Wall Street can't stop talking about Elizabeth Warren, and as trade war fears and recession scares abate, the Massachusetts senator's ascent is set to become the market's new obsession.

"With the trade war cooling down, the impeachment looking like a sitcom and recession fears subsiding, Elizabeth Warren is the new Wall of Worry," Josh Brown, CEO of Ritholtz Wealth Management, said in a tweet Thursday. "You'll be hearing about her night and day on Wall Street. Every strategist will cite her nomination as a risk to watch for in 2020."

The Dow Jones Industrial Average hit another record on Thursday, bringing its gain for the year to 18%. Traders believe the market always needs a fear, or a host of negative factors, to climb a so-called wall of worry higher and keep ascending. When the fears subside, contrarian traders believe that's a negative for the market.

While it's still a year to go before the November 2020 presidential election, some the Street's biggest investors and a host of market strategists for big banks have already expressed unease at the prospect of a Warren win.

Should Warren take the White House, the S&P 500 would sink about 25%, billionaire Paul Tudor Jones predicted. Longtime investor Leon Cooperman has been among the most vocal critics of the Democratic presidential hopeful, claiming she is "s----ing on" the 'f-----ing American dream" and seeing a market correction on a Warren presidency. Jamie Dimon recently inserted himself in the feud, saying Warren "vilifies successful people."

Wall Street brokerages and market research firms have been loud and clear about the damage a Warren win would do to stocks. Barclays, Oppenheimer, Jefferies and Mizuho recently warned separately about different sectors including health-care services, energy, banks and biotech that would suffer under Warren policies. Goldman Sachs warns the S&P 500 earnings could be reduced by 11% if the 2017 corporate tax cut is entirely reversed.

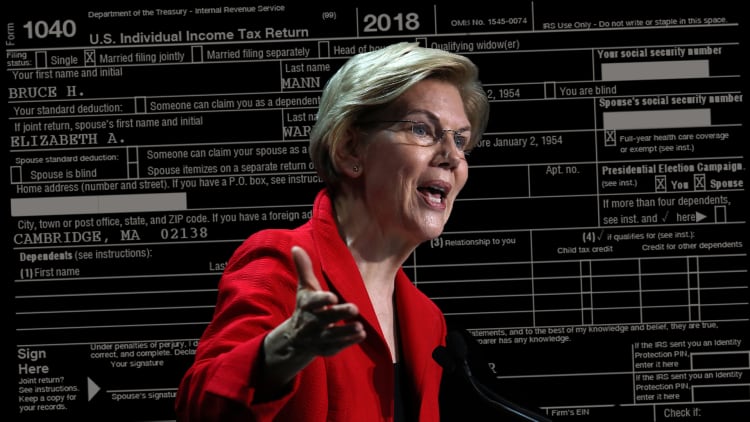

Warren has ratcheted up her pressure on the billionaire class recently, saying that her tax proposal could be doubled to 6% on fortunes over $1 billion to help pay for a "Medicare for All" plan.

Other fears abate

The election is likely to take center stage on Wall Street as the U.S.-China trade battle which roiled the market in the past 18 months has finally moved closer to a resolution. China said Thursday that the world's two largest economies had agreed to remove existing trade tariffs.

Fears of a recession are also cooling down as recent economic data point to an improvement. A gauge for U.S. services activities topped expectations for October, while the labor market remains solid as job creation easily beat estimate last month.

A slowdown in corporate earnings this year also seemed to be turning around as results this season have come in largely better than expected. Of the 87% of the S&P 500 companies that have reported so far, about 74% topped analysts' estimates, according to FactSet.

Warren worries overblown?

Other than the Ultra-Millionaire Tax, Warren also aims to change tax rules for private equity firms and rewind the 2017 corporate tax cuts. Warren's plan also calls for other taxes likely to affect the wealthiest Americans including a proposal to tax capital gains.

While Warren's plans to rein in Wall Street and corporate America could wreck the markets, the concerns could be overblown as she would likely need to win the presidency and have a Democratic majority in both houses of Congress for any of her bills to become reality.

"Investors must take into account the probability that potential outcomes will be realized," David Kostin, Goldman's chief U.S. equity strategist, said in a note last week. "Several conditions must be met before major policies of a new administration could be enacted: a particular candidate must win the presidency; the candidate's party must control the House and the Senate; the candidate must choose to pursue certain policies, and the legislation must pass through Congress."