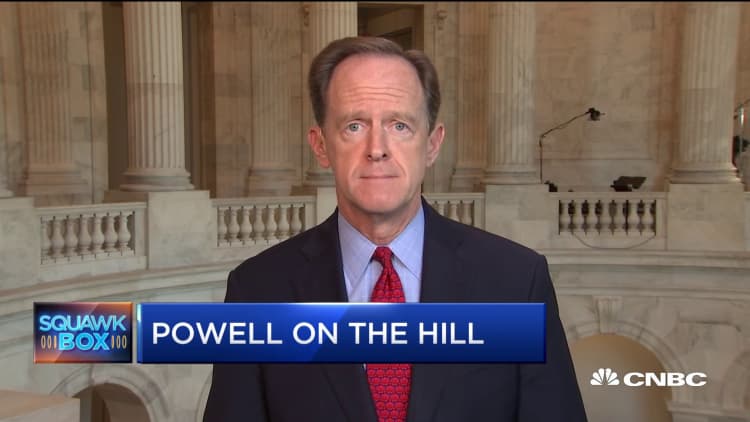

The Fed holding "rates at zero for such an extended period probably did contribute to some understandable resentment," the Pennsylvania senator said in a "Squawk Box" interview.

The average person with modest savings "earned zero" in bank accounts, while people with "financial assets, people who had accumulated some wealth, saw their wealth increase in value" in the stock market, said Toomey.

"That wasn't very fair," he argued. "By the way, it didn't give us booming economic growth."

The economy under Obama saw a slow but steady growth rate as the nation emerged from the 2008 financial crisis. Fed rates were so low at the time in an attempt to boost growth and asset prices.

Under Trump, the economy was on fire in 2018. But this year, growth appears to be slowing and perhaps reverting to an Obama-era type trend.

Toomey, however, argued that "our policies are much better now," pointing to the 2017 Trump tax cuts for individuals and corporations and the removal of restrictive business regulations.

Meanwhile, ever since Trump started railing against Fed Chairman Jerome Powell for raising rates too aggressively and putting a drag on the economy, Toomey has defended Powell and said he should remain on the job.

Toomey — an advocate for an independent Fed and a member of the Senate Banking Committee — will question Powell on Thursday when he goes before the panel.

In prepared testimony released ahead of Wednesday's House Financial Services Committee appearance, Powell set the stage for a rate cut.

Fed rates have been steadily rising since 2015 to a target fed funds overnight lending rate of 2.25% to 2.50%. Central bankers hiked rates four times last year alone, with the latest increase in December when financial markets were tanking.

Many investors and traders say the December hike was one too many, and the market is putting 100% odds on a rate reduction at the July 30-31 Fed meeting.