6 Housing Market Decline

By early 2006, America's unprecedented real estate explosion was hitting a wall. The boom hadn't turned to a bust, yet. But the housing market was slowing significantly. The evidence was clear: back-to-back quarterly drops in the median price of a home showed cracks in the armor of a market many experts believed would keep growing indefinitely.

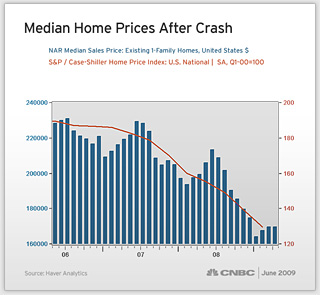

Median Home Prices Begin Dropping

From the fourth quarter of 2005 to the first quarter of 2006, the median home price in the U.S. fell 3.3%, the second consecutive drop. Prices had already declined 1% from the third to fourth quarters of 2005.

Credit Tightens Up, Slowing Real Estate Market

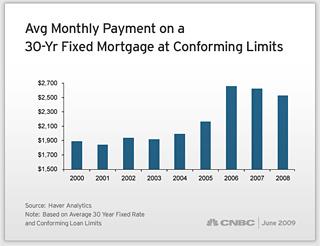

Loose lending standards began to tighten and mortgage rates began to climb. It was becoming more difficult for borrowers without good credit to get mortgages. The fuel of credit that fanned the real estate flames since 2001 was starting to dry up.

Refinancing Become Much More Difficult

At the same time, many of those alternative mortgages designed to help borrowers afford the home of their dreams began to haunt them. Homeowners who expected to refinancetheir loans found it difficult or impossible to get a new mortgage. Those borrowers and many others suddenly faced significantly higher monthly payments. They were often shocked to learn of the increases, having never fully understood the terms of their adjustable rate loans. In some cases, borrowers didn't read the fine print. In others, they misled lenders or falsified their income to get the mortgage. And, others simply put too much trust in their loan officer or mortgage broker.

Borrowers Shocked By Higher Monthly Payments

Now, huge numbers of homeowners faced a brutal new reality: bigger monthly mortgage payments on homes worth less than they had anticipated. Suddenly, much of the real estate wealth that had accumulated "on paper" was contracted instead of expanding--- depreciating instead of appreciating.

Homeowners Faced With Tough Choices

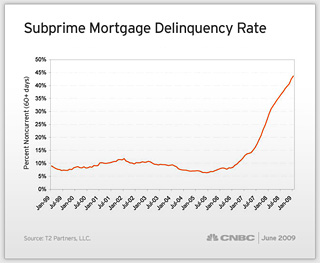

If they couldn't make the new, larger payments, homeowners were faced with several, often difficult, choices. They could try to sell their property, perhaps at a loss, just to free themselves of the growing mortgage. They could stay and try to negotiate a compromise with their lender. Or, they could fail to make their payments, leading to defaults, foreclosures, and short sales.

Defaults and Foreclosure Begin Rapid Rise

In some cases, borrowers were stretched so thin--- so highly leveraged--- they had no choice but to default on their mortgages. By mid-2006, the escalating wave of defaults was creating a massive pool of toxic assets sitting on the balance sheets of banks and in the portfolios of investors around the world.

Housing Market Decline

CNBC anchors and reporters discuss critical mistakes and unrealistic expectations that led the housing market to collapse.