For most Americans, reaching retirement with a large enough nest egg requires decades of planning, as well as consistent and adequate saving.

Figuring out where to begin — or if you're on the right track at any age — can be confusing and daunting.

One of the most common questions people have is how much to save for retirement, according to Rita Assaf at Fidelity. "And it's not surprising, because there are so many elements to consider," she said.

To begin figuring out how much you should be salting away each month, Assaf recommends getting a general sense of when you'd like to retire. You can't know the exact age you'll stop working, especially if you're young, but without some finish line in mind it'll be harder to eventually show up at the correct place.

If you're aiming for a longer working life, you may not need to put away as much. That's for three reasons: You're giving your money more time to compound while you're still getting a paycheck, you'll eventually have a shorter period to cover in retirement, and you may be able to get a higher Social Security check because you waited to claim the benefit.

On the other hand, if you want the option of retiring earlier, more of your current income will have to be directed at your savings.

Your "overall wealth outlook" is another big factor determining how much you should be socking away for your older years, said Lauren Wybar, a certified financial planner and senior financial advisor with Vanguard.

For example, if you own real estate that you plan to sell or that will generate income in future years, that may mean you can get away with putting away less, Wybar said. The expectation of a pension or significant inheritance may also reduce how much you need to save.

Tom Armstrong, head of customer analysis and insight at Voya Financial, says workers also want to think about what their spending will look like once they leave their careers. "We believe that most individuals should be saving enough to generate at least 70% of their preretirement income in retirement," Armstrong said.

To hit that goal, Armstrong says people usually need to put away between 10% and 15% of their salary each month (that's on their pretax income).

That was also the general monthly savings guideline offered by Catherine Golladay, head of workplace financial services at Charles Schwab.

Golladay, however, had two additions: First, the percentage of your income you save includes any employer match you may receive, so you might need to save, say, only 5% of pay if your company offers a 5% match to your savings.

She also said that you want to add 10% to the savings guideline for every decade you delay this routine. So if you begin preparing for retirement in your 30s, you should save between 20% and 25% of your salary, rather than 10% to 15%.

Although these numbers can be helpful in establishing a goal, they run the risk of backfiring, said Michael Liersch, head of advice and planning at Wells Fargo.

"It's more important to save something than to be discouraged that you're not saving the recommended amount," Liersch said.

"Do what you can at any point in your life," he added. "When you have the habit of saving, ultimately over time you will save more."

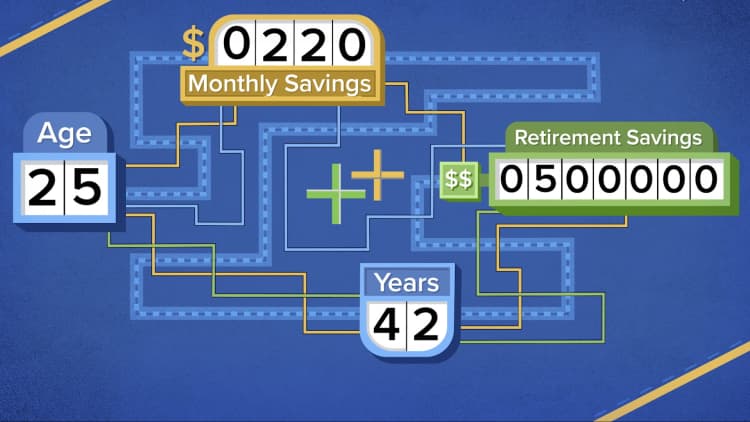

Indeed, even upping your savings by just 1% can have a big difference, Assaf said. For a household making $60,000 a year, that bump after decades of working can result in an extra $270 in retirement income down the line.