Bearish investors betting that a recession is looming can't seem to catch a break, even on a day where the stock market got "crushed" in morning trading, CNBC's Jim Cramer said Monday.

The Dow Jones Industrial Average, which swung as low as 27,517.67 during the trading day, managed to climb more than 10 points to 27,691.49 by session close. The S&P 500 and Nasdaq Composite both slipped more than half a percentage point before ending the trading day down just 0.20% and 0.13%, respectively.

"People are still betting on a recession. They think this is merely a Fed-mandated bubble and the buyers are going to get crushed and that I am way too positive," the "Mad Money" host said.

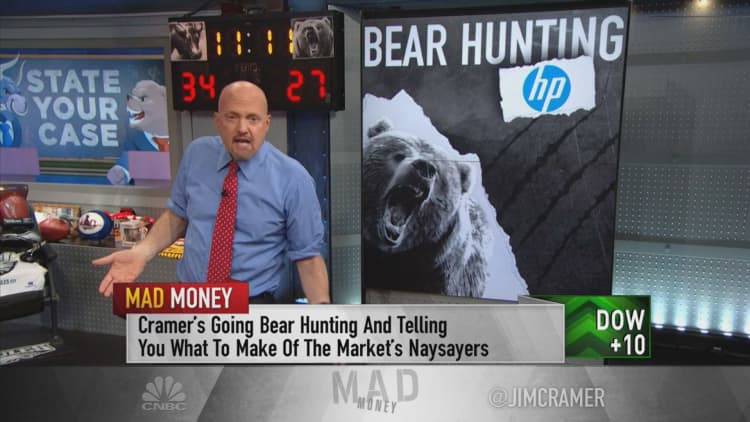

Cramer said the "permanent pessimists" keep "missing the mark," recalling action in Hewlett Packard and Walgreens, among other public companies, for reasons why.

HP has been a tough stock to buy, he said, that is until the printer manufacturer received a $22 per share takeover bid from Xerox — a company not even half its size. While the host isn't convinced that Xerox can pull the acquisition off, the details of the potential deal do not matter, he said. The stock surged more than 6% on the news and is up nearly $4 to $19.64 from its October intraday low as of Monday's close.

"The important thing is that HP has gone from ugly duckling to beautiful swan on the strength of what may be a chimerical takeover bid," Cramer said. In other words, you made a fortune if you believed in HP when you really shouldn't have believed in HP."

"Deal or no deal, HP's stock has got its groove back."

Same goes for Walgreens, who is being targeted by private equity firm KKR to be taken off the public market. Shares jumped more than 5% to close at $62.25.

Cramer noted that the drugstore is loaded with tens of billions in debt, feeling competition from Amazon and shares have been under pressure.

"At this point, it doesn't matter ... what I think about how crummy this business is. What matters is there's a potential acquirer who believes in it," he said.

"This market just keeps surprising us with companies that are doing better than anyone could've imagined, or at least their stocks were cheaper than we thought," Cramer said, "and that's a big reason why the bulls are running circles around" the bears.

Disclosure: Cramer's charitable trust owns shares of Amazon.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com