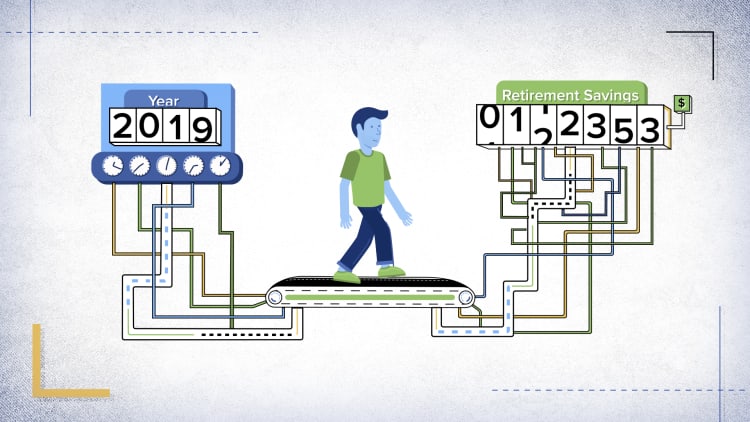

Americans have been contributing a greater share of their salaries to their 401(k) plan accounts — and that could have a substantial impact on retirement savings over time.

Savers stashed away an average 7.7% of pay in 2018, up from 6.8% just two years earlier, according to the most recent figures published by the Plan Sponsor Council of America.

That increase may not sound huge, but it can have a noticeable impact on a saver's nest egg decades down the road.

A 35-year-old earning $60,000 a year would save an extra $85,500 by retirement age by increasing 401(k) contributions by just 1%, according to a Fidelity Investments estimate. A 45-year-old earning $70,000 a year would have an additional $43,000.

"It's definitely a significant jump," said Hattie Greenan, director of research at the Plan Sponsor Council of America.

At the same time, businesses have been raising the amount of match and profit-sharing money they share with 401(k) savers. Employers contributed an average 5.2% of workers' salaries into their 401(k) accounts in 2018 (the most recent year for which data is available), up from 3.6% a decade earlier.

When employer and employee contributions are combined, 401(k) savers are stockpiling an average 12.9% of their salaries annually. Retirement experts typically recommend a total savings rate of between 10% and 15%.

The interesting thing is, employers — not the workers — appear to be the primary cause for the overall savings increase.

Sure, employees may be contributing more to their 401(k) accounts as a result of a strong economy, according to Greenan.

More from Personal Finance:

Think twice about early withdrawals from retirement savings

How to get a bigger tax refund from the IRS in 2021

More people may soon have annuities in their 401(k) plans

But a tight labor market has also helped fuel greater 401(k) contributions from employers out of a need to be more competitive, Greenan said. The current unemployment rate of 3.5% is at its lowest level in roughly five decades.

Trends in the design of 401(k) plans have helped buoy savings, as well.

More companies have been automatically enrolling workers into workplace retirement plans over the past decade. Automatic enrollment uses Americans' inertia to their own advantage, by enrolling workers into 401(k) plans and deducting a portion of their pay for retirement automatically if workers do not take any voluntary action to save.

Business owners have also raised the contribution rates at which they automatically enroll workers over time.

More than 60% of 401(k) plans automatically enroll individuals, up from 38% a decade ago.

The Pension Protection Act of 2006 created incentives, such as an exclusion from some annual compliance tests, for employers that adopt automatic enrollment. Such plans are called "safe harbor" 401(k) plans.

Most plans historically enrolled workers at 3% of pay — which retirement experts almost unanimously agree is generally far too low to save an adequate amount of money for retirement.

Now, 6 in 10 plans automatically enroll workers at a rate of more than 3% — which is more than double the figure from a decade earlier.

More than three-quarters of 401(k) plans using auto-enrollment are also automatically increasing participants' savings rate over time, a process known as auto-escalation.

And there's one more reason to expect a potential further boost in the numbers going forward, courtesy of the Secure Act, a new retirement law signed by President Donald Trump last month.

The law allows "safe harbor" 401(k) plans to automatically escalate workers' contributions up to a maximum 15% savings rate, instead of the current 10%.