In what started out as a volatile trading session, stocks found their footing around midday and moved solidly higher. The Dow Jones Industrial Average gained 1,315 points at its session high, as traders cheered progress on the $2 trillion stimulus package. But a tweet from Bernie Sanders late in the afternoon suggesting the bill could hit a few additional snags before the expected Wednesday night vote weighed on stocks ahead of the close, and the Dow ultimately finished the session with a 495 point gain. Still, Wednesday's performance built on Tuesday's historic rally, and it was the first time since February that the Dow and S&P 500 managed back-to-back gains.

Here's what happened:

4:26 pm: Market rebound by the numbers

- Boeing ends the day up 24.32%, turning in its best day ever back to its IPO in 1962.

- Dow closed up 2.39% for its second straight daily gain for the first time in more than a month, back to Feb. 6 and its four-day win streak.

- Week to date: Dow is up 10.57%, on pace for its best week since Oct 31, 2008.

- Month to date: Dow is down 16.56% on pace for its worst month since Oct. 1987.

- Dow is 28.3% below its intraday all-time high of 29,568.57 from Feb. 12.

- S&P closed up 1.15% for its first back to back gain in more than a month, back to Feb. 12 and its three-day win streak.

- Week to date: S&P is up 7.4% on pace for its best week since March 13, 2009.

- Month to date: S&P is down 16.2% on pace for its worst month since Oct. 2008.

- S&P is 27.05% below its intraday all-time high of 3,393.52 from Feb. 19. - Francolla

4:10 pm: S&P 500's daily swings

4:05 pm: Apple closes lower as company reportedly considers delaying 5G iPhone

After spending the day in the green with a gain of 4%, Apple reversed gains to close lower after Nikkei Asian Review reported that the company is considering delaying its 5G iPhone by twelve months due to the coronavirus. The phone was originally slated to launch in the fall. - Stevens

4:01 pm: Stocks post back-to-back gains, but close off highs as Sen. Sanders says he may delay the stimulus package

Stocks rose on Wednesday, extending Tuesday's historic rally, although the major averages fell from their highs of the day after Senator Bernie Sanders said he may delay the $2 trillion stimulus package. The Dow gained 495 points, or 2.39%. The S&P 500 rose 1.15% while the Nasdaq fell 0.45%. - Stevens

3:57 pm: Bernie Sanders threatens to hold up coronavirus stimulus bill

Senator Bernie Sanders threatened to delay the historic $2 trillion coronavirus relief bill due to an disagreement over an unemployment insurance proposal.

"Unless Republican Senators drop their objections to the coronavirus legislation, I am prepared to put a hold on this bill until stronger conditions are imposed on the $500 billion corporate welfare fund," he said in a tweet. -- Li

3:29 pm: Rolfe says he is skeptical of market's bounce

David Rolfe, chief investment officer at Wedgewood Partners, said he does not trust the stock market's two-day rally, which has the Dow up around 20% from its Monday intraday low. "I think the market has taken care of this supply shock bear market … but I still think this market needs to deal with the demand shock of all this," he said on CNBC's "Power Lunch." "I'm worried about that." - Stankiewicz

3:02 pm: Square rallies 25% on hopes of Senate bill keeping small businesses afloat

Shares of Square surged Wednesday after the Senate passed a bill that would help keep small businesses afloat and allows some non-bank lenders to participate in the emergency loan program. The $2 trillion bill — said to be the largest rescue package in history — includes small business loans to ease the economic impact of the coronavirus slowdown. Square has become a popular lending option for businesses such as coffee shops and restaurants, many of which are closed due to "shelter in place" measures in major cities. - Rooney

3:01 pm: Markets await Thursday's record breaking jobless claims in the millions

Traders have been waiting for Thursday's weekly jobless claims to see how bad the labor market has been hit by efforts to stop the spread of coronavirus. Economists' forecasts range from about 1 million to 4 million, and they say next week's report could also be record setting. The biggest layoffs are expected to come from the restaurants and leisure industries, as well as retail. In the financial crisis, one week claims peaked at about 650,000. "Thursday's claims is going to certainly show the largest spike in history," said BMO fixed income strategist Jon Hill. "I think the bulk of the expectations are between 1.5 and 3 million. If people see a low 700,000, they're just going to say next week is going to be worse." -- Domm

