The Trump administration on Monday disclosed the names of many small businesses which received loans under a program intended to blunt the economic damage from the coronavirus pandemic.

The disclosure comes amid demands from Democrats for more transparency around the Paycheck Protection Program, or PPP, funds established as part of the $2 trillion CARES Act, which President Donald Trump signed this spring.

[The full list is available on the Small Business Administration website, which you can access here.]

Treasury Secretary Steven Mnuchin sparked an outcry from Democrats when he originally implied that the Trump administration would not disclose the names of participants. The Treasury and SBA later reversed course, saying they would disclose names and other details about businesses that took PPP loans of $150,000 and above.

Those loans represent nearly three-fourths of total loan dollars approved, but a far smaller proportion of the number of actual loans. About 87% of the loans were for less than $150,000, according to the SBA.

Among the notable recipients are:

- The law firm Boies Schiller Flexner, whose chairman David Boies has represented powerful clients such as former Vice President Al Gore in the Bush v. Gore Supreme Court case, received between $5 million and $10 million.

- Transportation Secretary Elaine Chao's family's business, Foremost Maritime, got a loan valued at between $350,000 and $1 million. Chao is the wife of Senate Majority Leader Mitch McConnell, R-Ky.

- Perdue Inc., a trucking company co-founded by Agriculture Secretary Sonny Perdue, was approved for $150,000 to $350,000 in loan money. A spokesperson for the Agriculture Department said Perdue Inc., a trucking service, said the loan was for about $182,000 and supported 27 jobs. Perdue's adult children are 99% stakeholders in a trust that indirectly owns the company, and the secretary did not have any influence on the SBA's loan decisions or the company's decision to apply for aid, the spokesperson said.

- Restaurant chains P.F. Chang's China Bistro and Chop't received aid of between $5 million and $10 million.

- TGI Fridays, which is backed by private equity firm TriArtisan Capital Advisors, received at least $5 million. The private equity firm tried to take the restaurant chain public in a deal with a special purpose vehicle, but that was terminated in April amid market volatility due to the pandemic.

- The Archdiocese of New York got a loan valued at between $5 million and $10 million, while the Catholic Charities of the Archdioceses of San Francisco, Washington, D.C., New Orleans and Boston, among others, all received assistance valued at more than $2 million.

- The Ayn Rand Institute, named for the objectivist writer cited as an influence on libertarian thought, was approved for $350,000 to $ 1 million.

- Joseph Kushner Hebrew Academy in New Jersey, which is named after Trump's son-in-law and advisor Jared Kushner's grandfather, got a loan in the range of $1 million to $2 million. Jared Kushner's parents' family foundation supports the school, NBC News reported.

- Niche movie theater chain Alamo Drafthouse received a loan of at least $5 million. Theaters have been closed while new film releases have been delayed or pushed to streaming platforms.

- Numerous news organizations received PPP loans: Forbes Media got at least $5 million; The Washington Times got at least $1 million; The Washingtonian got at least $350,000; The Daily Caller received at least $350,000 and The Daily Caller News Foundation got at least $150,000; The American Prospect received at least $150,000.

- Political organizations also received loans: The Ohio Democratic Party got at least $150,000 and the Florida Democratic Party Building Fund got at least $350,000, while the Women's National Republican Club of New York got at least $350,000, the Black Republican Caucus in Florida got at least $150,000.

There were several errors in the database, so it's not clear whether all the companies listed received the funds. Some firms said they didn't receive or apply for the money they're listed as getting.

The SBA released other details about the program Monday, including:

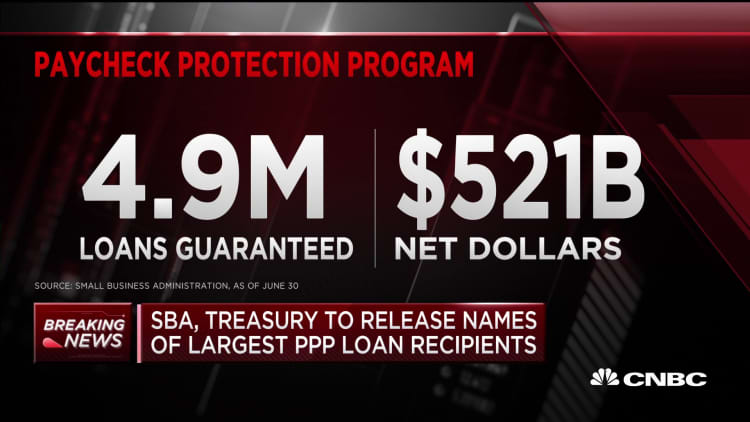

- It has approved 4.9 million loans for a total of more than $521 billion.

- Companies said that the funding supported more than 51 million jobs. But the businesses reported the total when they applied for loans, and it is unclear how many of those employees stayed on the payroll.

- The program has about $132 billion in funding remaining.

- The average loan is $107,000.

- Applicants in California received the most money overall with $68.2 billion, followed by Texas at $41.1 billion and New York at $38.3 billion. Businesses in California ,Texas and New York that received loans reported having about 4.1 million, 2.7 million and 2 million total employees, respectively.

- Businesses in economically distressed areas as designated by the SBA got nearly 23% of the loan money, while companies in rural areas received about 15% of the funds.

- Industries getting the largest share of net PPP dollars were health and social assistance, professional, scientific and technical services, construction and manufacturing.

The PPP's goal is to offer forgivable loans to smaller businesses, helping them to stay afloat and employees to maintain their jobs as the coronavirus puts the U.S. economy on hold.

Companies that maintain most of their payroll through the span of the loan may convert those funds into a grant.

While the aim of the program was to aid ailing companies with less than 500 employees, its effectiveness has remained unclear. Larger and public companies initially took advantage of loosely written language to tap the funds for themselves.

Ruth's Hospitality Group, which owns the Ruth's Chris Steak House chain, AutoNation and ShakeShack are among those that took out PPP loans. So did the Los Angeles Lakers.

They — and many more companies — ultimately returned the money after public outcry. More than $30 billion in loans were returned overall, senior administration officials who declined to be named said Monday.

Lawmakers have also pushed to find out if politicians or their families' have taken on funds from the program. Rep Vicky Hartzler, R-Mo., on Thursday disclosed that her family's businesses received nearly $480,000.

The program was initially rolled out in April, offering $349 billion to small businesses. After those funds quickly ran out, the government replenished the program with an additional $310 billion.

The program's critics have expressed concern that the amount of untapped funds could show that rural or minority-owned businesses with weaker or no banking relationships have had trouble accessing relief money. More than 40% of Black small business owners were forced to close shop as result of the pandemic.

Democrats have sought assurances that programs established to help Main Street sufficiently reach those who most need it. The bill Congress passed to replenish the program in April included $60 billion specifically for small lenders in response to concerns about businesses without a traditional banking relationship accessing loans.

Last month, Congress passed a bill easing the terms for how businesses can use the funds and qualify for forgiveness. It lowered the share of the loan that a company must spend on payroll and gave them a longer period of time to use the money.

The House of Representatives followed the Senate in passing a measure Wednesday to extend the program's application deadline from June 30 to Aug. 8.

Trump on Saturday signed the extension into law.

— CNBC's Kate Rogers, Betsy Spring, Kevin Breuninger and Kayla Tausche contributed to this report. Graphics by CNBC's John Schoen