Strategy to invest in the world’s future

Strategy to invest in the world’s future

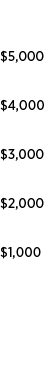

As one of the world's leading banks, UBS is laying the foundation for next generation opportunity and long-term prosperity. This means addressing and investing in global issues that affect regions and communities now. The world’s needs are our collective responsibility. Many investors want to do well by doing good which is fuelling demand for responsible investing. With $4.3T growth in Environmental, Social and Governance (ESG) focused investments since 1995, we now offer a compelling, unique strategy: Introducing The Global Sustainability Leaders Index.

The Global Sustainability Leaders Index

The Global Sustainability Leaders Index (GSLI) stems from the belief that companies that manage Environmental, Social and Governance (ESG) issues well can also yield superior risk-adjusted returns. The index is composed of 100 Global Compact signatories selected on the basis of Sustainalytics’ proprietary ESG Rating, which identifies the top sustainability performers within their respective sectors and regions. To be eligible for the index, companies must have a consistent base-line profitability and meet a set of stringent minimum sustainability criteria. For example, companies cannot be involved in tobacco or controversies that will significantly impact society or the environment and they have to comply with the Global Compact's 10 Principles relating to human rights, labor, the environment and anti-corruption.

A growing demand for responsible investments

More than ever before, investors care about how their investments are impacting our world. Even more so, they want to use their investing power to make the world a better place – now and for future generations. This has led to an interest in investing in sustainable and responsible companies becoming more mainstream. As a result, environmental, social and governance (ESG) focused investments have grown rapidly.

Source: US SIF Foundation, Report on US Sustainable, Responsible and Impact Investing Trends 2014. Includes mutual funds, variable annuity funds, closed-end funds, exchange-traded funds, alternative investment funds and other pooled products, but excludes separate account vehicles and community investing institutions.

The Global Sustainability Leaders Index – methodology and monitoring

Stock selection methodology

The Sustainability Leaders are selected based on Sustainalytics' ESG Rating.

Testing and monitoring performance

With backtesting since 2011, we closely monitor performance of the Index.

Stock selection methodology

Copyright ©2018 Sustainalytics. All rights reserved

Sustainalytics controls the rights to and is the owner of The Global Sustainability Leaders Index (the “Index”) and retains all proprietary rights therein. Sustainalytics and all of their respective a liates and suppliers does not participate in the creation or development of any investment products and the United Nations, the Foundation for the Global Compact or any of their respective a liates do not endorse this or any other investment product.

Sustainalytics does not sponsor, endorse or otherwise promote any security, other financial product or transaction (each a "Product") referencing the Global Sustainability Leaders Index. Sustainalytics makes no representation or warranty, express or implied, to the owners of any Product or any member of the public regarding the advisability of investing in securities or financial products generally or in the Product particularly or the ability of the Index to track the investment opportunities in the commodity futures market or otherwise achieve their objective. Sustainalytics has no obligation to take the needs of the owners of any Product or any other person into consideration in determining, composing or calculating the Index. Sustainalytics is not responsible for, has not participated and will not participate in the determination of the timing of, prices of, or quantities of any Product to be issued or in the determination or calculation of the equation by which the Product is to be converted into cash. Sustainalytics has no obligation or liability in connection with the administration, marketing or trading of any Product.

THE INDEX IS DERIVED FROM SOURCES THAT ARE CONSIDERED RELIABLE, BUT SUSTAINALYTICS, ALL OF THEIR RESPECTIVE AFFILIATES AND SUPPLIERS DO NOT GUARANTEE THE VERACITY, CURRENCY, COMPLETENESS OR ACCURACY OF THE INDEX OR OTHER INFORMATION FURNISHED IN CONNECTION WITH THE INDEX. NO REPRESENTATION, WARRANTY OR CONDITION, EXPRESS OR IMPLIED, STATUTORY OR OTHERWISE, AS TO CONDITION, SATISFACTORY QUALITY, PERFORMANCE, OR FITNESS FOR PURPOSE ARE GIVEN OR DUTY OR LIABILITY ASSUMED BY SUSTAINALYTICS, ALL OF THEIR RESPECTIVE AFFILIATES AND SUPPLIERS, IN RESPECT OF THE INDEX OR ANY DATA INCLUDED THEREIN, OMISSIONS THEREFROM OR THE USE OF THE INDEX IN CONNECTION WITH ANY PRODUCT, AND ALL THOSE REPRESENTATIONS, WARRANTIES AND CONDITIONS ARE EXCLUDED SAVE TO THE EXTENT THAT SUCH EXCLUSION IS PROHIBITED BY LAW.

To the fullest extent permitted by law, Sustainalytics shall have no liability or responsibility to any person or entity for any loss, damages, costs, charges, expenses or other liabilities, including without limitation liability for any special, punitive, indirect or consequential damages (including, without limitation, lost profits, lost time and goodwill), even if notified of the possibility of such damages, whether arising in tort, contract, strict liability or otherwise, in connection with the use of the Index or in connection with any Product.