3:00 pm: Oil posts fourth day of gains in five sessions

Oil prices rose on Wednesday as traders cheered the $2 trillion U.S. stimulus package that the White House and the Senate agreed to early Wednesday morning. U.S. West Texas Intermediate crude gained 48 cents, or 2%, to settle at $24.49 per barrel. International benchmark Brent crude rallied 0.88% to settle at $27.39 per barrel. The stimulus package, which is aimed at propping up the economy as the coronavirus rages on, could lead to an increase in demand for oil. As more and more people in the United States and around the world stay at home and avoid travel, demand for crude as dropped. — Stevens

2:55 pm: Final hour of trading: Stocks rally once again as White House, Senate reach stimulus deal

With roughly one hour left in the trading session, the major averages were once again on pace to post sharp gains. The Dow was up more than 5% while the S&P 500 jumped 4%. The Nasdaq traded 2.2% higher. Those gains come after the Dow posted its biggest one-day rally since 1933 on Tuesday. The White House and the Senate reached a deal on a massive stimulus package to cushion the economic blow from the coronavirus, lifting investor sentiment. The S&P 500 was also on pace for its first back-to-back daily gains since mid-February. —Imbert

1:50 pm: Rally picks up speed, Dow now up 6%

The market rebound gained steam in afternoon trading, with the Dow jumping more than 1,200 points, or 6.1%. Boeing soared nearly 32%, lifting the 30-stock average higher. The Dow is on pace to post its first back-to-back gains since early February. The S&P 500 and the Nasdaq climbed 4.8% and 3.1%, respectively. — Li

1:43 pm: Check out which states have imposed restrictions during the coronavirus outbreak

1:41 pm: Senate coronavirus aid bill would impose 1-year ban on stock buybacks for companies getting government loans

A draft copy of the massive $2 trillion Senate rescue package expected to be passed on Wednesday would bar companies receiving federal loans from stock buybacks for one year after the loan is paid back. The legislation would also bar certain companies receiving taxpayer funded loans from paying dividends to shareholders for one year after the loan is paid back, and from reducing their employment levels by 10% until the end of September. The text of the legislation is not final, and will have to be approved by the Democratic-controlled House of Representatives and President Donald Trump before becoming law. —Higgins

1:03pm: Defense ETF surges once again

The iShares U.S. Aerospace & Defense ETF (ITA) rallied more than 11%, a day after posting its biggest one-day gain on record. The ETF was led higher by a 32% surge in Boeing shares, the company's best day since at least Dec. 27, 1974. For the week, ITA was headed for its first weekly gain in six. —Imbert, Francolla

12:35 pm: Cramer: Amazon shares could shatter last month's all-time highs after coronavirus crisis abates

Amazon may be the ultimate beneficiary in the post-coronavirus world, CNBC's Jim Cramer said Wednesday, suggesting the company's cloud unit and e-commerce business are both positioned nicely to thrive.

"I think Amazon could go to $3,000 in this market," Cramer said on "Squawk on the Street." That would represent a more than 37% increase over last month's all-time high.

Since its Feb. 11 record, Amazon has dropped 11% as of Tuesday's close of $1,940 per share. While lower, the stock has held up much better than the S&P 500, which has seen a nearly 28% decline from last month's highs.

Another way to look at it, an Amazon rise from $1,940 per share to $3,000 would be an almost 55% gain.

Cramer believes Amazon is poised for such a strong move to the upside because the coronavirus pandemic has ushered in a new reality. "The world has changed," he added. "Very few people I know want to admit this." - Stankiewicz

11:55 am: Analysts are starting to bet stocks have bottomed with a ton of upgrades Wednesday

- Deutsche Bank upgraded Apple to buy from hold.

- JPMorgan upgraded Kraft Heinz to overweight from neutral.

- Stephens upgraded McDonald's to overweight from equal weight.

- Citi added a positive catalyst watch to T-Mobile.

- RBC upgraded TJX Companies to outperform from sector perform.

- Goldman Sachs upgraded Ross Stores to buy from sell.

