Maybe you know a "super saver."

It's the person who somehow manages to follow a budget, has emergency savings and puts away a ton for retirement. Although this type of financial discipline may be enviable, it can also mean making some sacrifices, based on the findings in a recent report from Principal Financial Group.

These savers are "finding a way to make their savings sustainable," said Joleen Workman, a vice president at Principal.

Top sacrifices by super savers

| Driving older vehicles | 48% |

| Owning modest home | 42% |

| Not traveling as much as I prefer | 39% |

| No housecleaner | 39% |

| Doing DIY projects instead of hiring help | 38% |

| High levels of work-related stress | 31% |

| Buying secondhand goods | 27% |

| Work more, takes away from social life | 22% |

| Work more, takes away family time | 21% |

| Telling friends/family no to common expenses | 19% |

Source: Principal Financial Group

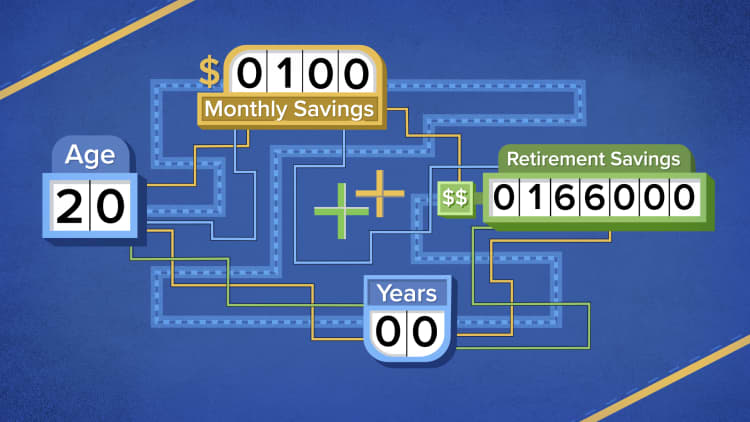

The report was based on a survey of about 1,700 individuals ages 20 to 54 who are viewed as super savers due to high contributions to their retirement plan at Principal. Most of them (75%) contributed at least $17,100 in 2019 and the remainder had a deferral rate of 15% or more.

Generally speaking, these super savers forgo some of life's luxuries, which may be an example to others who want to save more for their golden years. While some households have little to no wiggle room in their budget to save — especially if they've experienced income loss during the pandemic — others may just need some inspiration to create a budget and notch up their savings.

Additionally, everyone's goals are different and some of the sacrifices made by super savers may be unacceptable to others. Regardless of your goals, they typically require some give-and-take in your budget if you want to reach them, Workman said.

More from Personal Finance:

Why the real unemployment rate is likely over 11%

While IPOs are having a good year, 'just don't buy the hype'

Here's how to qualify for a mortgage in retirement

"Each individual is different, and everyone has different hobbies or other things that bring them joy," she said. "So if someone's goal is to drive a nicer car, then maybe they spend less on entertainment."

At the same time, it's not as if these super savers go without everything — they still splurge on things like movie streaming and dining out, among other activities. And this year, they're splurging on home-improvement projects, as well. However, all of those activities are generally done within the context of a budget that already has allocated a chunk to retirement savings.

Another upshot of prioritizing savings is confidence: Nearly all of the super savers in the survey (98%) feel financially secure due to their savings habits.

"The message boils down to this is a marathon, not a sprint," Workman said. "And this super saver population knows that."