A number of retailers were already teetering on the brink of collapsing prior to the coronavirus pandemic slamming the industry. The pressures have intensified immensely.

A few big names in retail, including Pier 1 Imports and Modell's Sporting Goods, filed for bankruptcy much earlier in the year, weighed down by hefty debt loads and slumping sales even before the Covid-19 crisis was declared a national emergency in mid-March. Since then, that list of names has ballooned.

A report from S&P Global Market Intelligence released earlier this month identified the dozens of retailers that have filed for bankruptcy in 2020 — which is now up to 40, following Ann Taylor parent Ascena Retail Group's filing on Thursday morning.

With the year roughly halfway over, there have already been more retail bankruptcies this year that in 2019 and in 2018, S&P Global said. There were 40 altogether in 2017. 2020 looks to be on track to top the 48 filings by retailers in 2010, according to S&P Global's tracking, following monstrous activity and upheaval during the years around the Great Recession.

More filings are expected. The women's clothing company J.Jill, for example, is still negotiating with its lenders after it issued a going-concern warning in mid-June. The U.S. mall owner CBL & Associates is also still in talks with its lenders after skipping two interest payments during the pandemic, and issuing its own going-concern warning.

The fates of some of the retailers that have filed this year, including that of department store chain J.C. Penney, are still up in the air. Some companies are still seeking buyers for parts of their businesses.

The wave of filings also means permanent store closures are piling up. The firm Coresight Research is expecting store closures announced by retailers this year to reach a new record, surpassing 25,000. So far, more than 5,400 have been tracked, the global research group has said.

Here are some of the biggest retail bankruptcies so far this year, in order by the date of filing.

Pier 1 Imports

The home goods chain Pier 1 Imports filed for Chapter 11 bankruptcy protection on Feb. 17, listing $340.6 million in liabilities.

Its plans to find a buyer were unsuccessful, as the pandemic hit, ultimately pushing Pier 1 into a total liquidation. Its going-out-of-business sales at hundreds of stores kicked off recently, as local lock-down restrictions in states began easing. Pier 1 is, meanwhile, planning to sell its intellectual property and other online assets to a firm known as Retail Ecommerce Ventures, for $31 million, according to court documents.

Art Van Furniture

The home goods chain filed for bankruptcy on March 8, listing liabilities in a range of $100 million to $500 million.

It planned to close most of its roughly 190 stores, but going-out-of-business sales were stalled because of the pandemic. Those sales have since been able to restart at select locations. Some Art Van stores are being replaced with a company known as Levin Furniture.

Modell's Sporting Goods

The sporting goods chain Modell's filed for Chapter 11 bankruptcy protection on March 11, listing liabilities of between $1 million and $10 million. At the time, it said it planned to shut all of its roughly 140 remaining stores for good, as the retailer was increasingly conceding sales to Amazon and suffered a poor 2019 holiday season.

The coronavirus pandemic, however, upended Modell's going-out-of-business sales, with retailers deemed non-essential forced to shut down for a period of time to try to help curb the spread of the virus. Modell's was later able to resume liquidation over the summer.

True Religion

The denim brand True Religion filed for bankruptcy on April 13, listing liabilities of between $100 million and $500 million. This was notably its second time doing so in under three years.

However, the company is expecting to emerge from bankruptcy later this year, according to court documents, having amassed roughly $138.5 million in secured debt and another $44 million that was owed to unsecured creditors. When it filed, True Religion said it would have preferred to wait out the pandemic and stay-at-home orders, but "simply could not afford to do so."

Neiman Marcus

The upscale department store chain Neiman Marcus filed for bankruptcy on May 7, listing liabilities of more than $1 billion.

Earlier this week, a court filing confirmed Neiman will be permanently leaving its recently opened store at the Hudson Yards mall in New York City. It is also closing two stores in Florida and one in Washington. A hearing to approve Neiman's business plan to emerge from bankruptcy has been pushed back, as some of the retailer's lower-ranking creditors have raised issue over an asset transfer in 2018. When the company filed for bankruptcy, it had a little over 40 department store locations in the U.S.

J.C. Penney

The Plano, Texas-headquartered department store chain J.C. Penney filed for Chapter 11 bankruptcy protection on May 15, listing more than $1 billion in liabilities.

