CNBC's Jim Cramer warned on Tuesday that Wall Street could have a "very rude awakening" because the expiration of stock sales restrictions following IPOs will soon lead to a deluge of equities on a market with little investor appetite.

Following an initial public offering, major shareholders and company insiders are not allowed to sell shares in the company for a specified period.

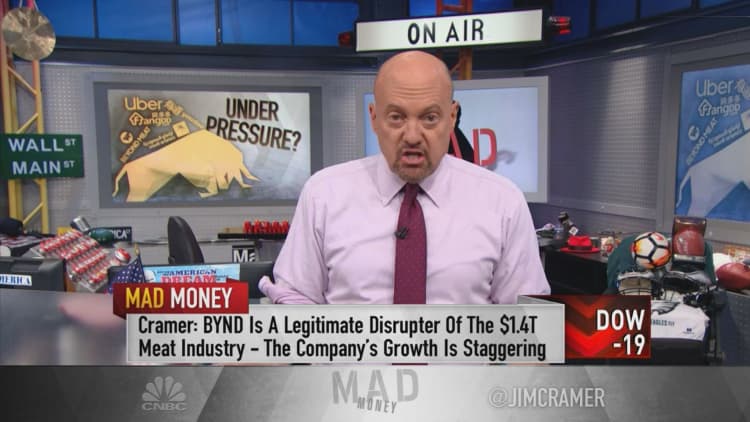

The "Mad Money" host pointed out that the stock lockup on insider trading for several recent IPOs are expiring, which means that those shares will be authorized for trading on public markets. That's in addition to other initial public offerings in the queue.

"When you have billions of dollars of stock entering the market without a natural home, you better believe the averages will come under pressure," Cramer said. "These lockup expirations and IPOs [are] going to take their toll, unless a flood of new money comes into the stock market. I hope we can absorb them without too much pain, but hope is not part of the equation."

The lockup on insider selling for Beyond Meat expired on Tuesday, and the stock tumbled more than 22% during the session. The release follows the faux-meat producer's secondary offering that came in August.

Beyond Meat would have seen an even larger fall had the company not reported a strong quarter the previous day, Cramer said.

"The market's being flooded with new shares of Beyond Meat and the supply overwhelmed the demand," the "Mad Money" host said. "I think it could have further to fall because even here it seems overvalued to me."

Cramer said he's "concerned" because lockups will also expire for many other businesses that made their market debuts in the first half of 2019. Uber, Pinterest and Zoom Video Communications are all approaching lockup expiratrions.

Insider shares of Uber, which began trading in May, will hit the market the first full week of November. Cramer said about 200 million shares are currently trading "badly" on the public market and that roughly 763 million more shares will come available.

The stock debuted on the market above $41 per share. It closed Tuesday's session at $32.42, a 22% decline.

"If Uber keeps trading at $32, we're talking about $24 billion worth of stock," Cramer said. "I suspect many of the shareholders will want out because this unicorn's been a bust and they don't want to lose more than they've already lost already."

"Unlike Beyond Meat, the Uber expiration is big enough to ... hobble the entire market," the "Mad Money" host said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com