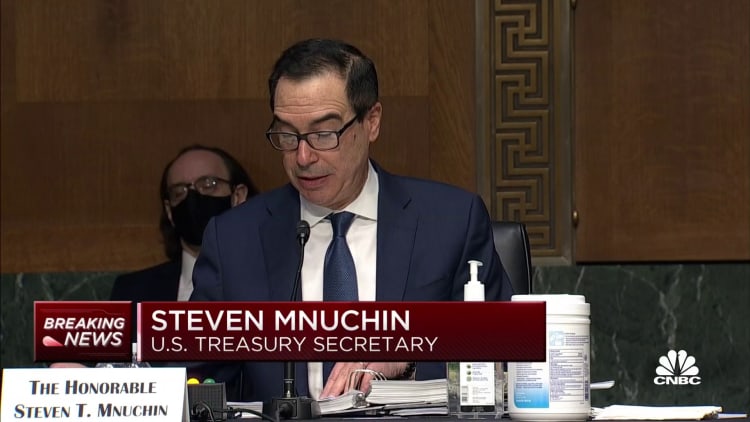

Treasury Secretary Steven Mnuchin said he was only complying with the law, but Democratic senators saw something more sinister at play as he sought to explain his recent decision to end some lending programs the Federal Reserve was using to get the economy through the coronavirus pandemic.

"You appear to be trying to sabotage our economy on the way out the door," Sen. Sherrod Brown, D-Ohio, told Mnuchin during a hearing Tuesday. "There is no legitimate justification for it."

Mnuchin, though, told a different story, citing portions of the law that said he didn't have the authority on his own to allow the programs in question to run past the end of the year.

"My actions are not economic," he said toward the end of the hearing. "It's purely my interpretation of the law."

At issue are a series of facilities the Fed used to loan money to small- and medium-sized businesses as well as state and local governments, and two in which it bought corporate bonds. Authority for the programs came through the $2.2 trillion CARES Act passed in March, during the early days of a pandemic that would cause the biggest quarterly drop in economic activity since at least the Great Depression, followed by the strongest rebound.

Most of the facilities were lightly used, with only a fraction of the $2 trillion or so of potential liquidity utilized.

Still, Fed officials say the initiatives are vital to maintaining market order and as a backstop should the economy run into issues like it did more than eight months ago.

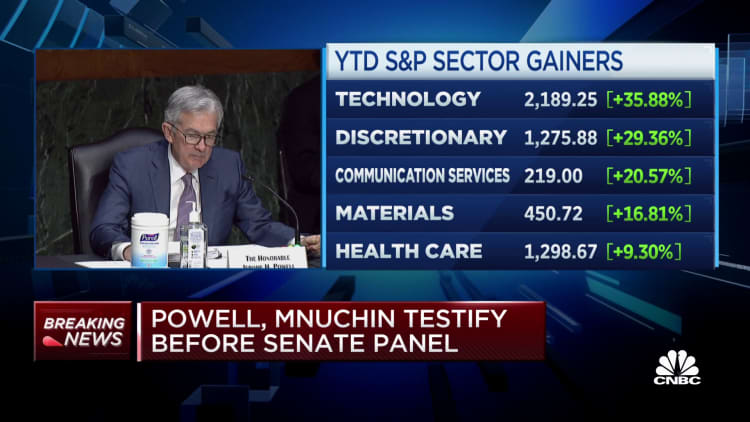

"It's premature to be pulling back on support for the economy," said Fed Chairman Jerome Powell, who joined Mnuchin at the hearing, which is required by the rescue legislation.

Powell and Mnuchin worked closely together on the rescue funding package but are on opposite sides of whether the funding should continue. Mnuchin said the remaining $455 billion should be returned to the Treasury and deployed for direct cash injections for the economy.

Both struck more conciliatory tones during the hearing.

Mnuchin said he wanted to "thank Chairman Powell, because he has been a terrific partner in everything we've done." Powell later noted that "we've done a lot and we've really appreciated the working relationship we had with Treasury on the facilities." However, he noted that "our thinking is that we would have left the facilities in place to be backstops."

Differing political views

Both sides had their advocates.

New Jersey Democrat Sen. Robert Menendez took issue with Mnuchin's insistence that he was merely complying with the congressional mandate by ending the lending facilities on Dec. 31.

"No one will be better off after you end the CARES Act facilities," Menendez said. "As we enter a third wave of Covid, I think ending these facilities is not mandated by law. It's important as an economic backstop. It will have real and harmful consequences on our recovery, on our businesses, on American workers."

"Congress can reauthorize this money if you want to extend it, but I think those small businesses need grants," Mnuchin responded.

From the other side of the aisle, Sen. Pat Toomey, R-Pa., who had been pushing for the programs' end even before Mnuchin made his announcement, pointed out that markets have been functioning fine since the decision.

"If some terrible thing were to happen to threaten the viability of our financial markets, then the Treasury and the Fed could come back to Congress and ask for appropriate facilities at that time," Toomey said. "It's up to Congress to decide what to do about that. It is not up to the Fed to lend money to what are probably insolvent companies."

As the hearing progressed, a bipartisan group of legislators announced an agreement on a $908 billion stimulus plan aimed at aiding businesses and displaced workers as well as funding vaccine-related expenses and other areas. Senate Majority Leader Mitch McConnell later in the day shot down the proposal.

Powell has said that even the lending powers the Fed has can only go so far and Congress will need to do more for an economy that he said is improving but has an "extraordinarily uncertain" outlook. He said Tuesday that the majority of the credit for the economic expansion should go to the fiscal actions but added that the Fed also will continue to deploy its tools as necessary, even without the CARES funding.

"The fact that the economy was in very good shape at the beginning of the pandemic, that may be one of the reasons why it has recovered faster than we thought and has kind of continued to defy expectations," he said. "There are parts of the economy that really will need help or might need help to get that last span of the bridge in place to get to the other side of the pandemic."