CNBC's Jim Cramer noted that bond yields are falling on coronavirus and slowdown fears, which could bleed into bank profits. The "Mad Money" host broke down why the software companies Ssalesforce and Adobe are headed for an intense rivalry in the enterprise space. Later in the show, he laid out a list of stocks that investors can buy to hedge against the coronavirus sell-off.

Trouble ahead for banks?

U.S. Treasury yields are sliding, and that could negatively impact financial institutions, CNBC's said Monday.

"Worries about a worldwide slowdown mean people will buy [U.S.] Treasurys, and when people buy Treasurys, interest rates go down," the "Mad Money" host said. "Lower long-term rates translate to lower earnings for the banks, which is why they've been coming down so hard."

A brewing battle in tech

Cramer said and may "become one of the great rivalries in tech."

"Lately both companies have been encroaching on each other's turf," the "Mad Money" host said. "They used to be companies with specific products. Now they offer entire platforms for small and medium-sized businesses, and that increasingly puts them in competition."

Discounted stocks

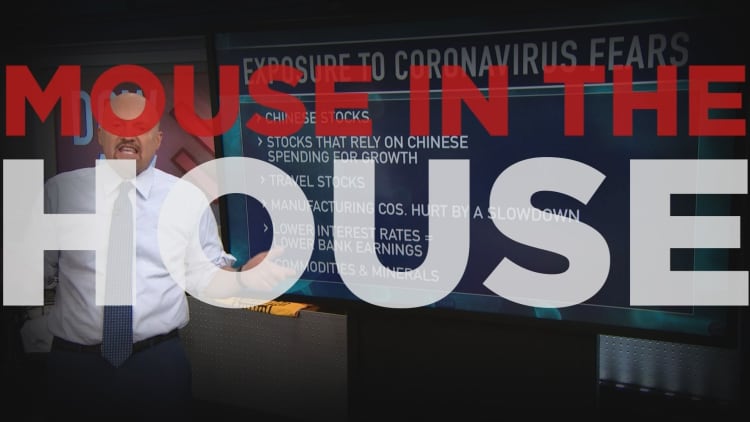

Cramer said investors should refrain from dumping stocks as fears of the deadly coronavirus jolt the stock market.

"Don't panic. It almost never makes sense to sell right into the maw of a big freakout like this one," the host said.

"Instead of selling everything, you need to ask yourself: well, what's not impacted? What's going down that doesn't deserve to go down?"

A number of stocks will be discounted as panicked selling hits Wall Street. Cramer revealed a list of stocks investors should consider buying into weakness.

Cramer's lightning round

In Cramer's lightning round, the "Mad Money" host ran through his thoughts about callers' favorite stock picks of the day in rapid speed.

: "Nope, got to pass on that one. I got to tell you something: that whole industry is in flux. I'd rather see you in , which got a small business there."

: "I interviewed them. I happen to think that they have got a really compelling story. Now I know, look ... this market's going down, but as one to be able to accumulate into weakness, that makes a helluva lot of sense. I'm on board there."

: "If you want to be in experiential economy and you want a little yield, why don't you go with EPR Properties."

Disclosure: Cramer's charitable trust owns shares of Salesforce.com.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com