Bernie Sanders' proposed inequality tax plan, which would levy a new tax on companies whose CEOs earn more than 50 times as much as their average employee, mostly bypasses tech companies, which pay high salaries.

With one big exception: Apple.

Because the company has a relatively large base of retail store employees who are not paid as much as engineers or typical tech employees, CEO Tim Cook makes more than 200 times the average Apple employee's salary.

Specifically, the company reported approximately 132,000 employees at the end of its 2018 fiscal year, which ended Sept 30, 2018. Of those, about 70,000 work in its retail stores, according to Bloomberg.

The company's proxy statement from its 2018 fiscal year reveals, "The 2018 annual total compensation of our CEO was $15,682,219, the 2018 annual total compensation of our median compensated employee was $55,426, and the ratio of these amounts is 283 to 1." All public companies are required to reveal this ratio in SEC filings.

Under Sen. Sanders' proposal, companies whose CEO makes more than 200 times the average employee's salary would have an additional 2% tax levied on them. Apple's effective tax rate was 18.3% on taxable income of $72.9 billion. Bumping that up another 2% would have meant an additional $1.4 billion payout.

Amazon is another exception, thanks to its enormous staff of warehouse workers.

However, although CEO Jeff Bezos is the richest person in the world from his Amazon stock holdings, his annual compensation is lower than Cook's. As the company notes in its 2018 proxy statement: "The 2018 annual total compensation of our median compensated employee other than Mr. Bezos was $28,836; Mr. Bezos' 2018 annual total compensation was $1,681,840, and the ratio of those amounts is 1-to-58."

That would add an additional 0.5% tax to Amazon's annual payments.

But Amazon operates on much lower margins than Apple, and in 2018, its taxable income was only $11.3 billion, meaning it would have paid only $56 million more in taxes.

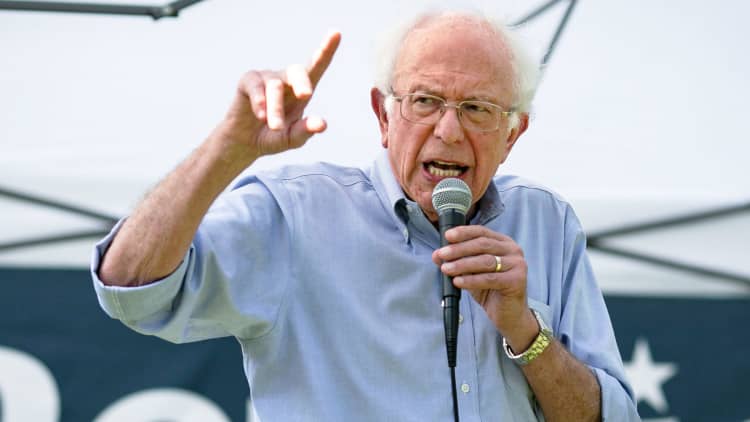

Sanders, who is an independent from Vermont, is chasing the Democratic presidential nomination for 2020, but trails well behind fellow progressive Sen. Elizabeth Warren (D-Mass.) and moderate ex-Vice President Joe Biden in the latest polls.