The Detroit automakers' earnings showed they are better prepared and more resilient to weather a crisis than they were a decade ago — even as the coronavirus pandemic still hobbles much of the global auto industry.

It's something Wall Street has wanted the companies to prove they were capable of doing since the Great Recession, which forced General Motors and then-Chrysler into government-backed bankruptcies in 2009.

But the Detroit automakers didn't receive the respect from investors many thought they deserved after releasing second-quarter earnings last week. Despite GM, Ford Motor and Fiat Chrysler each significantly beating earnings expectations, shares of the companies were down for the week as Wall Street shrugged off the results.

The initial cold-shoulder response had analysts who cover the automakers, specifically GM, questioning what more could be done for the companies to enter Wall Street's good graces as Tesla and several electric vehicle start-ups with no revenue have recently done.

GM shares closed Friday at $24.89, down 3.2% from Monday. Ford stock sank 4.6% to $6.61 for the week. Fiat Chrysler closed at $10.15, down 5.3% for the week. With the overall market rising Monday, shares of Ford was up nearly 5% and Fiat Chrysler was up more than 4% in morning trading, while GM was up about 2%. Shares of the Italian-American automaker remain down nearly 30% for the year.

'Remarkable negative' reaction

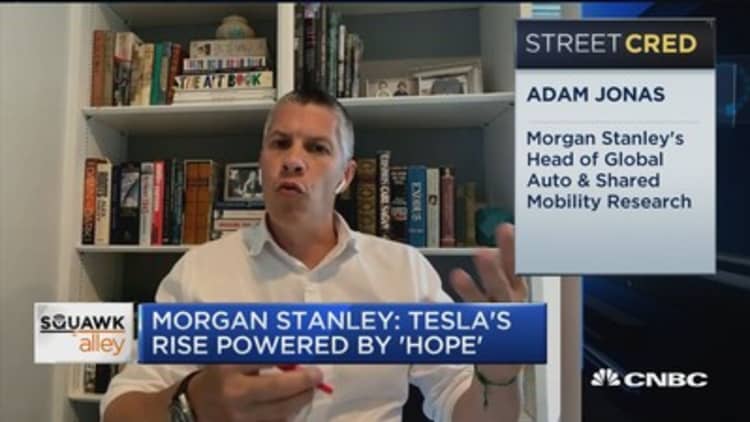

Instead of asking GM CEO Mary Barra about the company's performance, Morgan Stanley analyst Adam Jonas asked whether she would change its name to better align with its emerging technologies. He suggested "Ultium," after GM's next-generation vehicle batteries.

Deutsche bank analyst Emmanuel Rosner recommended the automaker spin off its electric vehicle operations, "forcing the market to recognize its advanced technology."

"The remarkable negative market reaction to GM's impressive 2Q earnings beat, in our view reflects much more than just management's conservative 2H20 outlook meeting high investor expectations," Rosner wrote in an investor note following the company's Wednesday earnings.

GM, despite the pandemic, has reconfirmed plans to invest $20 billion from 2020 through 2025 in autonomous and electric vehicles.

Barra, who would historically defend the company's reputation, didn't nix the idea of a name change. She said the input was appreciated and that GM, which was established in 1908, is "going to make any changes necessary to drive the shareholder value."

"That's something that we evaluate and look at, when's the right time and what are the proof points that ... make it real. We believe strongly in our EV future," she said.

Beating Wall Street

Reasons analysts gave for the lack of movement following the better-than-expected earnings, including a surprise net profit by Ford, varied by automaker. Overall, they included a disbelief in a rapid recovery of vehicle sales and the Detroit automakers not being able to successfully adapt to emerging technologies such as electric and autonomous vehicles.

CFRA Research senior equity analyst Garrett Nelson raised 12-month price targets on Ford and GM following their earnings, but he maintained sell ratings for both of the stocks.

"We maintain a Sell following the stock's sharp rebound, not expecting GM's vehicle sales to return to pre-pandemic levels anytime soon and consider its new model pipeline as relatively unexciting compared to peers," he wrote regarding GM.

Jonas said investor concerns surrounding GM's "ability to confront the end of the internal combustion era … otherwise known as 'the melting ICE cube,' remain as prevalent as ever."

Credit Suisse analyst Dan Levy categorized last week's lack of movement in GM shares as Wall Street "looking past" near-term accomplishments and focusing on long-term strategies for electric and autonomous vehicles.

For Ford, investors are returning their sights to the company's multiyear $11 billion restructuring plan through the early 2020s that has been criticized for moving too slowly and being years behind recent cost-cutting actions of GM.

"While the product opportunity is bright with F-150 and Bronco, and there could be upside to '21 (estimates) as these products bear fruit, there is nevertheless significant work ahead on global redesign," Levy wrote.

Earnings

Ford was the only Detroit automaker to beat profit and revenue expectations of Wall Street during the second quarter.

Ford reported an adjusted pretax loss of $1.9 billion after warning investors in April that it expected to lose more than $5 billion. Its automotive revenue of $16.6 billion exceeded the $15.95 billion analysts expected.

Fiat Chrysler missed on revenue but beat earnings estimates with a smaller-than-expected loss of $1.24 billion (1.05 billion euros) in the second quarter due to the coronavirus.

GM only lost $806 million from April through June despite its North American factories being closed eight out of 13 weeks during the quarter due to the pandemic — a feat that "ought to give potential investors food for thought," according to Rosner.

It also missed on revenue but its loss of 50 cents a share was less than a third of the $1.77 per-share loss investors expected.

"Our Q2 results were significantly impacted by the pandemic, but we're demonstrating how well we can perform through a challenging time," GM CFO Dhivya Suryadevara told analysts Wednesday during an earnings call.