A company known as Sparc LLC, which is comprised of the U.S. mall owner Simon Property Group and the apparel-licensing firm Authentic Brands Group, is making a $305 million bid for bankrupt Brooks Brothers, a court filing said Thursday.

The offer, still subject to better and higher bids and court approval, is to keep at least 125 of Brooks Brothers' stores open for business, the filing said.

A court hearing to approve the bid has been set for Aug. 3, while other competing offers are due by Aug. 5, according to the filing. A hearing to approve the final sale of Brooks Brothers' assets is set to take place Aug. 11.

WHP Global, a rival to ABG, is also preparing a bid for Brooks Brothers, the company told CNBC.

"It's early innings in the Brooks Brothers bankruptcy sale process," WHP Chairman and CEO Yehuda Shmidman said in a statement. "We are big believers in the power of the Brooks Brothers brand, the global footprint and the management team."

Simon, which is the biggest U.S. mall owner by the number of malls it operates, had already teamed up with ABG to supply financing to carry Brooks Brothers through its restructuring, as the retailer searched for a buyer. An $80 million loan from the duo that refers to itself as Sparc came, in a rare deal, with no interest or fees.

Brooks Brothers, known as the pioneer of the polo shirt and uniform of the polished preppie, filed for Chapter 11 bankruptcy court protection from creditors earlier this month, on July 8. At the time, it had roughly 250 locations in North America.

This is certainly not the first time Simon and ABG have worked together, either. They are increasingly looking to do so — now through this Sparc entity. With ABG bringing expertise in manufacturing and licensing, Simon brings expertise in real estate.

ABG and Simon have together put up a stalking-horse bid of $191 million for the bankrupt denim maker Lucky Brand's assets, which is still subject to court approval.

Before Sparc was formed, ABG and Simon came together in 2016 to buy the teen apparel retailer Aeropostale out of bankruptcy. And, in a deal with mall owner Brookfield Property Partners, they acquired Forever 21 out of bankruptcy last year.

America's biggest mall owners are increasingly looking to do deals to salvage retailers hit hard by the coronavirus pandemic, CNBC has reported. Dozens have filed, including J.C. Penney, Neiman Marcus, J.Crew, New York & Co. parent company RTW Retailwinds and Ann Taylor parent Ascena Retail Group.

In many instances, as it plays out, these bankrupt retailers are major tenants in malls, with sprawling store counts. Meanwhile, some of the biggest retail real estate owners in the country, like Simon, are sitting on cash. A lot of it. On June 29, in an investor update, Simon said it had roughly $8.5 billion of liquidity on its balance sheet, including about $3.5 billion of cash on hand. It issued another $2 billion in senior secured notes on July 7.

ABG also manages brands such as Barneys New York, Nautica and Nine West, according to its website.

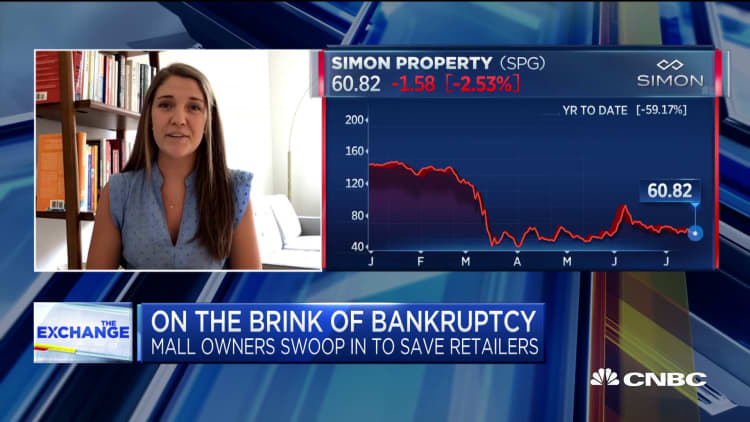

Simon shares are down nearly 59% this year. The company has a market cap of $18.9 billion.

Read more: Here is the full press release from Brooks Brothers