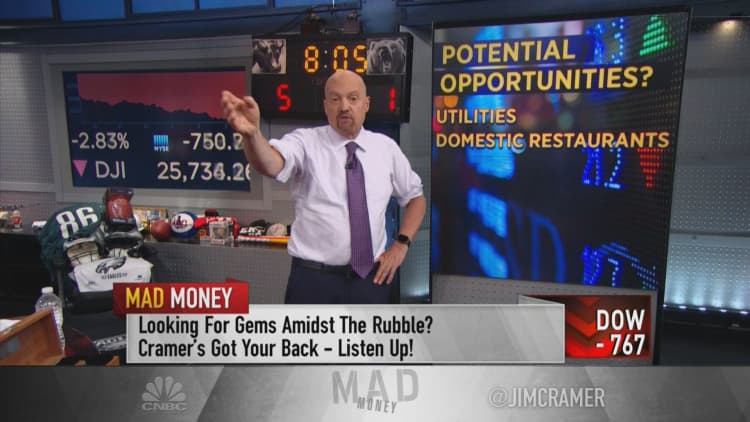

After a brutal trading day on Wall Street, CNBC's Jim Cramer shined a light on a number of sectors where investors can search for buying opportunities in a market shaken up by escalating trade tensions.

The CBOE Volatility Index, known as the VIX, has more than doubled in the past six trading days as the major U.S. indexes have all plummeted in the past week. A high VIX measure indicates a risky market.

The "Mad Money" host on Monday labeled retail, pharma, tech, fossil fuels and the industrials areas are tough to invest in here as companies with Chinese exposure are expected to cut forecasts in the wake of tariff threats on remaining imports from China. But investors will be able to start new positions in a number of stocks that have sold off too much, he said.

"Remember, in harsh sell-offs like this one, you wait for stocks to go down and then you start picking among the rubble on the fifth day, searching for the ones that were punished for the wrong reasons," Cramer said.

"You need to buy small to start and then again and again, and let's see what happens" after that, he added.

Utilities

Cramer recommended Dominion Energy, PPL, Verizon and AT&T as investible stocks, given that the companies are offering dividend yields between 4.5% and 6%. The yield is the portion of profits that is paid out to shareholders, and the host has said dividend stocks are the best plays currently on the market.

"I wish American Electric Power had a bigger dividend, but, you know what, their 3% yield won't cover you now because this stock has run so much," he said.

Restaurants, food and beverage

Restaurants and international chains that have no exposure to China are worth a bet, Cramer said. He pointed to Yum Brands — parent of KFC, Taco Bell and Pizza Hut — as the best play because its China division, Yum China, was spun off in 2016.

Cramer also suggested Chipotle, while calling McDonald's, Starbucks and Burger King-parent Restaurant Brands wait-and-see plays.

"This whole industry is benefiting from the increasingly-aggressive competition in the online delivery space," he said. "The delivery platforms are too competitive ... but that's good news for all sorts of restaurants."

Investors can lean on global food and beverage stocks, including Coca-Cola, he added.

Financial Technology

Stocks in the financial technology sector have rallied big, but Cramer thinks investors should be ready to find new entry points.

"I'm betting they'll be great places to hide because they don't have much meaningful exposure to China," he said.

Defense

The more that the the U.S.-China relationship deteriorates the more attractive the defense contractor stocks become, Cramer said.

"The one I like is L3Harris ... because it's the highest tech-defense contractor," he said. "On the other hand, Lockheed Martin ... it was tempting, but I think it's got downside."

Gold

Cramer endorsed Barrick Gold as a value play and Agnico Eagle as a growth play.

"I like them both, especially Agnico Eagle after we heard from CEO Sean Boyd last week," he said.

Housing

Cramer expects homebuilders to get a boost as long-term interest rates fall to low levels. D. R. Horton and Lennar are among his favorite picks, here.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com