UBS has become the first broker to upgrade Deutsche Bank's stock following its initiation of a historic restructuring program.

In a note published Friday, UBS analysts upgraded the German lender's stock from a "sell" to "neutral" and raised its 12-month price target from 5.70 euros ($6.42) a share to 6.60 euros, on the basis that the new strategy would yield a more balanced risk to reward ratio.

UBS analysts Daniele Brupbacher, Mate Nemes and Nichole Maroun suggested Deutsche would pursue "more aggressive cost cuts and regulatory support potentially resulting in lower capital requirements."

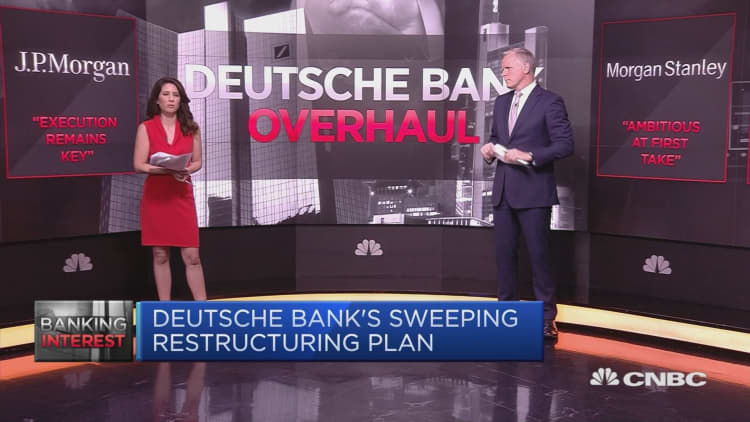

Deutsche Bank will see 18,000 jobs cut by 2022 and the closure of its global equities sales and trading business. It plans to cut costs by 25% while growing core revenues by 10% over four years without a capital increase, which some Wall Street analysts have labeled too "radical" and "ambitious," but UBS disagrees.

"The plan shows willingness and determination to change the profile of DB, the home regulator will be supportive we think," the note stated.

"It's the attempt to break out of the self-feeding debt/equity circle."

The analysts determined that risk of a required capital increase is limited, and concluded that core revenues will instead be the most pivotal factor in the investment case for Deutsche.

The restructuring steps announced by the bank show a "willingness to change," the analysts suggested, while acknowledging that the "operating environment is not improving and strategic options have been limited."

They added that a small room for error means a broad range of outcomes are still possible, and revenue weakness could push Deutsche into more drastic measures with regard to costs, possible merger and acquisition activity, disposals or capital increases.

The note does suggests that Deutsche's target of an 8% return on tangible equity (ROTE) by 2022 is unattainable, instead calculating a 2022 ROTE of 4.3%, the basis for its price target.

Deutsche Bank employees were seen leaving offices around the world on Monday as the ax began to fall on its long-suffering equities division.