Penney's future is still being determined, as it looks to emerge as a smaller company. It has already announced more than 150 store closures, along with 1,000 layoffs. The company currently has until July 31 to win approval for a business plan, according to court documents. It has proposed splitting its business into two publicly traded companies, one of which would be a real estate investment trust. When Penney filed for bankruptcy, it still was operating roughly 850 stores.

GNC Holdings

The health chain GNC Holdings filed for bankruptcy on June 23, listing liabilities of more than $1 billion.

At the time, it said it planned to shut as many as 1,200 of its 5,200 U.S. stores, as it searched for a buyer. The company is still hoping to emerge from bankruptcy later this year in the fall. In its bankruptcy filing, GNC said the pandemic only accelerated the "financial pressure for the past several years."

Lucky Brand

The denim maker Lucky Brand filed for bankruptcy on July 3, listing liabilities of between $100 million and $500 million.

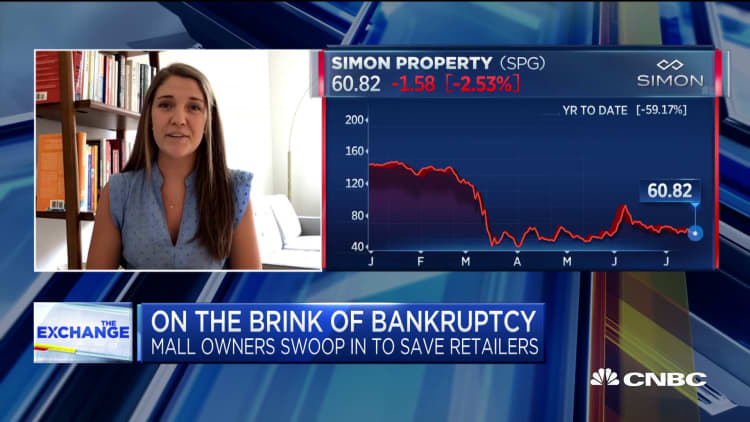

With more than 200 stores in shopping malls across the country, the company has so far said it plans to close 13 locations permanently, but more could be on the way. A venture known as Sparc Group LLC, which is comprised of mall owner Simon Property Group and the licensing firm Authentic Brands Group, has been named the stalking-horse bidder, offering $140.1 million in cash and $51.5 million in credit to buy the company's assets. The deal is still subject to court approval.

Sur la Table

The kitchen accessories retailer Sur la Table filed for Chapter 11 bankruptcy on July 8, listing liabilities of between $50 million and $100 million.

At the time of the filing, the company said it had already started liquidating 51 of its 121 U.S. stores. It was hurt especially by not being able to hold its in-person cooking classes, which it is most well-known for, during the pandemic.

Brooks Brothers

The men's apparel maker Brooks Brothers filed for bankruptcy on July 8, listing liabilities of between $500 million and $1 billion.

A stalking-horse bid by Sparc (Simon Property Group and Authentic Brands Group) for $305 million is looking to salvage at least 125 stores. WHP Global, a rival to ABG, is also preparing a bid for Brooks Brothers, the company told CNBC. Simon, which is the biggest U.S. mall owner by the number of malls it operates, had already teamed up with ABG to supply a zero-interest, $80 million loan to carry Brooks Brothers through its restructuring, as the retailer searched for a buyer. A court hearing has been set for next month.

RTW Retailwinds

New York & Co. parent RTW Retailwinds filed for bankruptcy on July 13, listing liabilities of between $100 million and $500 million, with 378 retail and outlet stores.

The retailer said it plans to permanently close most, if not all, of its locations. It is also still evaluating potentially selling its e-commerce operations and related intellectual property in bankruptcy proceedings.

Ascena Retail Group

The parent company of Ann Taylor and Loft, Ascena Retail Group, filed for Chapter 11 bankruptcy protection earlier this week on Thursday, listing more than $1 billion in liabilities. It had 2,800 stores across the U.S., Canada and Puerto Rico, as of the filing.

Moving forward and hoping to get back to profitability, it said it plans to permanently close a "significant" number of Justice stores, along with certain Ann Taylor, Loft, Lane Bryant and Lou & Grey stores during its restructuring. It is closing all of its plus-size Catherines stores. A final number of store closings will be determined based on "the ability of Ascena and its landlords to reach agreement on sustainable lease structures," it said.

Read more: These restaurant chains filed for bankruptcy during the pandemic

—CNBC's Nate Rattner contributed to this data visualization.