Preparing taxes can be a headache. For many taxpayers, it doesn't have to come with a cost, too.

Between public and private options, both online and in person, there are a number of options for free preparation and filing.

For about 70% of the nation's taxpayers — those with adjusted gross income of $69,000 or less in 2019 — the IRS Free File program may be a choice. That's a partnership involving the agency and a consortium of 10 companies that includes H&R Block, Intuit (maker of TurboTax) and TaxSlayer.

However, fewer than 2% of the eligible 105 million taxpayers use it, according to a recent report from the National Taxpayer Advocate's office at the IRS.

That could change this year, because the companies that participate are now barred from hiding the free products on their websites — which in the past led some consumers to pay for tax preparation that they could have received at no charge.

Some of those online tax software providers will also allow you to complete simple federal returns (and sometimes state returns) for free through their websites. (Military members and veterans may also have access to free filing services.)

If you go it alone and end up baffled, remember that you might be able to find answers to your questions on the site of the service you use.

And, of course, you can choose to pay for extra help — some online tax prep sites offer a package that gives you access to live assistance from a CPA if you need it. Those options can run more than $100, though, depending on the company.

About 50.5 million taxpayers turned to online tax prep software in 2017, according to the IRS.

If you need in-person help, the IRS' Volunteer Income Tax Assistance Program offers free tax help around the country to people who generally make $56,000 and individuals with disabilities or or whose English may be limited. There also is a Tax Counseling for the Elderly Program that's geared toward older Americans and offers free tax help. The IRS offers guidance for finding those volunteers in your area.

More from Smart Tax Planning:

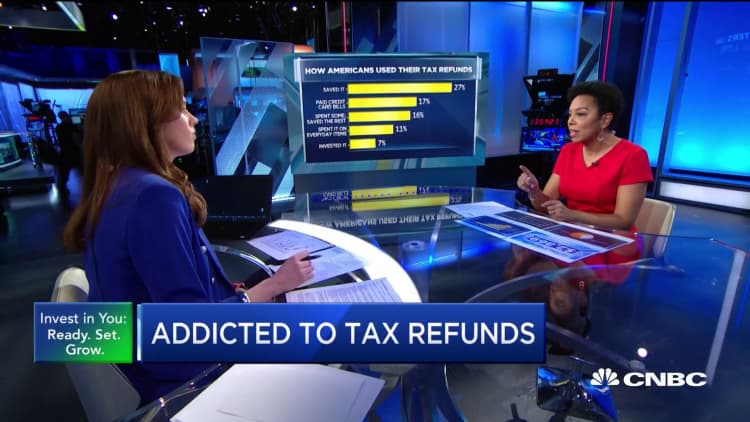

Here's why you shouldn't celebrate that big tax refund

Those market losses could help you save on taxes

How to maximize traditional and Roth retirement savings

Of course, you also can pay someone to handle the whole thing for you.

If you go that route, carefully choose who completes your tax returns — because regardless of who does it, you are ultimately responsible for its contents. While a fraudulent tax preparer would be on the hook for illegal actions, you could owe back taxes, penalties and interest for filing an inaccurate return.

This year, the IRS expects to process more than 150 million individual returns. Through Feb. 28, the agency had issued 45.5 million refunds averaging $3,064.