CNBC's Jim Cramer said early Monday that the collapse in oil prices and bond yields put the stock market in "uncharted waters" as Dow futures were pointing to a 1,300-point nosedive at Wall Street's open.

As crude futures were plunging Sunday night after OPEC's production cut deal failed and the 10-year Treasury yield was making shocking new lows in a global flight to the perceived safety of bonds, Cramer tweeted that these moves are "signalling an imminent recession."

The 10-year Treasury yield, which moves inversely to price, dropped to a new record low of 0.318% early Monday before recovering some of those losses. Oil prices were off about 20%, though they had been 30% lower overnight.

At 4:15 a.m. ET, Cramer went a step further, tweeting that the moves in oil and yields, on top of the already widespread market concerns about the spread of the coronavirus, "are both unprecedented and exceed the chaos of 2007-2009 today."

While he pointed out the "speed" of computerized stock futures trading in thin early morning volume, CNBC's "Mad Money" host was still surprised. "That you could have such a monumental move in six hours is truly astounding," he tweeted. "The average oil stock could be down 25% at the opening. The average S&P stock could be down 10%. Gold remains the only bull market besides utilities, drugs," he added.

The incredible swings up and down last week ended Friday with the Dow Jones industrial average rapidly cutting much larger losses in the final 10 minutes of the session to close down 256 points. The Dow actually eked out a small weekly gain last week.

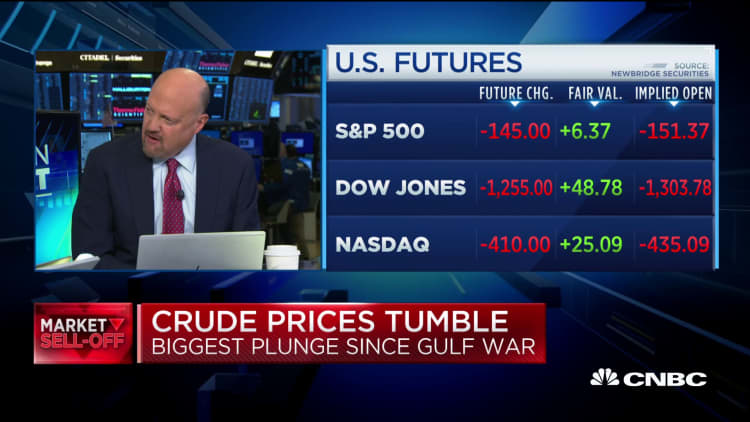

However, that shred of optimism was nowhere to be seen Monday morning, in a global stock market rout with about 5% drops seen in Asia, Europe and U.S. futures. The Dow, S&P and Nasdaq futures hit "limit down" 5% on Monday, meaning they cannot trade lower than 1,255 points on Dow futures, lower than 145 points on S&P futures and lower than 410 points on Nasdaq futures.

Shortly after Monday's open on Wall Street, the went down over 7%, triggering the first of Trading was paused for 15 minutes. When trading resumed, the S&P 500 was down about 6%.