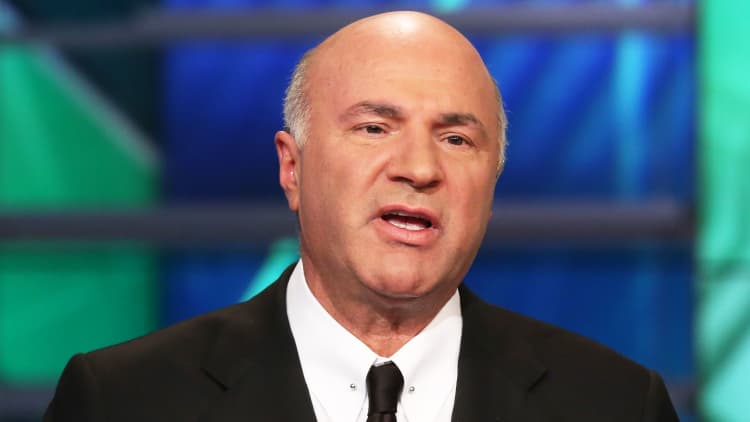

Kevin O'Leary told CNBC on Monday that the long-term economic consequences of the coronavirus pandemic are coming into focus for companies in his personal investment portfolio.

"I've got enough focus now after all these months, 20% of my small private portfolio is going to fail," O'Leary said on "Halftime Report." "They're going to zero. They are in restaurants. They are in sports and entertainment. They're anything doing movie theaters, all that stuff, gyms. ... I don't want to support them anymore, and I don't think the government should either."

The "Shark Tank" investor said he believes that the companies face a difficult road ahead as a result of changing behavior of consumers. But that changed behavior is one reason why many large-cap tech companies have a bright future and have seen their stock prices rise, he added.

"Let those guys die. They have to die, because the consumer is moving into a different direction," he said. "But where the consumer is going is being empowered by the Facebooks, by the Microsofts, by all of these tech companies. Amazon, are you kidding me? That's a must-have for any small business."

O'Leary's comments came as policymakers in Washington debate another piece of coronavirus relief legislation. A Republican proposal, expected to be released later Monday, is likely to include another round of $1,200 stimulus checks for Americans; liability protections for businesses and universities, and a more targeted loan program for small businesses.

The Paycheck Protection Program was established earlier this year to offer low-interest loans that could be converted into grants if recipients used the money for specific costs, including keeping workers on the payroll. Treasury Secretary Steven Mnuchin has said there could be "second checks" for certain companies whose revenues are down more than 50%.

O'Leary said last week he believes market forces should decide which companies emerge from the coronavirus pandemic. "Why do I want to pour government money, my money as a taxpayer, into businesses that are not going to survive? And the only way to do that is to let 'Mr. Market' do its work," O'Leary said then.

Some people who support coronavirus aid to companies say it is necessary because government mandates shut their businesses down or restrict how they can operate. While designed to slow transmission of the virus, the requirements directly contributed to the negative impacts on their business, they say.

O'Leary, who has investments in numerous businesses through "Shark Tank," had been an initial supporter of coronavirus support programs like PPP. He has said he encouraged about 80% of his companies to apply for loans through the program. Even so, he warned back in May that about 20% of loan recipients may ultimately not survive the pandemic.

"What's different from what we saw in March is I now know who the losers are, and the market does too," O'Leary said Monday.

Disclosure: CNBC owns the exclusive off-network cable rights to ″Shark Tank," on which Kevin O'Leary is a co-host.