President Donald Trump blamed the Federal Reserve for mounting fears about a slowing U.S. economy on Wednesday as he defended his administration's trade war with China.

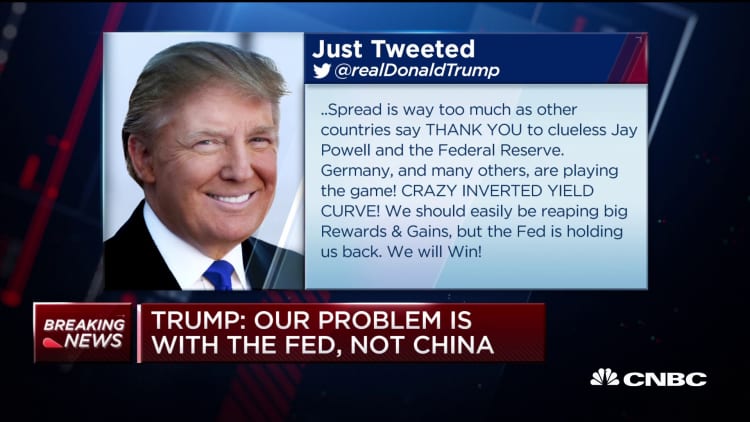

In a pair of tweets, the president argued the central bank and its "clueless" chairman, Jay Powell, have dragged on the U.S. economy. He also blamed the Fed for the yield on the 2-year U.S. Treasury moving higher than the yield on the benchmark 10-year Treasury — an indicator of a possible recession that contributed to major U.S. stock indexes dropping about 3% on Wednesday.

"CRAZY INVERTED YIELD CURVE!" the president wrote. "We should easily be reaping big Rewards & Gains, but the Fed is holding us back. We will Win!"

Trump also claimed "we are winning, big time" in his administration's trade conflict with the world's second-largest economy. "China is not our problem," but rather "our problem is with the Fed" and its interest rate policy, he said.

Trump has repeatedly pushed the Fed to cut its benchmark federal funds rate in recent months as the trade conflict with Beijing has, at times, contributed to stock market chaos and concerns about U.S. economic growth slowing. On Tuesday, he argued the Fed "raised too much" and "too fast" in hiking rates by a quarter of a percentage point seven different times in 2017 and 2018.

He said the central bank is "now too slow to cut" rates. Last month, the Fed decreased the target range on the federal funds rate to 2% to 2.25% — the first time it cut rates since the 2008 financial crisis. Trump nominated Powell for the job.

On Tuesday, Trump delayed new tariffs on some Chinese goods that were set to take effect on Sept. 1. They will now be implemented on Dec. 15. Stocks popped Tuesday following the announcement as investors grew more hopeful about the trade conflict easing or ending.

Trump told reporters "we're doing this for the Christmas season, just in case some of the tariffs would have an impact on U.S. consumers." The president and members of his administration have insisted China will bear the burden of the duties rather than American businesses and consumers.

The yield curve inversion sent fear back into stock markets Wednesday. The falling yields in longer-term U.S. Treasurys reflect a move into safe-haven assets as concerns grow about the economy's health.

The bond market phenomenon took place Wednesday as parts of the global economy showed signs of flagging. Germany's economy contracted by 0.1% between April and June, according to data released Wednesday.

The Trump administration is not actively working on plans to kick-start the U.S. economy, The Washington Post reported Wednesday.