- Goldman Sachs downgraded Under Armour to neutral from buy.

- Piper Sandler upgraded Hershey to overweight from neutral.

- Nomura Instinet upgraded Square to neutral from reduce.

- Barclays downgraded Hertz to equal weight from overweight.

- Berenberg upgraded Activision Blizzard to buy from hold.

- Gordon Haskett upgraded Rockwell Automation to buy from hold.

- Cowen upgraded Southwest Airlines to outperform from market perform.

- Morgan Stanley upgraded Box to overweight from equal weight.

- Deutsche Bank upgraded Delta, American, United, Southwest and JetBlue to buy from hold.

11:36 am: Which countries are flattening the curve?

11:23 am: Short-term US debt yields turn negative amid surge in demand

The yields on the benchmark 1-month and 3-month Treasury bills dropped into negative territory on Wednesday as a surge in demand from central banks and investors fueled demand for the safety of U.S. debt. The two bills yielded -0.01% and -0.03%, respectively. President Donald Trump has long desired negative interest rates in the U.S. like those seen in Europe, saying as recently as January that he'd like to see American businesses paid for borrowing money. "Even now as the United States is by far the strongest economic power in the world, it's not even close. … We're forced to compete with nations that are getting negative rates, something very new," Trump said on Jan. 21. "Meaning, they get paid to borrow money, something I could get used to very quickly. Love that." — Franck

11:08 am: US auto sales expected to fall at least 15% this year due to the coronavirus

U.S. auto sales are expected to fall at least 15% this year as the country implements more aggressive restrictions to prevent the spread of the coronavirus, threatening an already-stressed autos industry, according to new research from IHS Markit.

The COVID-19 pandemic that has spread to nearly every country on the globe has forced a number of governments to implement drastic measures to slow its spread. This has posed the single biggest risk factor for the autos industry in years as consumer demand stalls, according to IHS Markit.

IHS Markit forecasts 2020 U.S. auto sales to be 14.4 million units, down by at least 15.3% year-over-year. The global auto sales forecast is expected to decline more than 12% from last year to 78.8 million units, according to IHS Markit, which would be a larger decline than the 8% drop during the Great Recession a decade ago. — Higgins-Dunn

10:43 am: S&P 500 still 28% from its record high

Even with Tuesday's epic rebound that saw the S&P 500 post its best day since 2008, the equity benchmark is still about 28% from its recent peak reached on Feb. 19. Prior to yesterday's rally, the S&P 500 registered its fastest 30% drop from its record high in history. It only took 22 trading days to post a decline of that magnitude, according to Back of America. The second, third and fourth quickest 30% drawdowns all occurred during the Great Depression era. – Li, Rattner

10:35 am: Credit card stocks pushing higher

Shares of credit card companies rose in early trading. Discover Financial jumped 6.1%, and Mastercard rose 3.2%. American Express and Visa posted gains of 2.7% and 1.8%, respectively. Discover has now soared more than 42% this week, putting it on track for its best week ever since being spun out of Morgan Stanley in 2007. — Pound, Francolla

10:22 am: Stocks' historic volatility

As of 10am, the S&P 500 was down 0.6%, which is a pretty modest move amid the recent bout of volatility that's seen record swings in either direction. - Stevens, Rattner

10:05 am: Deutsche Bank upgrades Apple to buy from hold

Shares of Apple jumped 1% in early trading after the company was upgraded to a "buy" rating by Deutsche Bank. The firm said it's "tilting bullish" on the stock, citing accelerating growth in the tech giant's iPhone, AirPods and services segments. - Bloom

10:04 am: Stock rally fades, major averages negative

Just over 30 minutes into the trading session the Dow turned negative. The 30-stock index is down about 60 points, joining the S&P 500 and Nasdaq which are each more than 1% lower. The Dow had previously gained more than 700 points. - Stevens

9:42 am: Boeing leads the Dow

Shares of Boeing jumped nearly 20% in early trading after the Senate and White House agreed to a $2 trillion stimulus bill that should prove to be a windfall for the struggling aerospace industry. Boeing's stock is headed for its second day of gains after climbing 20.9% on Tuesday, which was its best day since 1974 and second best day on record. However, overall Boeing's stock has lost more than half its value since 2020 began. - Sheetz

