Stocks fell sharply Thursday after a tech rally, sparked by stronger-than-expected Nvidia results, was short-lived. Traders also braced for a key speech from Federal Reserve Chairman Jerome Powell.

The Dow Jones Industrial Average closed 373.56 points lower, or 1.08%, at 34,099.42. The S&P 500 lost 1.35% to end the day at 4,376.31. The tech-heavy Nasdaq Composite shed 1.87% to 13,463.97.

Thursday marked the worst day for the Dow since March. The S&P 500 and Nasdaq had their biggest one-day loss since Aug. 2.

Nvidia shares reached an all-time high after the company reported quarterly earnings and revenue that exceeded lofty analyst expectations. The company also raised its guidance, with executives predicting third-quarter revenue would climb to $16 billion, or a year-over-year increase of 170%. However, the stock closed just 0.1% higher.

The information technology sector the S&P 500's biggest loser, ending Thursday down 2.15%, weighed by declines in other semiconductor stocks including Advanced Micro Devices and Intel. Shares of major tech companies saw declines during the session, with Amazon losing 2.7%, Apple declined 2.6%, and Netflix dropping 4.8%.

Dollar Tree was the worst-performing stock in the S&P 500, losing 12.9% on disappointing third-quarter guidance. Shares of Nike shed 1.1%, extending their record losing streak. Boeing dragged down the Dow, losing nearly 5%.

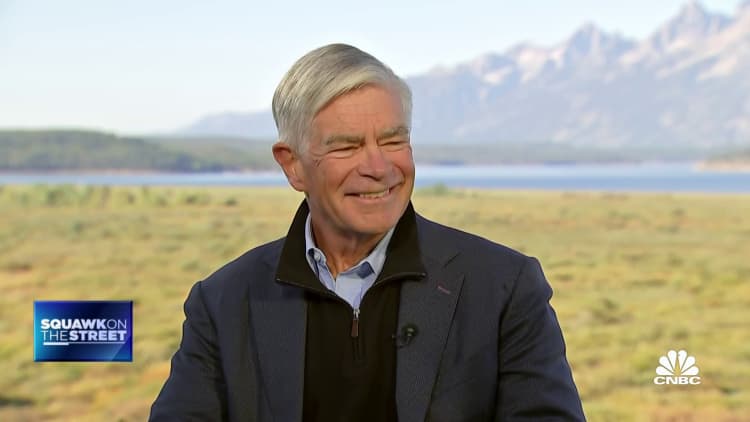

"I think it's a very narrowly focused market," said Phillip Colmar, global strategist at MRB Partners, adding that just a few names are driving the entire market. "I do think if you've got a better growth backdrop and higher bond yields, it lends itself naturally to a broadening of the market. We saw some of that in recent weeks."

Colmar noted that he would lighten up on the tech sector, given its recent moves higher this year. "Themes sometimes get front loaded into the price action and then it takes a while to catch up," he said.

To be sure, other investors remain bullish on the tech sector as their hopes for a resilient economy remain intact.

"The tech story is coming back, which is ironic because normally when real yields go up, valuations get hit and the more richly valued stocks do worse," Carson Group director and macro strategist Sonu Varghese said, adding that his firm balances its tech holdings along with cyclical stocks, such as small to mid-cap sized industrials and energy names. "We think the economy is actually running fairly resilient right now."

U.S. Treasury yields climbed on Thursday as investors waited for signals on monetary policy from central bankers' comments at the Jackson Hole, Wyoming meeting on Friday. The yield on the benchmark 10-year Treasury note was higher at 4.241%, after hitting a 16-year high earlier this week.