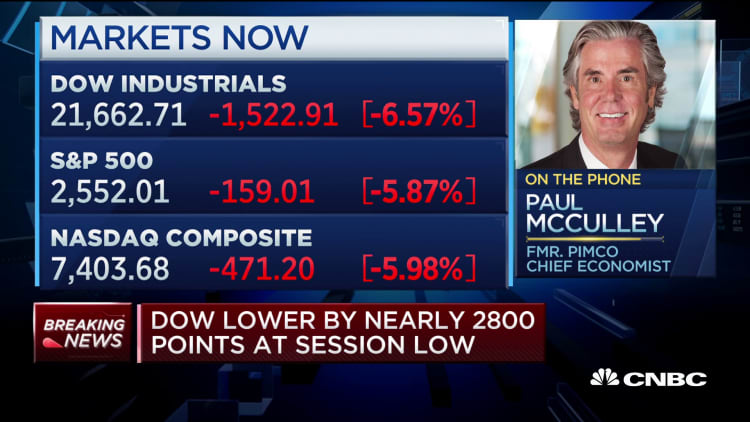

Economist Paul McCulley said that the stock market's sharp drop Monday was not a sign that investors disapproved of the dramatic rate cut and asset purchases announced by the Federal Reserve on Sunday night.

"I think the Fed categorically did the right thing. They threw a mosaic of everything they had at the immediate moment. So you get zero criticism of the Fed (from me)," McCulley, former chief economist at PIMCO, said on "Squawk Alley."

"But the equity market is actually discounting the uncertainty, though they know the direction, on the real economy. So I don't think there's any sort of indictment from the equity market on what the Fed did."

Trading was halted almost immediately after it began on Monday, with the S&P 500 dropping more than 7%. That fall follows an announcement by the central bank that it was cutting its benchmark interest rate by 1% and launching a program of at least $700 billion in asset purchases.

The coronavirus pandemic has led to large cities ordering bars and restaurants to close and sapped demand for air travel, leading many to predict a recession for the U.S.

Another PIMCO alum, Mohamed El-Erian of Allianz, harshly criticized the Fed earlier Monday, saying it should have been "laser-focused" on some of the more technical issues in the markets and saved the interest rate cut for later.

McCulley said the Fed does need to help in the commercial paper market, but that the main issue now is in the hands of the fiscal side of Congress and the executive branch.

"The Fed can get money into Wall Street's plumbing system, and they're doing it with alacrity. But the bottom line is we need to get money, hard cold money, in real American's pockets, particularly the most vulnerable amongst us," McCulley said.

McCulley also criticized President Donald Trump, saying his communication on the pandemic has been poor.

"It is incumbent upon our government to provide information that is robust and correct, and also where they don't know to say they don't know," he said. "And here, in contrast to Chair [Jerome] Powell, I would say Mr. Trump has been a lost ball in deep rough when it comes to communication in recent weeks."