CNBC's Jim Cramer on Friday told investors to expect more negativity in the market as stocks enter a seasonally weak period in September.

The "Mad Money" host has been warning about the key date of Sept. 17 marking an inflection point after which stocks historically see a major decline.

"You may have to do some buying into any serious decline over the next ten days," Cramer said.

Cramer laid out several key events set in the coming days, including his prediction for the "most positive thing" in the week ahead.

"Remember, negativity...is good for the bulls, not bad. A market that's negative is a market that's easily impressed," Cramer said.

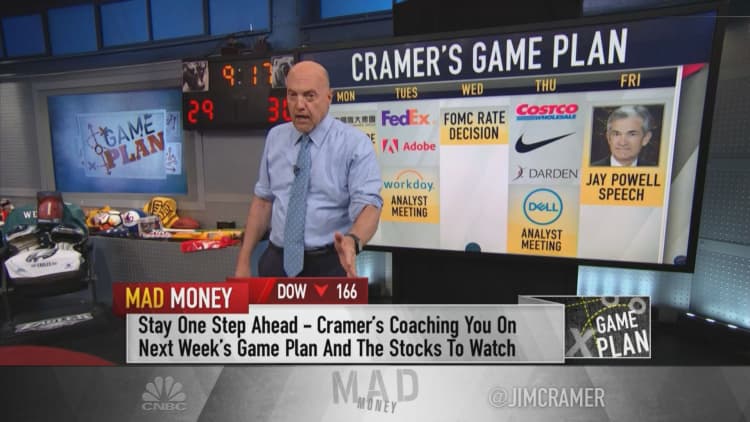

Here's Cramer's game plan for the next five trading days:

Monday: Lennar earnings, Evergrande developments

Lennar, one of Cramer's favorite homebuilders, reports earnings after the close Monday.

"I'm particularly attuned to what they have to say about shortages and about the demand for homes," Cramer said, noting Lennar could give key insights into retail, banking and even the work-from-home economy.

The host will also be monitoring any new developments with Chinese property giant Evergrande, which is on the brink of collapse under a crushing debt of $300 billion.

"I cannot stress enough how colossal this company is. It almost certainly needs ... government intervention to stay afloat," Cramer said.

"If Evergrande collapses, you have to hope the fallout stays in China and doesn't rock our own institutions. Yes, this company is that big," the host added.

Tuesday: FedEx and Adobe earnings, Workday analyst meeting

Tuesday brings earnings reports from FedEx and Adobe.

FedEx "has gotten hit with a ton of negative commentary about it which tells me that anything good will spur buying," Cramer said.

As for Adobe, the host called the stock the "true bellwether of the tech group."

"The stock's been on fire for ages, as it should be because business is booming. They're now integral to ecommerce and I love their suite of products," Cramer said of Adobe.

Cramer is also monitoring an analyst meeting hosted by Workday.

"Chairman and Co-CEO Aneel Bhusri wouldn't be throwing one of these gatherings if he didn't have something good to reveal," Cramer said.

Wednesday: Federal Reserve statement, Fed Chair Powell briefing

The Federal Reserve hosts its much-anticipated September meeting with the two-day session ending in an announcement Wednesday afternoon followed by a press briefing with Fed Chairman Jerome Powell.

"This is a seasonal negative moment. I think we have to expect the market will put a downbeat spin on whatever he says," Cramer said.

Investors will be looking for clues about when the central bank will begin tapering its pandemic-era easy monetary policy.

"I expect this meeting to cause another wave of selling because there are just too many worries about a slowdown and too much worry about inflation to be able to get through this without a lot of selling," the host said.

Thursday: Costco, Nike and Darden Restaurants earnings; Dell analyst meeting

A slew of major corporations report quarterly earnings Thursday.

Costco will report earnings Thursday, and Cramer thinks the stock could fall after the event.

"This is a company that gives you monthly numbers yet the clueless always expect some sort of upside surprise and then they sell the stock when they don't get one," the host said. "Short of announcing a special dividend or a price hike for their membership program, I expect the clueless to sell Costco."

Consumer giant Nike also announces earnings results.

"We keep hearing that its supply chain is in tatters in part because it sources 50% from Vietnam. Plus some people are wary that Nike may be the next product that the Chinese government cracks down on," the host said.

Darden Restaurants' earnings report could provide some insight into the effects of the delta Covid variant, Cramer noted.

"The parent of Olive Garden can give us a clear look into what the latest outbreak is doing to the economy. I trust them to say that things are better but not perfect," Cramer said.

Dell hosts an analyst meeting Thursday, which Cramer says could be an bright spot for the week.

"If you asked what could be the most positive thing in this entire panoply next week, it would be this," Cramer said.

Friday: Fed Chairman Jerome Powell speech

Powell is set to speak at Friday's Fed Listens event.

"Let's hope he doesn't have to give us some sort of a do-over from something he said on Wednesday. He has an encouraging story to tell: once Covid runs its course, supply chain issues could go away," Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com