Jim Cramer on Thursday said "these are not normal times," calling on lawmakers to learn the lessons of the financial crisis and take action to avoid a pending crisis.

The CNBC host broke down what his idea of a "massive federal intervention" would look like to help health officials get a grip on the fast-spreading coronavirus outbreak. Earlier, the Senate canceled its scheduled recess next week as lawmakers on Capitol Hill debated an economic response plan.

The "Mad Money" host insisted that bold action now can prevent a worst-case scenario in the U.S. economy, saying "the only way to beat COVID-19 I believe is to risk a recession."

"We need to slow the spread of this virus and that means rules against gathering, rules that make people stay home, rules that are very bad for business," Cramer said. "That's why we need a massive federal intervention to keep businesses afloat."

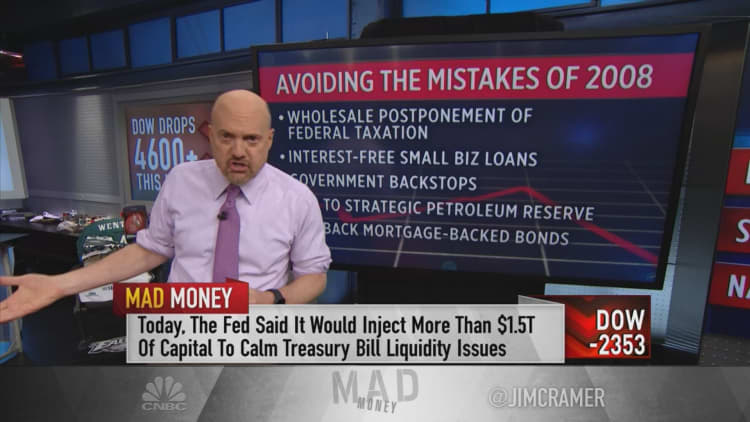

Cramer recommended that lawmakers institute a "wholesale postponement of federal taxation," let the U.S. Department of Treasury borrow $500 billion at low interest rates to fund the government and recoup back taxes after the COVID-19 outbreak is solved.

To prevent small businesses from going bankrupt, he suggested the government offer interest free loans to establishments that maintain their head count and offer paid sick leave through the downturn, he said.

Officials should institute government backstops and guarantees on revolving credit to reduce pressure on the banks, limiting the chances of a financial crisis, Cramer said.

The government can buy oil at low prices for the strategic petroleum reserve to help stop oil prices from falling even lower and stave off American crude producers from going bankrupt, he said. The U.S. is the largest oil producer in the world.

"Worst case, we end up with too much crude that we can sell at higher levels when the economy recovers," he said.

The Federal Reserve must buy mortgage-backed bonds to bring down the yield on the 30-year Treasury, Cramer added. While long-term Treasury yields have declined dramatically, the 30-year bond inched up this week, he noted.

"If the Fed buys mortgage backed bonds, we can get those rates lower, bolstering the now flagging housing market," he said.

Cramer also called on waving student loan payments for the next three months.

Cramer devised his six-point plan hours after he scorched the government's coronavirus response saying "they know nothing," echoing words he famously uttered more than a dozen years ago prior to the financial crash. He urged on "Squawk on the Street" Thursday morning that "this is the time for radical action."

House Democrats spent Thursday garnering support for an emergency response bill. Republicans said the legislation was too partisan and sought to include wishes from the White House. President Trump Thursday evening called for payroll tax reduction and measures for the Small Business Administration, among other steps.

Last week, Trump signed a wide-reaching spending bill, committing $8.3 billion to prevention efforts and research to develop a vaccine to combat the deadly disease.

"If we don't do something like this six-part plan, we're going to have a serious financial emergency on top of the public health emergency," Cramer said. "Please, I'm begging everyone in Washington [to] come together. Don't make the same mistakes that caused the last financial crisis."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com