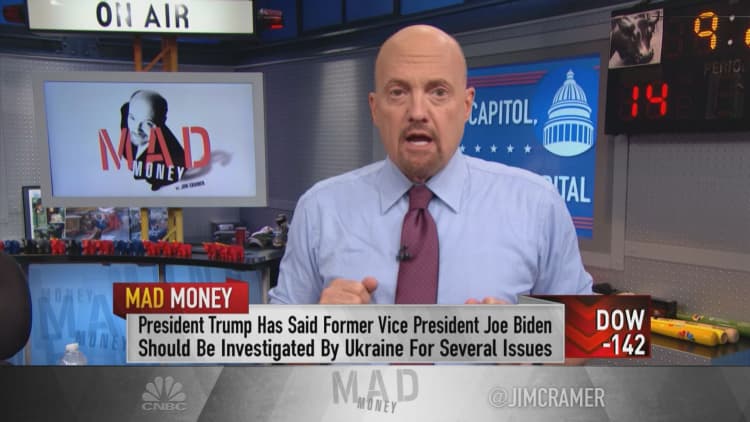

CNBC's Jim Cramer on Tuesday said there's no need to "freak out" after House Speaker Nancy Pelosi decided to open an impeachment inquiry into President Donald Trump over charges of abuse of power.

The Dow Jones Industrial Average shed more than 142 points and the S&P 500 fell 0.84% during the session, which closed prior to Pelosi's announcement. The tech-heavy Nasdaq Composite also dropped nearly 1.5% in anticipation of her statement.

Cramer compared Tuesday's market action to what happened the last time a U.S. president was impeached two decades ago.

"I need you to recognize that the Senate will most likely acquit," the "Mad Money" host said about the divided Congress. "How much will that matter to the stock market? You know what, we've seen this movie before."

Cramer said there was no surprise that former President Bill Clinton would be acquitted by the Democratic-controlled Senate after a Republican-led House launched an impeachment against the Democrat in 1998. After that formal impeachment inquiry was opened, the Dow fell 0.8%, the S&P 500 sank 1.4% and the Nasdaq plummeted 4.8% in a similar fashion to Tuesday's reaction.

The major indexes recovered most of those losses the next day on its way to double-digit rallies by the time the House officially voted to impeach then-president Clinton within two months. The Nasdaq, in particular, led the market, increasing 39%, as every pullback proved to be a buying opportunity, Cramer said.

"Overall, stocks absolutely crushed every other asset class during the Clinton impeachment. Why? Because impeachment, well, it was a sideshow," he said. "What really mattered was the booming dot-com business and the emergency rate cut from Alan Greenspan's Fed that caused the market to catch fire. If this turns out like 1998 all over again, then you may want to buy at the moment of maximum rancor."

The market is not quite there yet, though, because stocks need to get to an oversold position, Cramer continued. Still, investors can buy shares of companies that have good fundamentals if they continue to get crushed by news out of Washington, he added.

Cramer said his charitable trust has been selling some stocks to protect profits and prepare to buy future dips.

"I say there's no hurry to start buying here, although … history says that you're going to have to try to pull the trigger soon, rather than be left behind," the host said. "Today's merely day one of Speaker Pelosi's sudden pro-impeachment pivot. No harm in waiting until this market gets oversold before you put a lot of money to work."

Trump has been under fire for a phone call in which he allegedly pressured Ukrainian President Volodymyr Zelensky to investigate former Vice President and presidential candidate Joe Biden and his son, Hunter Biden.

WATCH: Cramer reacts to impeachment proceedings on Trump

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com