The S&P 500 could be riding into a "make-or-break moment" in the short term, CNBC's Jim Cramer warned Wednesday.

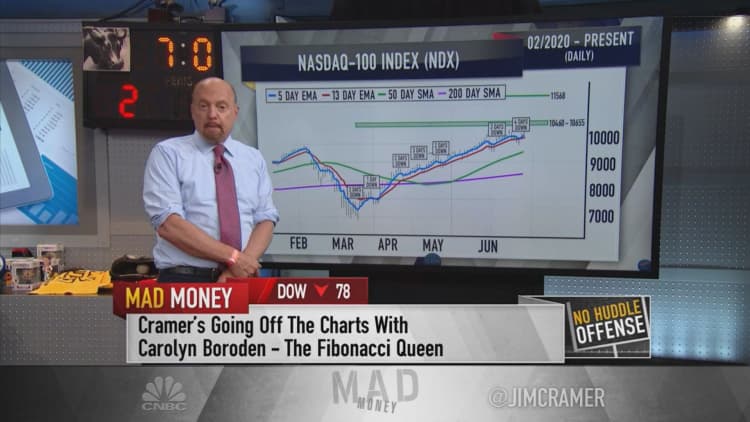

The "Mad Money" host came to that conclusion after reviewing chart analysis from FibonacciQueen.com's Carolyn Boroden, a market technician who has a price target of 3,720 but is concerned about a looming decline in the broad index.

"If it can't break through last week's highs at 3,100," Cramer said, "Boroden thinks you need to prepare for pain because the near future could get ugly."

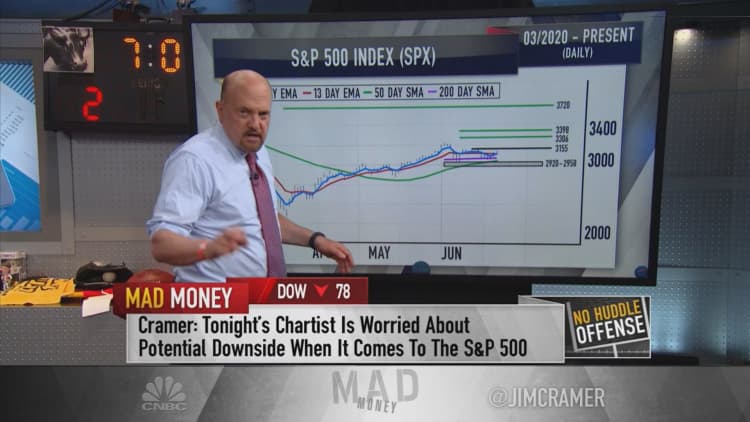

In May, Boroden projected that the market was in rally mode as it moved toward an initial price target that she held of 3,280. The index topped 3,232 in June before dropping off 7% in the span of three trading days.

The S&P 500, Boroden thinks, won't rally to her 3,720 price target — a 19% run from current levels — until it can break through 3,280, Cramer explained.

"Given that we failed to break through that resistance, she's worried about potential downside here," he said.

The daily S&P chart paints a dimmer picture. Cramer pointed out that while the index is trading above its 50-day and 200-day moving averages, another indicator is singing a bearish tune.

The 13-day exponential moving average is currently above the 5-day, which reflects slowed momentum. This is not a call, however, for investors to give up on their holdings. When the market stages a rally and the 5-day and 13-day averages inverse, it will trigger bullish activity on Wall Street, Cramer said.

"If the S&P can do that and then take out last week's highs, up about 40 points from here, then Boroden thinks we can resume the recent rally," Cramer said. "In that case, she says, the S&P could tack on another 200 to 300 points from these levels."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com