CNBC's Jim Cramer on Wednesday told investors it can be hard to own high-quality stocks, such as the "Magnificent Seven" tech stocks. He detailed why these companies are "among the most heavily-traded in the business," but also why he thinks they shouldn't be.

"It wasn't easy sticking with the Magnificent Seven," Cramer said. "You had to fight so many trends, so many obvious pain points, so many outspoken naysayers. Remember, as obvious as these winners seem in retrospect, it was very easy to get shaken out."

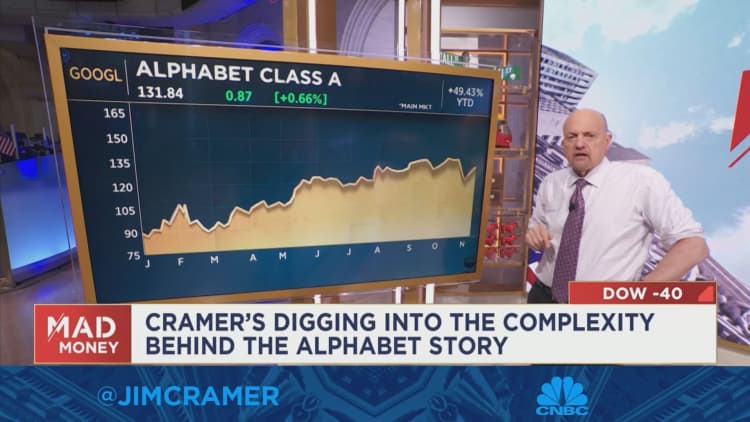

- Alphabet: Google parent Alphabet has been a tough stock for several reasons, Cramer said, including two antitrust lawsuits brought on by the Justice Department and artificial intelligence competition from Microsoft. But he emphasized the company's franchise in YouTube and its search business, adding that investors shouldn't get too worked up about the cloud earnings shortfall reported in its most recent quarter.

- Amazon: Amazon is also facing heat due to an antitrust suit, and there are concerns about the market share erosion of the company's web services division, Cramer said. But he praised the company's most recent quarter and its cost-saving measures, saying that worries about inflation and the bond market drove its stock down.

- Apple: To Cramer, Apple received downgrades from some on Wall Street due to declining hardware sales as well as tough business in China. However, he said he values the company's customer satisfaction levels and its growing number of users in developing countries.

- Meta: Cramer said many had concerns about Meta's slowed ad sales due to conflict in the Middle East. But to him, this is a temporary issue, and he lauded the company's products like Instagram and WhatsApp.

- Microsoft: Microsoft's shares fell when it reported upfront expenses for artificial intelligence without material revenue to show for it, according to Cramer. But the company has showed it is now able to monetize is AI investments, he said.

- Nvidia: Worries about the U.S.'s ban on tech chip sales to China may have led some investors out of China, Cramer said. But he emphasized his long-held belief that Nvidia will continue to be valuable because of its prominent role in making chips that are essential to artificial intelligence.

- Tesla: Cramer admitted that Tesla recently reported a poor quarter. However, he said the company is still valuable because of CEO Elon Musk, calling this stock a "cult of personality play."

Sign up now for the CNBC Investing Club to follow Jim Cramer's every move in the market.

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Alphabet, Amazon, Meta, Microsoft and Nvidia.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com