In 2008, in the middle of the most recent economic recession, prominent Silicon Valley venture capital firm Sequoia Capital advised its portfolio companies about how bad things were, in a presentation called "R.I.P. Good Times." Now the firm is sounding the alarm again, telling founders and CEOs of its portfolio companies to prepare for worsening conditions.

The move comes as the coronavirus continues to roil U.S. and foreign financial markets, causing public companies to take steps to minimize impact to their employees and businesses. The memo shows private companies could be affected, too.

"With lives at risk, we hope that conditions improve as quickly as possible," the firm said in the memo. "In the interim, we should brace ourselves for turbulence and have a prepared mindset for the scenarios that may play out."

The firm advised companies to ask key questions as COVID-19 keeps playing out, including whether they need to cut back on head count and be more thrifty with marketing expenditures.

Founded in 1972 and based in Menlo Park, California, Sequoia is among the world's most successful venture capital firms, having invested in GitHub, Google, LinkedIn, Nvidia, Oracle, Square, YouTube and Zoom.

The memo is not nearly as sweeping or broad as the original R.I.P. Good Times memo about various economic factors, but is much more targeted and specific in recommendations on what start-ups should do. In particular, it outlines questions like "Where could you trim expenses without fundamentally hurting the business?" and suggests taking a close look at head count and customer acquisition costs.

Here's the full memo:

Dear Founders & CEOs,

Coronavirus is the black swan of 2020. Some of you (and some of us) have already been personally impacted by the virus. We know the stress you are under and are here to help. With lives at risk, we hope that conditions improve as quickly as possible. In the interim, we should brace ourselves for turbulence and have a prepared mindset for the scenarios that may play out.

All of you have been inundated by suggestions for precautions to take around COVID-19 to protect the health and welfare of you, your employees, and your families. Like many, we have studied the available information and would be happy to share our point of view — please let us know if that is of interest. This note is about something else: ensuring the health of your business while dealing with potential business consequences of the spreading effects of the virus.

Unfortunately, because of Sequoia's presence in many regions around the world, we are gaining first-hand knowledge of coronavirus' effects on global business. As with all crises, there are some businesses that stand to benefit. However, many companies in frontline countries are facing challenges as a result of the virus outbreak, including:

- Drop in business activity. Some companies have seen their growth rates drop sharply between December and February. Several companies that were on track are now at risk of missing their Q1–2020 plans as the effects of the virus ripple wider.

- Supply chain disruptions. The unprecedented lockdown in China is directly impacting global supply chains. Hardware, direct-to-consumer, and retailing companies may need to find alternative suppliers. Pure software companies are less exposed to supply chain disruptions, but remain at risk due to cascading economic effects.

- Curtailment of travel and canceled meetings. Many companies have banned all "non-essential" travel and some have banned all international travel. While travel companies are directly impacted, all companies that depend on in-person meetings to conduct sales, business development, or partnership discussions are being affected.

It will take considerable time — perhaps several quarters — before we can be confident that the virus has been contained. It will take even longer for the global economy to recover its footing. Some of you may experience softening demand; some of you may face supply challenges. While The Fed and other central banks can cut interest rates, monetary policy may prove a blunt tool in alleviating the economic ramifications of a global health crisis.

We suggest you question every assumption about your business, including:

- Cash runway. Do you really have as much runway as you think? Could you withstand a few poor quarters if the economy sputters? Have you made contingency plans? Where could you trim expenses without fundamentally hurting the business? Ask these questions now to avoid potentially painful future consequences.

- Fundraising. Private financings could soften significantly, as happened in 2001 and 2009. What would you do if fundraising on attractive terms proves difficult in 2020 and 2021? Could you turn a challenging situation into an opportunity to set yourself up for enduring success? Many of the most iconic companies were forged and shaped during difficult times. We partnered with Cisco shortly after Black Monday in 1987. Google and PayPal soldiered through the aftermath of the dot-com bust. More recently, Airbnb, Square, and Stripe were founded in the midst of the Global Financial Crisis. Constraints focus the mind and provide fertile ground for creativity.

- Sales forecasts. Even if you don't see any direct or immediate exposure for your company, anticipate that your customers may revise their spending habits. Deals that seemed certain may not close. The key is to not be caught flat-footed.

- Marketing. With softening sales, you might find that your customer lifetime values have declined, in turn suggesting the need to rein in customer acquisition spending to maintain consistent returns on marketing spending. With greater economic and fundraising uncertainty, you might even want to consider raising the bar on ROI for marketing spend.

- Headcount. Given all of the above stress points on your finances, this might be a time to evaluate critically whether you can do more with less and raise productivity.

- Capital spending. Until you have charted a course to financial independence, examine whether your capital spending plans are sensible in a more uncertain environment. Perhaps there is no reason to change plans and, for all you know, changing circumstances may even present opportunities to accelerate. But these are decisions that should be deliberate.

Having weathered every business downturn for nearly fifty years, we've learned an important lesson — nobody ever regrets making fast and decisive adjustments to changing circumstances. In downturns, revenue and cash levels always fall faster than expenses. In some ways, business mirrors biology. As Darwin surmised, those who survive "are not the strongest or the most intelligent, but the most adaptable to change."

A distinctive feature of enduring companies is the way their leaders react to moments like these. Your employees are all aware of COVID-19 and are wondering how you will react and what it means for them. False optimism can easily lead you astray and prevent you from making contingency plans or taking bold action. Avoid this trap by being clinically realistic and acting decisively as circumstances change. Demonstrate the leadership your team needs during this stressful time.

Here is some perspective from our partner Alfred Lin, who lived through another black swan moment as an operating executive:

"I was serving as the COO/CFO of Zappos when I was summoned to Sequoia's office for the infamous R.I.P. Good Times presentation in 2008, prior to the financial crisis. We didn't know then, just like we don't know now, how long or how sharp or shallow of a downturn we will face. What I can confirm is that the presentation made our team and our business stronger. Zappos emerged from the financial crisis ready to seize on opportunities after our competitors had been battered and bruised."

Stay healthy, keep your company healthy, and put a dent in the world.

Best,

Team Sequoia

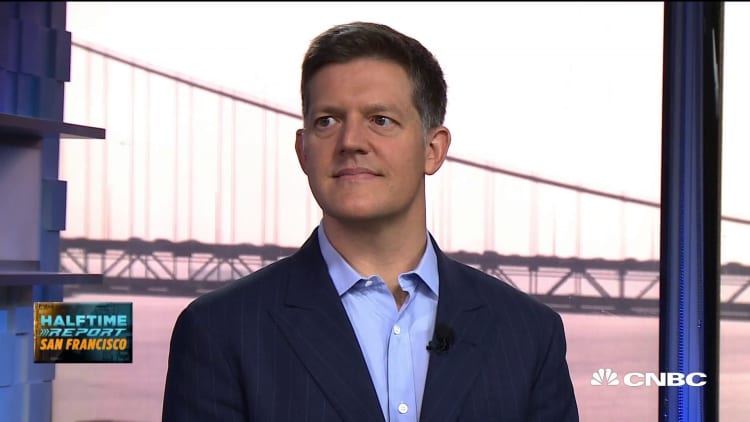

WATCH: People need to focus on profitable growth: Veteran Valley investor