CNBC's Jim Cramer on Monday said investors should refrain from dumping stocks as fears of the deadly coronavirus jolt the stock market.

"Don't panic. It almost never makes sense to sell right into the maw of a big freakout like this one," the "Mad Money" host said.

"Instead of selling everything, you need to ask yourself: well, what's not impacted? What's going down that doesn't deserve to go down?"

Since the onset of the outbreak last week, Cramer has cautioned about getting behind stocks that have a considerable amount of exposure to China's market, given that the virus originated and affected a large number of people in that country.

The pneumonia-like virus has been blamed for more than 80 deaths in China and there are 2,900 reportedly ill across the globe. Airline and other travel-related stocks have fallen considerably as travel restrictions have been put in place, while Disney, McDonald's, Starbucks and other U.S. companies with presences in China have halted business there.

A number of stocks will be discounted as panicked selling hits Wall Street. Cramer said investors should spot the ones out that are worth buying into weakness.

With the exception of Owens Minor, "these are all conservative situations, but then again, I'm recommending them because they'll work regardless of whether or not we can contain the coronavirus outbreak in a short period of time," Cramer said. "You need that kind of peace of mind if you're going to try to buy anything into what I think could be a multi-day sell-off."

AbbVie

AbbVie is one of select stocks that climbed during the session, but the stock is down more than 5% this month. The biopharmaceutical company's HIV drug Aluvia is being used in China as a possible remedy for coronaivrus.

Additionally, the company is inching closer to acquiring Allergan, which Cramer is bullish about because it will include Botox and a migraine pill that the U.S. Food and Drug Administration recently approved.

"I think the estimates for this drug are way too low, which is why we want to buy more AbbVie for my charitable trust, which you can follow along by joining the ActionAlertsPlus.com club," Cramer said. "Meanwhile, the company's paying you a bountiful 5.6% dividend. That's not bad."

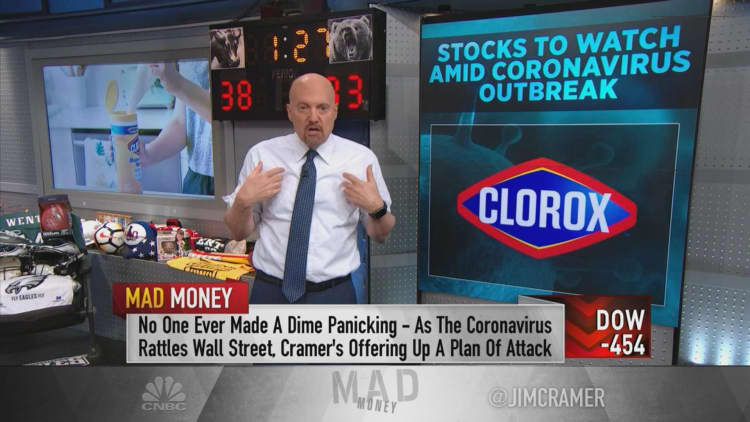

Clorox

Until a cure is discovered for coronavirus, Cramer noted that consumers will hit stores in droves to load up on germ-killing cleaning supplies to fend off the virus. The host said Clorox will be a beneficiary of this as people buy up their disinfecting wipes. Clorox stock rose on the market during the trading day.

"Whenever there's an epidemic, Clorox's stock tends to be a winner," the host said. "It went up 10% during the H1N1 outbreak [in] 2009."

McCormick

With coronavirus spreading quickly, people may be inclined to stay in home to limit their odds coming in contact with the disease. Spice maker McCormick is the "ultimate stay-at-home stock," Cramer said. He flagged that the stock caught multiple downgrades from analysts, but found solace in that the stock is not far off its highs.

"If you're too afraid to go out to eat ... you'll need to cook, and if you cook you need seasonings. Let's see what they say tomorrow," the host said.

The company is set to report fourth-quarter earnings Tuesday morning.

Owens & Minor

Cramer pointed out global health-care solutions provider Owens & Minor as a stock worth getting into as health officials scramble to stop the spread of coronavirus. Owens & Minor owns Halyard, a large supplier of hospital gowns and masks.

The stock, however, is down 80% over the past five years, while the S&P 500 is up 58% in that same span.

Cramer said it's "not for the squeamish" investor, but added "historically it's been a good investment during a heavy flu season, and so I think it works here as long as you recognize" it's a speculative play.

Moderna

Moderna develops medicines based on messenger ribonucleic acid, or mRNA. The biotechnology company is also reportedly working on a coronavirus vaccine. Cramer said he believes Moderna could be the company that comes up with a cure the quickest.

"I wouldn't normally recommend a biotech stock as speculation on something like this—odds are, nobody's going to come up with a cure—but Moderna has so much going for it that I actually think it's worth buying, here."

Thermo-Fisher

"If you read The Lancet, one of the world's oldest medical journals ... they repeatedly point out that Thermo-Fisher's gene-sequencing technology is the key to figuring out how to treat the disease. The stock's been a tremendous performer, but it could be even better."

Bristol-Myers Squibb

Drugmaker Bristol-Myers reports earnings next week. Cramer said he bets the company will "lay out some synergy targets for the Celgene deal. Their infectious disease portfolio is strong and it's one more reason to buy the stock, plus, the 2.8% yield doesn't hurt."

Disclosure: Cramer's charitable trust owns shares of AbbVie, Disney and Starbucks.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com