The most successful money maker in modern finance has one simple rule of thumb for investing: remove all emotion.

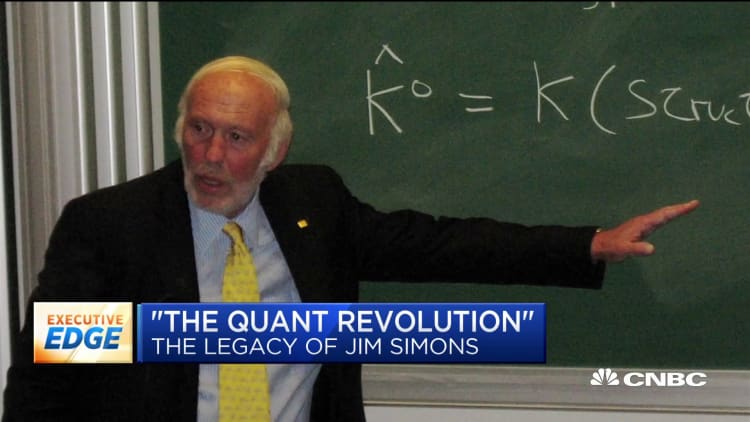

Jim Simons revolutionized investing when he left academia in 1978, at the age of forty, to begin trading. Relying on his experience and skills as a decorated mathematician, professor and code breaker, Simons looked at the market in a fundamentally different way when he launched his quantitative-focused fund Renaissance Technologies in 1982 from a strip mall in Long Island.

According to "The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution," a new book by the Wall Street Journal's Greg Zuckerman, Simons' secret and winning strategy has always been to remove emotion and focus on pure, hard data.

"The importance of models as opposed to sort of intuition," Zuckerman said Tuesday on CNBC's "Squawk Box" when asked about Simons' trick. "Too often we get caught up in stories when it comes to stocks. We get caught up in things like Uber and WeWork … you look at the best companies today, Amazon, Netflix, Tencent, it's all models. And that's the Simons solution. By deferring to models and the scientific method you don't fall for things like behavioral biases."

Using his mathematical background and large sets of data, Simons set out to build computer models that he believed could identify and profit from patterns in the market. His algorithms are based on data from as far back as the 1700s, according to Zuckerman, and they take advantage of even the smallest and shortest fluctuations in prices. The average holding period is two days. Simons' unconventional background has proliferated throughout the firm, which is known for hiring people with PhDs in math and physics rather than traditional Wall Street players.

His years of success and outsized returns have placed him in a class of his own, even ahead of legendary investors like Ray Dalio, Warren Buffett and George Soros to name a few. Since 1998 Renaissance's flagship Medallion Fund has returned 66% annually, or 39% after fees, Zuckerman found. While Simons no longer oversees the fund, which exclusively manages employee money, he remains active at the firm.

Zuckerman said that the traditional method of investing — intuition, speaking with companies, analyzing balance sheets, etc. — is no match for Simons and Renaissance since the firm's models are able to process vast amounts of information instantaneously.

Quant pioneers

Quantitative-based investing now accounts for the largest portion of daily stock trading, but few firms do it on the same scale as Renaissance.

"For a long time, for decades, they had better, they had cleaner data, and more data than anybody else and it really is a huge advantage. They were paying attention to these kinds of things, the importance of big data, years before Mark Zuckerberg was even finished with grade school," Zuckerman said.

But it hasn't been all smooth-sailing. There have been years like 2007 that delivered disappointing returns, and the fund is currently embroiled in a years-long dispute with the IRS over what the government says is unpaid taxes.

While all stock trading is now machine-based, algorithmic or algo trading has been blamed for outsized market swings and flash crashes. As quant investing continues to gain traction, SEC Chairman Jay Clayton told CNBC in September that the government organization is monitoring computer trading "to make sure that trading today is as fair and transparent as it was when it was voice trading."

Simons, predictably, believes that quantitative trading is actually helping investors and the market more broadly by providing liquidity.

"By having a lot of fast trading, spreads have come way down, volumes have gone up, and therefore it's easier to get off a trade because there's more volume. I think it's actually brought short term volatility down, not up. So I think it's been good for the market," he told CNBC in 2016.

The move toward passive investing could potentially prove problematic for Renaissance.

Patterns we can't see

This investing approach, which comprises funds tracking market barometers like the major indicies and sectors, now accounts for nearly half of the US stock market. This could be bad for Renaissance since the fund relies on people and the market mispricing securities.

"The whole genius of Renaissance Technologies and Jim Simons is that there are patterns in the market that we humans don't really pick up on and their machines do. They use unbelievable data … But what happens if the behavior of the market changes and we'll see going forward. For now there are enough dentists and people like me trading the market that they [Renaissance] take advantage of, but we'll see. If everybody goes to passive then the nature of the market could change," Zuckerman said.

Even Simons panicked

Simons may have built his $23 billion fortune on a calm and cool investing approach, but even he can be susceptible to market-induced emotion. Zuckerman said that at the end of 2018 when stocks started selling off Simons was on vacation with his wife in California. Seeing red across the screen he called his money manager and said "shouldn't we be protecting here, shouldn't we be shorting?"

Ultimately, the firm tries not to override the system. "They're scientists and mathematicians, they don't necessarily feel as emotional as you and I do, they're a kind of different breed … if you defer to models and the scientific method then you can outperform," Zuckerman said.

Simons perhaps summed up his investing approach best of all in a 2016 interview when he said he has no opinions on stocks. "The computer has its opinions and we slavishly follow them," he said.