9:39 am: Rally gains steam, Dow up more than 600

The rally accelerated minutes after the opening bell, with the Dow jumping more than 600 points. Boeing led the gains in the 30-stock benchmark, with a gain of 19%. The S&P 500 last climbed 1.6% and the Nasdaq gained 1.5%. - Li

9:37 am: Nike shares jump 8% on earnings

Nike's stock got a lift on Wednesday following its quarterly earnings. The athletic retailer's sales topped analysts' estimates, thanks to a boost in online sales, as well as strength in North America. Chief Executive Officer John Donahoe said the business is starting to see a "recovery" in China, where the coronavirus originated, following a period of store closures. During the fiscal third quarter, Nike's sales dropped 5% in greater China, following 22 consecutive quarters of double-digit growth. The shoe giant earned $10.10 billion in revenue, topping the estimated $9.8 billion, according to Refinitiv. Shares of Nike popped 8% shortly after the opening bell. – Fitzgerald

9:34 am: Stocks open higher, Dow gains more than 400 points

Stocks rose on Wednesday, extending Tuesday's gains which saw the Dow post its best day since 1933, while the S&P registered its largest gain since 2008.

The Dow rose 400 points for a gain of 2.1%. The S&P 500 rose 1% while the Nasdaq gained 0.8%. Investors cheered the White House and Senate finally striking a deal on a historic $2 trillion coronavirus stimulus bill. - Stevens

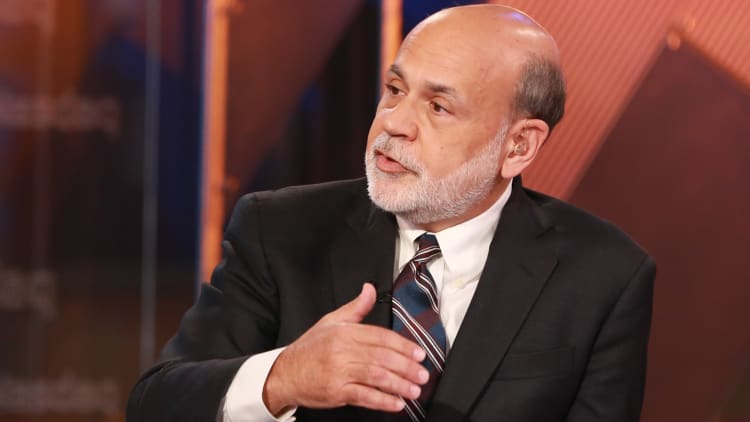

9:14 am: U.S. stock futures jump as Bernanke says 'very sharp' recession will be followed by 'fairly quick' rebound

U.S. stock futures moved higher less than 20 minutes before the market opens. The Dow is now poised for a 360 point gain when stocks begin trading, with the S&P 500 and Nasdaq also set to open in the green.

Former Federal Reserve Chairman Ben Bernanke sounded an optimistic tone on the longer-term state of the economy, predicting in a CNBC interview that while the U.S. is in the midst of a sharp recession, it shouldn't last."It is possible there's going to be a very sharp, short, I hope short, recession in the next quarter because everything is shutting down of course," he said.

"If there's not too much damage done to the workforce, to the businesses during the shutdown period, however long that may be, then we could see a fairly quick rebound," Bernanke later added. - Stevens, Cox

9:05 am: Bernanke says this is much closer to a natural disaster than the Great Depression

"Some of the field of volatility that you're talking about, it's really much closer to a major snow storm or a natural disaster than it is to a classic 1930s-style depression," the former Federal Reserve Chairman said Wednesday on CNBC's "Squawk Box."

"It's quite different and you know different tools are necessary. I would like to emphasize that nothing is going to work – the Fed is not going to help, fiscal policies are not going to help – if we don't get the public health right," he added. - Stevens

8:56 am: Bernanke: Fed has been 'extremely proactive'

Former Federal Reserve Chairman Ben Bernanke said that the Fed has been proactive in its efforts to shore up the economy, which has included slashing interest rates to near zero, as well as unlimited quantitative easing.

