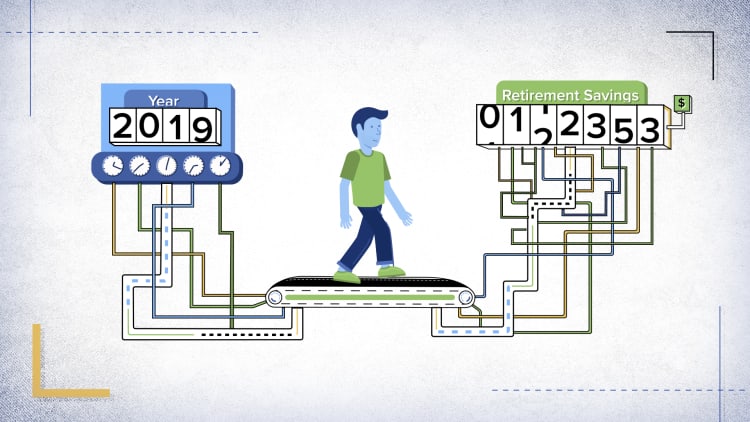

Here's a head-scratcher: Getting a raise could hurt your standard of living in retirement.

That conclusion seems counterintuitive. After all, wouldn't saving the same percentage of a larger paycheck yield more savings, and therefore a healthier retirement?

Not exactly, according to new research published by Morningstar.

"Raises — and how we spend them — can actually make it more difficult to retire comfortably," the report said.

That's partly due to something called "lifestyle creep."

More from Personal Finance:

Tax season is here! What you need to make it easy

Supreme Court could upend consumer financial protection

The secret to financial success: Paying off debt

Getting a raise may make things previously out of financial reach seem more affordable. But paying for that new car, larger house or bigger apartment locks in larger monthly bills.

Unless Americans increase their savings by an appropriate amount, they won't be able to fund these bigger expenses in retirement as easily.

"It's not a one-off thing," said Steve Wendel, Morningstar's head of behavioral science and one of four co-authors of the report, called "More Money More Problems." "It's a continuing bill – you have to continue paying for this new lifestyle."

A person's existing retirement savings and Social Security benefits also typically stay static or grow more slowly than income does after a raise. They may actually "shrink" relative to new retirement needs, according to Morningstar.

For example, Social Security benefits increase with wages, but only to a certain amount.

Americans also typically don't change their savings rates after receiving a raise. This strategy — saving 10% of a paycheck both before and after getting a bump in pay, for example — isn't smart, according to the report.

Instead, savings rates should generally increase with wages, researchers argue.

"People by and large aren't increasing their contributions when they get a raise," Wendel said. "It's not something many Americans do."

Luckily, there's a rule of thumb people can use to make sure they're saving an appropriate amount of each pay increase: Spend twice your years to retirement.

A saver would double their years left to retirement and could safely spend that percentage of their raise, while saving the rest.

A 35-year-old could spend 60% of a raise and save the remaining portion. A 50-year-old could spend 30% and save the remaining 70%. (These examples assume a retirement at age 65.)

However, savers should only use this framework, derived from an analysis of the Survey of Consumer Finances, as a good starting point — especially if they're unlikely to get a more detailed analysis from a financial advisor, researchers caution.

Older savers will likely have to set aside more of their raises than their younger counterparts, too — regardless of how well-funded the household is for retirement, according to Morningstar.

Older people have less time to save for retirement, and their savings have less time to appreciate.