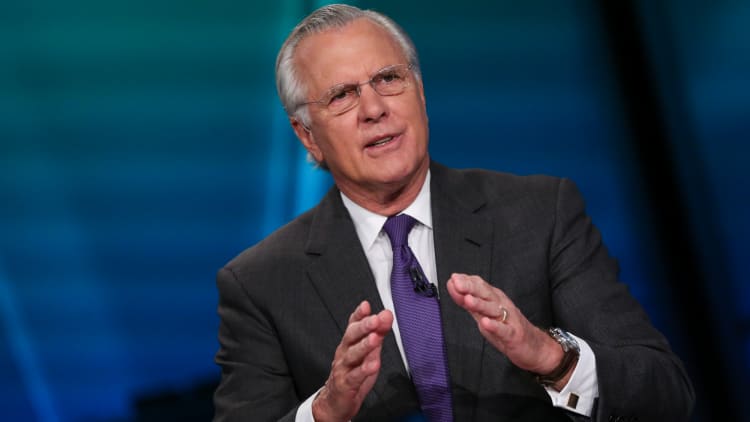

Former New York Fed President Bill Dudley is calling on the central bank not to help President Donald Trump fight his trade war with China.

In a sharply worded commentary to his one-time colleagues, Dudley urged Fed officials not to lower interest rates simply as a backstop while the president continues his tit-for-tat tariff battle with the Chinese that has escalated in recent days.

"Central bank officials face a choice: enable the Trump administration to continue down a disastrous path of trade war escalation, or send a clear signal that if the administration does so, the president, not the Fed, will bear the risks — including the risk of losing the next election," he wrote in a post on the Bloomberg News site.

Dudley went so far as to suggest the Fed could — and should — try to influence the next election against Trump.

"After all, Trump's reelection arguably presents a threat to the U.S. and global economy, to the Fed's independence and its ability to achieve its employment and inflation objectives," he wrote. "If the goal of monetary policy is to achieve the best long-term economic outcome, then Fed officials should consider how their decisions will affect the political outcome in 2020."

A Fed spokesman said the central bank does not use politics as a guide for its decisions.

"The Federal Reserve's policy decisions are guided solely by its congressional mandate to maintain price stability and maximum employment. Political considerations play absolutely no role," the official said in a statement.

Some economists criticized Dudley's statement as inappropriate for a former central banker.

"We fear that the opinion column ... is likely to prove counterproductive for the current Fed leadership, which we are confident had no hand in the production of the opinion piece and has had to deny immediately that 'political considerations' play any part in policymaking," Krishna Guha, head of global policy at central bank strategy at Evercore ISI, said in a note.

The White House did not respond to a request for comment.

Trump has taken on the Fed repeatedly, last week even equating Chairman Jerome Powell with China President Xi Jinping and asking in a tweet, "Who is our bigger enemy?"

The president is demanding sharply lower interest rates that he says are needed to keep the economic expansion going and to help fight the trade war.

In his latest attack, Trump tweeted Tuesday that the Fed "loves watching our manufacturers struggle with their exports to the benefit of other parts of the world." He added that the central bank "has been calling it wrong for too long!"

Dudley said the Fed should "refuse to play along" and could "go further" than Powell's inference last week that monetary policy might not be effective in staving off the economic damage from tariffs.

"Officials could state explicitly that the central bank won't bail out an administration that keeps making bad choices on trade policy, making it abundantly clear that Trump will own the consequences of his actions," he wrote.

Doing so would send a signal that the Fed won't be complicit in the trade war while also preserving "much-needed ammunition" for rate cuts down the road that might be needed to combat economic downturns, Dudley said.

Markets expect the Fed to approve another 25 basis point cut to follow the one OK'd in July, the first in 11 years, and are pricing in a nearly 80% chance of one more before the end of the year.

In his speech last week in Jackson Hole, Wyoming, Powell pledged that the Fed would continue to do its part to support the economy but did not lay out any specific intentions.

WATCH: Fed should continue to not comment, says former Dallas Fed president