"I think the Fed has been extremely proactive and Jay Powell and his team have been working really hard and got ahead of this," he said. - Stevens, Sheetz

8:52 am: Former Federal Reserve Chairman Ben Bernanke says 'very sharp' recession coming

Former Federal Reserve Chairman Ben Bernanke said the coronavirus will tilt the U.S. economy into a recession. "It's going to be a very sharp, short - I hope short - recession in the next quarter or two," he said Wednesday on CNBC'S "Squawk Box." "You're going to see some really scary numbers."

That said, the former Fed Chair added that "we came into this with a much stronger banking system" than in 2007. – Stevens, Sheetz

8:42 am: Bill Ackman exits market hedges, uses $2 billion he made to buy more stocks including Hilton

Pershing Square's Bill Ackman exited his market hedge positions earlier this week and used the more than $2 billion in proceeds to bulk up on his fund's existing stakes as well as reinvest in coffee chain Starbucks.

In a letter to Pershing stakeholders, Ackman said the fund completed the exit from his bets against the market on March 23 and generated $2.6 billion compared with premiums paid and commissions totaling $27 million. He first announced his market hedges on March 3.

Ackman said he used the influx of cash to add to Pershing's existing investments in Agilent, Berkshire Hathaway, Hilton, Lowe's and Restaurant Brands. The fund also purchased "several new investments including reestablishing our investment in Starbucks," which it had closed in January. - Franck

8:23 am: Target delays store remodels, withdraws forecast

Target is putting some of its ambitious growth plans on hold. The big-box retailer will put on hold plans to remodel hundreds of stores, postponing openings of new stores and delaying the addition of fresh groceries and beer to curbside pickup. Instead, Target CEO Brian Cornell said the retailer will focus on a singular mission: providing food, medicine and other essential items. He said Target is withdrawing its guidance for the first quarter and fiscal year because of the unpredictable business climate. — Repko

8:16 am: Bullard: Second quarter will be the biggest hit, but impact will be short-term

Federal Reserve Bank of St. Louis President James Bullard said that the coronavirus outbreak will be a large hit to second quarter GDP, but that the impact will be short-term. "This isn't at all comparable to past events in US macro economic history," he said, adding "as far as the timeline, no one really knows ... for planning purposes, we want to think about the second quarter as the big hit quarter.

"If we can get this to work right, everything will snap back to normal when this is over," he said. - Stevens, Sheetz

8:11 am: Federal Reserve Bank of St. Louis President James Bullard says $2 trillion stimulus package looks right

Federal Reserve Bank of St. Louis President James Bullard said the $2 trillion stimulus bill that the White House and Congress agreed to early Wednesday morning "looks abought right." "This is about relief, not stimulus," he said Wednesday on CNBC's "Squawk Box." He also noted that Q2 real GDP "will be reduced on purpose to meet health objectives." - Stevens, Sheetz

8:04 am: Markets can rise 15% by year-end, Credit Suisse's Garthwaite says

Credit Suisse global equity strategist Andrew Garthwaite said in a note to clients that equity markets could gain 15% by the end of the year as global economies move past the coronavirus pandemic. Garthwaite said in the note that the low interest rates from aggressive central bank action, the success of Korea and China in returning to work and the historical patterns of bear markets all support the idea of a strong bounce back for the rest of the year. The investments in medical infrastructure should also limit the potential for a second wave of the virus in the fall, the note said. "We assume a six- to eight-week full lockdown in Europe and the US, before the majority of workers return, on the basis that in two to three months' time treatments, testing and ventilators will be far more able to accommodate a second spike," the note said. — Pound

7:55 am: Volatility is the name of the game

During the month of March, the Dow has had a daily average move (up or down) of 5.84%, while the S&P 500 has had a daily average move of 5.48%. That's roughly 10 times the average daily move for each during 2019. - Schacknow

7:52 am: Gundlach says S&P 500 will rebound to 2,700 on this snap back

DoubleLine Capital CEO Jeffrey Gundlach said he expects the S&P 500 to rally to 2,700 on this market rebound. "I can see the S&P 500 making it to around 2700 on this snap back," Gundlach tweeted on Tuesday. This implies about a 10% from Tuesday's closing level of 2,447.33. Stocks rallied on Tuesday on hopes of stimulus package from the U.S. government, which passed on Wednesday. The S&P 500 rallied 9.4% for its best day since October 2008 on Tuesday. – Fitzgerald

7:39 am: Spain reports record number of coronavirus deaths

Spain recorded a record number of deaths in one day from the virus, with 504 people passing away on Tuesday. Since the pandemic began, a total of 2,991 have died in the second-worst hit country in Europe.

