The overall outlook for the U.S. economy continues to improve and may be gathering steam despite a few global uncertainties and mixed signals from the Federal Reserve, according to the latest CNBC Global CFO Council survey.

That's an improved outlook over the last two surveys of the council, a group of chief financial officers representing a broad swath of the economy and overseeing more than $2 trillion in market capitalization. Members of the council come from a wide range of sectors, including retail, banking, energy, technology and transportation. CNBC surveys this group of 25 CFOs on a regular basis.

Two-thirds of the council expect their revenues will increase in the second half of 2013, while over 50 percent said that their margins will increase in the last two quarters of FY 2013. And in their most positive signal yet, over 80 percent said they expect their capital expenditures to increase by at least 7 percent year over year in 2014. Despite these numbers, only about a third reported slight increases in hiring plans in 2013.

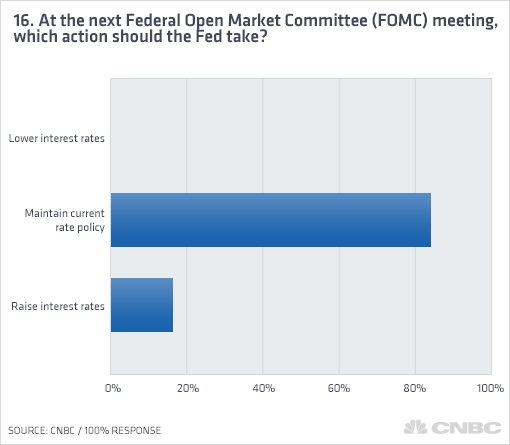

The council's interpretation of Federal Reserve Chairman Ben Bernanke's stimulus intentions showed its members are not as certain as some market pundits that the Fed will reduce stimulus this year, with CFOs expecting the tapering to take hold by the first quarter of 2014. The council remains divided on whether the tapering will extend past the fourth quarter of 2014. Yet overwhelmingly, over 80 percent think the Fed should maintain current policy at the next Federal Open Market Committee meeting.

(Read more: Summer Travel Outlook From the CFOs)