There have been 42,058 confirmed cases of coronavirus in Spain, with the country's capital, Madrid, home to the highest number of infections.

Given the unprecedented pressure on hospitals, funeral homes and crematoriums around Madrid, an ice rink in the city has been transformed into a temporary morgue. Palacio de Hielo, as it is known, received the first coffins on Monday. The freezing temperatures are expected to protect the bodies until funeral homes have the capacity to bury or cremate them. - Amaro

7:36 am: Cruise line stocks rise on stimulus hopes

Cruise lines, one of the hardest hit industries from the spreading coronavirus, rose in premarket trading on Wednesday after the White House and Senate agreed on a stimulus bill. Shares of Norwegian Cruise Lines jumped 12% premarket, after gaining 42% on Tuesday. Shares of Royal Caribbean Cruises rose 11% after rallying 22% on Tuesday and Carnival jumped 10% following its 14% gain on Tuesday. – Fitzgerald

7:31 am: Mortgage applications tank 29% as coronavirus sidelines homebuyers

An increase in interest rates, combined with a massive shutdown of the economy caused homeowners and potential homebuyers to back away from the mortgage market. Total mortgage application volume fell 29.4% last week from the previous week, according to the Mortgage Bankers Association's seasonally adjusted index. "Several factors pushed rates higher, including increased secondary market volatility, lenders grappling with capacity issues and backlogs in their pipelines, and remote work staffing challenges," said Joel Kan, MBA's associate vice president of economic and industry forecasting. – Olick

7:30 am: Airlines surge on coronavirus stimulus package

Airline stocks rallied in premarket trading on Wednesday after the White House and Senate agreed on a $2 trillion coronavirus stimulus bill. Senate Majority Leader Mitch McConnell said the bill would "stabilize key national industries" to prevent as many layoffs as possible. Airline stocks have been among the hardest hit by the coronavirus as travel has slowed. Shares of American Airlines jumped 9% in premarket trading, after gaining 34% on Tuesday. United and Delta Air Lines rose more than 9%, after gaining 34% and 25%, respectively, on Tuesday. – Fitzgerald

7:15 am: Stock futures point to mixed picture at the open

The much awaited $2 trillion coronavirus stimulus bill got the greenlight early Wednesday morning, and the Street cheered the progress, sending Dow futures higher and pointing to an 800-point rally at the open. But gains started to fade around 7 a.m. ET, and futures turned negative. The Dow Jones Industrial Average is set to open 83 points lower. The S&P 500 and Nasdaq are also poised for modest losses at the open.

Stocks staged a historic rally on Tuesday, with the Dow gaining 11.37% in its best day since 1933, and its fifth best day in history. The 30-stock index's 2,112.98 point gain was its largest on record. Meanwhile, the S&P 500 rose 9.38% in its best day since Oct. 2008.

Driving the gains was the hope that Congress was close to agreeing to a stimulus bill. The deal, which the White House and Senate leaders eventually agreed to early Wednesday, is a massive $2 trillion relief bill — said to be the largest rescue package in American history — to combat the economic impact of the coronavirus outbreak.

The Senate has yet to release the final terms of the deal. Senate Majority Leader Mitch McConnell said the Senate will vote and pass the legislation later Wednesday. - Stevens

- CNBC's Kate Rooney, Patti Domm, Nate Rattner, Yun Li, Michael Bloom, Diana Olick, Peter Schacknow, Melissa Repko, Thomas Franck, Michael Sheetz, Noah Higgins-Dunn, Kevin Stankiewicz, Gina Francolla, Fred Imbert, Silvia Amaro and Tucker Higgins contributed reporting.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.